Will Biden blame this on Putin too?

In the frenzy over today’s soaring CPI print which came in at a fresh 40 years high, many missed the other, far scarier, data point from the BLS which showed that while nominal wages keep rising at an impressive pace, on a real – or inflation adjusted basis – earnings have failed to keep up with inflation for 11 consecutive months, and in February real hourly earnings contracted by 2.6% compared to a year ago. This number will get far, far worse next month when the full impact of the biggest energy supply shock since the 1970s oil crisis hits front and center.

But while Biden admin-friendly economists may be purposefully ignoring it, ordinary Americans certainly haven’t failed to notice what is going on with their purchasing power, and despite the constant propaganda of wage inflation, most Americans say their salaries aren’t keeping up with prices (something we touched on earlier in “Record Gas Prices Are Starting To Bite The US Consumer“).

In February, 73% of “lower earners,” defined as those with household income of less than $25,000 annually, said they’d felt the impact of inflation recently, but only 9% said their wages had kept up with the cost of living, according to a report from the Capital One Insights Center.

Across all income levels, just 18% of consumers said their wages were keeping pace with the higher cost of living.

Naturally, those with household incomes of $100,000 or more were better able to cope with inflation that hit a fresh 40-year high of 7.9%. Higher earners were about three times as likely to say their wages had kept pace with inflation, at 31%, said Melissa Bearden, head of consumer intelligence for Capital One. While 30% of higher earners said they got a non-performance-based raise or bonus over the past three months, just 10% of lower earners said that.

While financial pressures are felt most acutely by lower earners, some consumers at higher income levels also report feeling a crunch.

“Higher earners are struggling to pay all their bills at more than twice the rate they were earlier in the pandemic,” the survey said, with that percentage jumping from 10% in April 2020 to 22% last month (the Capital One’s data came from a series of national surveys taken since April of 2020 that reached from 2,000 to 10,000 people).

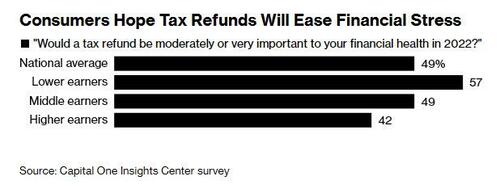

With the nation’s covid-boosted “excess savings” now long gone for most of the population, the US is reverting to month-to-month income, and many Americans hope tax refunds will help ease the financial stress. More than half of lower earners (57%) expecting a tax refund said it would be “very or moderately important to their overall financial health this year.” Almost half of middle earners felt that way.

Here are the other notable highlights from the survey:

- Most people (62%) said inflation had affected their spending. Thirty-eight percent of consumers said they tried to spend less by cutting non-essential spending and canceling or putting off trips, and 42% said they either saved less, tapped into savings, borrowed money or took out a loan.

- The percentage of people who say they are “underemployed,” or working for less money than they want, is falling. Among middle earners making $25,000 to $100,000 in household income, the rate of underemployment dropped to 7% in February from 21% in April 2020. Higher earners saw their rate of underemployment slide to 3% from 13% over the same time period. Lower earners saw their rate of underemployment fall far less — to 18% in February from from 22% in April 2020.

- Around 25% of middle earners and higher earners expect a tax refund that tops $1,500. Just over half of lower earners aren’t sure if they’ll get a tax refund.