Panic Across The Plains States As Nat Gas Prices Explodes To $80

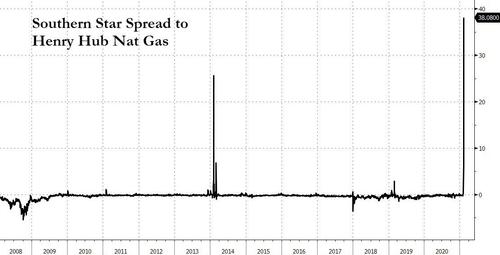

One look at the price of nat gas in the central states and you’d think it was a pennystock with a 1000% short interest: behold the price of Southern Star nat gas spot (Texas, Oklahoma, Kansas). It just hit $38 and is normally $2. Other spot prices for the same region are more than twice as high as we explain below.

Why the stratospheric increase in prices?

As S&P Global Platts explains, the Midcontinent led the surge in US gas prices in Feb. 11 trading as a sharp rise in heating demand met a sudden collapse in supply due to regional production freeze-offs, significantly tightening balances across the much of the Central US, where many places found themselves with virtually no nat gas.

In morning trading, cash prices at hubs in Kansas, Oklahoma and eastern Arkansas hit levels not seen since 2014, with select locations hitting record highs, ICE data showed.

At One Oak Gas Transmission, Southern Star and Enable Gas, spot prices reached record highs around $85, $45 and $30/MMBtu, respectively.

At other hubs, including ANR Oklahoma, Panhandle and NGPL Midcontinent, prices hit their highest in seven years, topping $16, $14 and $12/MMBtu, respectively.

The culprit behind this unprecedented supply/demand imbalance: freezing cold. During the upcoming holiday weekend, the Midcontinent population-weighted temperature is forecast to dip below 0 degrees Fahrenheit before slowly thawing to above freezing by the following weekend.

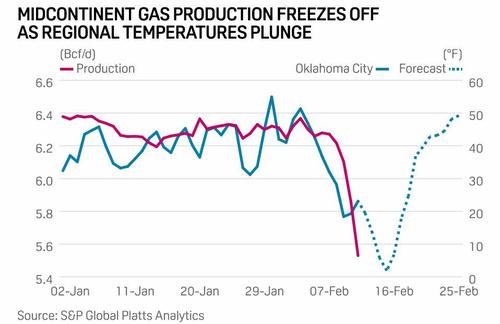

As heating demand from homes and businesses rises, topping 5 Bcf/d on Feb. 11, colder temperatures have also prompted wellhead freeze-offs, cutting production receipts just when they’re most needed. Mid-continent gas production was estimated at 5.5 Bcf/d, down about 800 MMcf/d, or 13%, compared with the prior 30-day average, S&P Global Platts Analytics data shows.

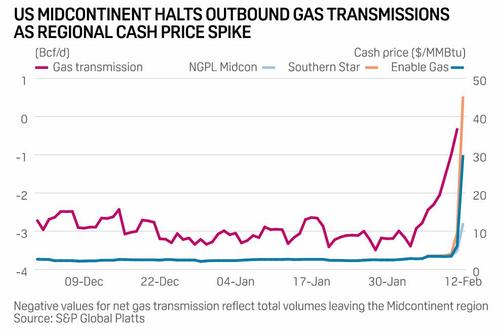

So as regional production gets squeezed and hub prices rise, Midcon markets have sharply reduced net gas transmissions to neighboring markets – most notably Texas and the Southeast. On Feb. 11, net volumes leaving the Midcon fell by a whopping 90% to about 335 MMcf/d – down from an average 2.9 Bcf/d in the 30-days prior.

Other markets across the US – particularly those supplied by the Midcon – saw a similar, though less pronounced, uptick in gas prices in Feb. 11 trading.

Texas

In neighboring Texas, the cash price for Houston Ship Channel increased $6.26/MMBtu on the day to $10.796/MMBtu – its highest level since July 2008. Across the state, the population-weighted average temperature is expected to fall from 15 degrees F below normal Feb. 11 to 37 F below normal by Feb.15, Platts Analytics data showed.

Texas demand sat at 15.5 Bcf on Feb. 11 and was forecast to tick higher to 23.6 Bcf as temperatures continue to fall. As Texas keeps more gas at home to meet the higher demand, net outflows fell by 1 Bcf on Feb. 11 to 10.6 Bcf/d.

Rockies & West

Spot gas prices in the Rockies soared to levels rarely seen in the last 10 years. Cheyenne Hub was trading $9.07 higher at $14.70/MMBtu – the highest price since February 2014. CIG, Rockies saw a similar upward trajectory, trading $8.45 higher to $13.28/MMBtu.

Heightened demand for Rockies gas in other regions comes just as local demand hits seasonal highs. The average temperature in the Rockies was forecast to fall to 19 F on Feb. 12, plunging to 6 F on Feb. 14. Frigid temperatures pose additional upside risk for prices amid possible production freeze-offs. Cash gas prices in the Permian Basin, another production region which has seen increased competition for supply, also surged in Feb. 11 trading. Waha Hub was trading $5.88 higher at $10.42/MMBtu – also the location’s highest since February 2014.

Midwest

Prices gains in the upper Midwest were muted in comparison to the Midcontinent. At Chicago city-gates, prices spiked to new highs reaching $8.11/MMBtu, up $4.13 from the day prior, to its highest level since March 2019. The spread between Chicago city-gates and Henry Hub reached a $2.19 premium, the first time a premium has been this high since January 2019, S&P Global Platts data showed.

Across the entire central US, including the Midcon and Upper Midwest, demand is projected to hit 49.5 Bcf/d on Feb. 15, an all-time high since Platts began recording data in 2005. Heating demand, meanwhile, is expected to reach its highest level since 2019 at 42.5 Bcf/d, about 29 Bcf higher than the five-year average, analytics data shows.

Northeast

Historically the most volatile region for gas prices, the Northeast remained comparatively insulated from the Feb. 11 market surge. At Algonquin city gates, prices rose $1.57 to $12.67/MMBtu; Iroquois Zone 2 rose $2.12 to $12.49/MMBtu. Both locations marked their highest prices since December 2019. According to the US National Weather Service, Boston temperatures are expected to reach a low of 11 degrees F on Feb. 12, while New York City temperatures are forecast to reach a low of 21 F – both adding upward pressure to gas prices on the day.

Frigid weather is expected to persist throughout the next week, continuing to evaporate storage inventories and likely keeping spot gas prices elevated across the region.

* * *

Needless to say, if anyone was short any midcontinent nat gas, they just experienced a short squeeze orders of magnitude worse than the one that almost destroyed Melvin Capital. May they rest in peace.

Tyler Durden

Thu, 02/11/2021 – 21:50

Panic Across The Plains States As Nat Gas Prices Explodes To $80

One look at the price of nat gas in the central states and you’d think it was a pennystock with a 1000% short interest: behold the price of Southern Star nat gas spot (Texas, Oklahoma, Kansas). It just hit $38 and is normally $2. Other spot prices for the same region are more than twice as high as we explain below.

Why the stratospheric increase in prices?

As S&P Global Platts explains, the Midcontinent led the surge in US gas prices in Feb. 11 trading as a sharp rise in heating demand met a sudden collapse in supply due to regional production freeze-offs, significantly tightening balances across the much of the Central US, where many places found themselves with virtually no nat gas.

In morning trading, cash prices at hubs in Kansas, Oklahoma and eastern Arkansas hit levels not seen since 2014, with select locations hitting record highs, ICE data showed.

At One Oak Gas Transmission, Southern Star and Enable Gas, spot prices reached record highs around $85, $45 and $30/MMBtu, respectively.

At other hubs, including ANR Oklahoma, Panhandle and NGPL Midcontinent, prices hit their highest in seven years, topping $16, $14 and $12/MMBtu, respectively.

The culprit behind this unprecedented supply/demand imbalance: freezing cold. During the upcoming holiday weekend, the Midcontinent population-weighted temperature is forecast to dip below 0 degrees Fahrenheit before slowly thawing to above freezing by the following weekend.

As heating demand from homes and businesses rises, topping 5 Bcf/d on Feb. 11, colder temperatures have also prompted wellhead freeze-offs, cutting production receipts just when they’re most needed. Mid-continent gas production was estimated at 5.5 Bcf/d, down about 800 MMcf/d, or 13%, compared with the prior 30-day average, S&P Global Platts Analytics data shows.

So as regional production gets squeezed and hub prices rise, Midcon markets have sharply reduced net gas transmissions to neighboring markets – most notably Texas and the Southeast. On Feb. 11, net volumes leaving the Midcon fell by a whopping 90% to about 335 MMcf/d – down from an average 2.9 Bcf/d in the 30-days prior.

Other markets across the US – particularly those supplied by the Midcon – saw a similar, though less pronounced, uptick in gas prices in Feb. 11 trading.

Texas

In neighboring Texas, the cash price for Houston Ship Channel increased $6.26/MMBtu on the day to $10.796/MMBtu – its highest level since July 2008. Across the state, the population-weighted average temperature is expected to fall from 15 degrees F below normal Feb. 11 to 37 F below normal by Feb.15, Platts Analytics data showed.

Texas demand sat at 15.5 Bcf on Feb. 11 and was forecast to tick higher to 23.6 Bcf as temperatures continue to fall. As Texas keeps more gas at home to meet the higher demand, net outflows fell by 1 Bcf on Feb. 11 to 10.6 Bcf/d.

Rockies & West

Spot gas prices in the Rockies soared to levels rarely seen in the last 10 years. Cheyenne Hub was trading $9.07 higher at $14.70/MMBtu – the highest price since February 2014. CIG, Rockies saw a similar upward trajectory, trading $8.45 higher to $13.28/MMBtu.

Heightened demand for Rockies gas in other regions comes just as local demand hits seasonal highs. The average temperature in the Rockies was forecast to fall to 19 F on Feb. 12, plunging to 6 F on Feb. 14. Frigid temperatures pose additional upside risk for prices amid possible production freeze-offs. Cash gas prices in the Permian Basin, another production region which has seen increased competition for supply, also surged in Feb. 11 trading. Waha Hub was trading $5.88 higher at $10.42/MMBtu – also the location’s highest since February 2014.

Midwest

Prices gains in the upper Midwest were muted in comparison to the Midcontinent. At Chicago city-gates, prices spiked to new highs reaching $8.11/MMBtu, up $4.13 from the day prior, to its highest level since March 2019. The spread between Chicago city-gates and Henry Hub reached a $2.19 premium, the first time a premium has been this high since January 2019, S&P Global Platts data showed.

Across the entire central US, including the Midcon and Upper Midwest, demand is projected to hit 49.5 Bcf/d on Feb. 15, an all-time high since Platts began recording data in 2005. Heating demand, meanwhile, is expected to reach its highest level since 2019 at 42.5 Bcf/d, about 29 Bcf higher than the five-year average, analytics data shows.

Northeast

Historically the most volatile region for gas prices, the Northeast remained comparatively insulated from the Feb. 11 market surge. At Algonquin city gates, prices rose $1.57 to $12.67/MMBtu; Iroquois Zone 2 rose $2.12 to $12.49/MMBtu. Both locations marked their highest prices since December 2019. According to the US National Weather Service, Boston temperatures are expected to reach a low of 11 degrees F on Feb. 12, while New York City temperatures are forecast to reach a low of 21 F – both adding upward pressure to gas prices on the day.

Frigid weather is expected to persist throughout the next week, continuing to evaporate storage inventories and likely keeping spot gas prices elevated across the region.

* * *

Needless to say, if anyone was short any midcontinent nat gas, they just experienced a short squeeze orders of magnitude worse than the one that almost destroyed Melvin Capital. May they rest in peace.

Tyler Durden

Thu, 02/11/2021 – 21:50

Read More