The trio of the Sanctions War, Green Energy Crusade and the Virus Patrol is a mortal threat to capitalist prosperity. That’s already evident in the Eurozone where these policy diseases are most advanced and where the real GDP growth rate has plunged by 74% from its pre-2008 crisis rate.

That’s right. The real growth rate in the E19 countries posted at just 0.67% per annum during the 14-year span between Q1 2008 and Q1 2022, which compares to 2.29% per annum during the equivalent period between 1995 and 2008.

Eurozone Real GDP, 1995-2022

Moreover, the EU hari kari artists are just getting started. Notwithstanding the planned phase-out of Russian seaborne crude oil entirely by the end of 2022 and facing a potential total cut-off of Russian pipeline gas, these birdbrains are now planning a sixth round of sanctions on top of all the madness that has gone before.

Accordingly, Europe is heading for a rip-roaring stagflation, even as the monetary policy dial is still set on ultra-easy. That is, the ECB’s policy rate is still -0.25%, thereby creating a huge gap with the Fed’s policy rate which currently stands at +1.58% and is heading higher at a 75 basis points per meeting clip.

To be sure, both of these rates are utterly irrational in the face of 8%+ Y/Y inflation, but in the near term the current and prospective gap is so egregious as to literally sink the Euro’s exchange rate. It is now flirting with parity, meaning that its FX value against the dollar is down 15% in the past year alone, and more than 58% since the peak in mid-2008.

Needless to say, a collapsing FX rate is a classic recipe for surging imported inflation. So talk about behind the curve—the ECB is so far to the rear as to be scarcely visible.

What this means, of course, is that the ECB will be forced to hit the brakes hard as self-inflicted energy inflation surges and Europe’s headline CPI heads toward 10%. At the same time, real GDP growth will tumble back into the red, but the central bank will be in no position to bring on the stimmies. In fact, the brutal stagflation ahead will leave the ECB incoherent and paralyzed.

Nor is that the end of Europe’s headwinds. On top of sanctions, green energy roadblocks and monetary paralysis, you can also add fiscal incontinence. Eurozone debt is now pushing 100% of GDP, meaning that the headroom for fiscal stimmies has also been largely exhausted. That’s especially true because when you take Germany out of the equation, much of the rest of Europe led by Club Med has a public debt ratio of well more than 100% of GDP.

So the question recurs. What in the world is wrong with these people? Are they deliberately trying to sabotage society and even a minimum level of prosperity?

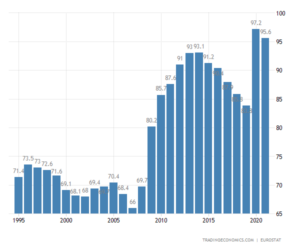

Eurozone Public Debt-To-GDP Ratio

Needless to say, these questions are not merely rhetorical. Energy, food and other inflationary pressures are literally making mincemeat of middle class living standards.

Needless to say, these questions are not merely rhetorical. Energy, food and other inflationary pressures are literally making mincemeat of middle class living standards.

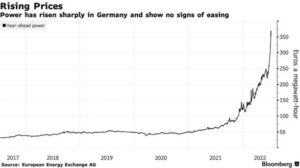

For instance, last week German year-ahead power prices rose 19%; have almost tripled this year alone; and are up by more than 7X since early 2021. Benchmark European gas costs have also surged in a parallel manner.

So why in the world are European leaders being led around by the nose on the Ukraine matter by the neocon war-mongers of Washington?

Surely they are astute enough to see that what is happening in Ukraine is essentially a civil war in historic Russian lands; that the eastward push of NATO was a colossal mistake; and that Putin has neither the intention nor capacity to threaten the rest of Europe.

Likewise, it is hard to believe that the ostensible adults in charge of national and EU security policy actually believe Washington risible nonsense about “defending the liberal international order” and upholding the “territorial sovereignty” of nation-states.

After all, these are the same folks who facilitated the dismemberment of Yugoslavia and bombed Serbia for 71 straight days in 1999 in order to partion that country so that the Albanians of Kosovo could have their own sovereignty.

And when it came to the Taliban, Saddam Hussein and Moammar Khadafy what did the sanctity of borders have to do with it? Washington/NATO didn’t like these regimes and that’s all it took to unleash the bombers, cruise missiles and tank battalions across borders that had far more historic validity than those of present day Ukraine..

So therefore, why not independence for the Russian-speakers of the Donbas, Crimea and Novorussiya generally? For crying out loud, these historic Russian territories were herded into modern Ukraine at gun-point by Lenin, Stalin and Khrushchev in 1922, 1945 and 1954, respectively, purely as a matter of administrative convenience.

Indeed, the case against Europe’s participation in Washington’s ludicrous Sanctions War against Russia is so overwhelming that the underlying truth of the matter is hard to deny. To wit, Europe’s political leaders have descended into acute mental derangement—a form of groupthink that has become totally detached from rationality.

Of course, that’s the same disease that has led to the hook, line and sinker embrace of the Green Energy madness. Europe’s brain-dead bureaucrats have essentially adopted self-destructive energy policies dictated by a petulant Scandinavian teenager and a bunch of far-out, industrial society-hating German “greens”.

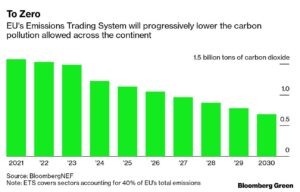

For instance, as part of its plan to reduce CO2 by 40% from 1990 levels by 2030, the EU still plans to cap pollution under the Emissions Trading System (ETS) at about 12 billion tons from 2021 to 2030, tightening the total amount of emissions allowed each year.

Those limits had remained despite lobbying from coal-dependent members like Poland because there was just plain no room in Europe’s “Overton Window” to question the sacrosanct claim that failure to prevent global temperatures from rising by 1.5 C by 2050 would bring the ruination of Planet Earth.

That’s rank hogwash. The truth is, for upwards of 90% of the time during the last 600 million years of the Earth’s relentless “climate change”, the average temperature has been well above the current 15 C, sometimes by as much as 10 C higher.

And never did those higher temperatures lead to an inexorable doomsday cycle of heat retention that fried the planet.

Of course, even the European greenies have been caught up by the short hairs as Russia has turned back the spigot on natural gas. And we do mean that the spigot has been shuttered.

Not a single Gazprom molecule has been flowing to Europe through the Yamal pipeline via Poland for six weeks. Flows through Nord Stream 1 via the Baltic have been running at 40pc of capacity since mid-June. They dropped to zero this week for ten days of scheduled maintenance.

As a consequence, even the green-dominated coalition government in Germany has had to crank-up its coal-fired plants out of desperate fear that natural gas storage will be insufficiently rebuilt by fall, meaning that Germany could have a dark winter of industrial shutdowns and freezing households.

So they have kept in operation 11 coal-fired plants which were scheduled for deactivation this fall, while reactivating 17 coal and oil-fired utility plants that have already been shutdown.

Still, that has not silenced the Greens, whose Economy Minister had presided over the panicked flight to coal. A one Climate Change howler claimed,

“Regardless of short-term increases in coal in the power market, the overall total emissions should still be reduced by the combination of energy efficiency, renewable deployment and other measures,” Sartor said. “This is the beauty of having strong, legally binding EU emissions caps and strong EU sectoral legislation.”

Right. They just never learn. On the Sanctions War front, in fact, Europe is now heading in a completely suicidal direction, contemplating the embrace of the hideous oil price cap scheme being peddled by Janet Yellen.

This sanctions proposal actually stems from a prior EU sanctions package that included an embargo on Russian oil imports and a ban on EU firms insuring seaborne shipments of Russian oil. Those steps are set to begin by the end of the year.

However, because many shipments of Russian oil to countries around the world are insured in the EU and U.K., Yellen has repeatedly said she is concerned that the EU’s plans could take Russian oil off the global market. So her solution is to jump from the frying pan into the fire.

This would purportedly be accomplished via a carve-out from the insurance ban. The change would allow firms in the EU, U.K. and elsewhere to insure and finance shipments of Russian oil, if the sales price falls under the cap, which would purportedly be in the range of $40-60 per barrel!

Supposedly, China, India and other developing world buyers of discount Russian crude oil would go a long with the scheme and get an even deeper discount.

Alas, that assumes that Russia would agree to sell at these prices, and that countries in desperate need of crude oil would strictly abide by the Washington/NATO rules. But as the astute Ambrose Evans-Pritchard recently noted, fat chance of that!

European leaders have been formulating policy in a parallel universe, discussing unenforceable schemes for a $40-$60 price cap on Russian exports of crude, supposedly with extraterritorial reach into Asian markets. The false assumption – breathtaking in its serial fallacies – is that the Kremlin needs the money and will oblige meekly.

Indeed, we can only say “you don’t say” in response to one analyst who immediately pinpointed the holes in the scheme:

There are several outstanding issues to settle on the price-cap idea. Those include figuring out exactly how to enforce it, convincing other nations to subscribe to it and deciding the sales price at which Western countries would permit the purchase of Russian oil. Looming over the proposal is also the presumption that Russia would continue to sell oil at a price mandated by the U.S. and its allies.

The fact is, Russia has already proven it is not Nixon’s infamous pitiful helpless giant when it comes to navigating the global commodity markets in the face of the Sanctions War. During the first 100-days of the war it has generated a record $97 billion of oil, gas and coal revenues by deftly selling at modest discounts from soaring global prices at slightly lower volume of fuel.

In June, for instance, Russia’s oil exports fell to their lowest level since August 2021, but its oil export revenues rose by $700 million to $20.4 billion, 40% more than the 2021 average.

And the proof is now in the pudding. During the second quarter, Russia’s current account surplus soared to a record $70 billion. In round terms, that’s a quarter trillion dollar annualized run-rate of surplus trade with the rest of the world. Some kind of sanctions!

Moreover, while it is widely assumed that Putin would roll-over in the face of Yellen’s price cap and accept Washington’s price dictate because oil import revenues are too valuable—worth $700 million per day—that presumption may not be valid at all. Apparently, Russia could cut production by upwards of 3-5 mb/d for many months—-far longer than Asia and other customers could do without its oil.

Thus, two JPMorgan analysis, Natasha Kaneva and Ted Hall, recently argued that Russia could halve its total output temporarily and starve the world of up to five million barrels a day (5% of global supply) without doing lasting damage to its drilling infrastructure, or suffering an intolerable economic hit.

Furthermore, they estimate that a shock and awe squeeze of this magnitude would drive prices to $380 a barrel, levels that would bring the global economy to a shuddering halt. As these analysts further noted,

There is no immediate financial constraint. Russia’s National Wellbeing Fund has $116 billion set aside in usable money. The treasury’s cash balance is a further $85 billion. Together this is enough to cover a total loss of budget revenues from fossil fuel exports for almost a year, perhaps longer than Europe’s comfortable societies can endure the pain. Russia would be exchanging lower volumes for higher prices in any case, so it might not lose that much revenue.

At the end of the day, the facts do not lie. Russia is currently awash with more fossil fuel revenues than it can handle, unable to sterilize a current account surplus of 20% of GDP by accumulating foreign reserves.

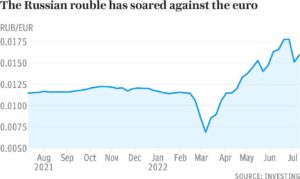

Consequently, the Rouble now stands at an 8-year high against euro.

So are the EU policy apparatchiks and politicians on the road to destroying what remains of Europe’s capitalist prosperity?

It surely looks that way.

David Stockman via InternationalMan.com