Ryan Fitzmaurice, senior commodity strategist at Rabobank

A confluence of bullish factors propelled oil prices to new multi-year highs this week

The Chinese government has reportedly given state-owned energy companies a directive to secure winter energy supplies at all costs in response to recent shortages

The last time oil prices were this high was back in early October 2018, right before prices crashed in the fourth quarter of that year, although the setup is much different this time

Panic buying

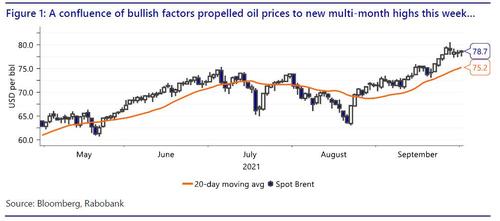

Spot oil prices continued their ascent this week, setting new multi-year highs in the process as a confluence of factors worked to bid up nearby futures. This recent show of strength is largely inline with our expectations and notably, oil prices have shrugged off news of a Chinese SPR release, a stronger US dollar, and a risk-off event with relative ease, continuing higher unabated.

Moreover, China appears to have made an abrupt and key policy change with respect to their commodity markets approach. To that end, recent reports are indicating that the central government there has given state-owned energy companies a directive to secure winter energy supplies at any and all costs. As many are aware, commodity inflation is soaring and pressuring large importers and particularly China, and at the same time, supply shortages are becoming more and more frequent across the globe. Up until now though, China was more focused on trying to pressure commodity and oil prices lower by releasing strategic reserves and tightening import licenses, however, things have changed. Now the plan is to hoard all available supplies no matter the cost, to support continued economic growth, especially in a cold winter scenario.

This is a potential game-changer for energy markets and is likely to kick off a panic buying spree such as we saw in toilet paper and other household items in the early days of the pandemic and even more recently in the UK’s ongoing supply chain crisis. Further to that end, the oil markets already have the herd of systematic traders on the bid-side of the market, as well as inflation-driven macro flows, and with plenty of room for those positions to grow. In addition to the speculative interest, the world’s biggest commodity importer is now going on a historic buying spree. As such, this buying is a strong tailwind for oil, as supply certainty trumps price in the near-term.

This time is different

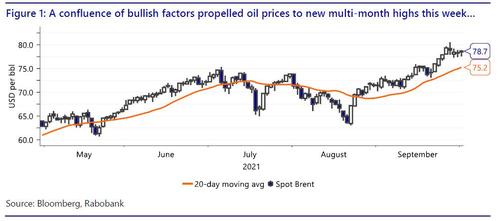

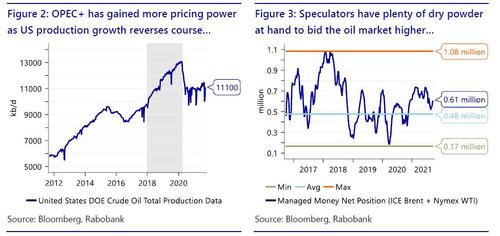

The last time oil prices were this high was back in early October 2018, right before prices crashed in the fourth quarter of that year. At the time, we were bearish on oil prices as the speculative “long” oil trade was extremely crowded with money managers holding the largest position on record with net exposure reaching an impressive 1.08 million contracts between the ICE Brent and NYMEX WTI crude oil benchmarks at the peak. Furthermore, the macro backdrop was bearish in 2018 with Chinese equity markets registering ytd losses of more than 20% in October of that year. On the supply-side, OPEC+ had much less pricing power back then as the US shale drillers were still in aggressive growth mode. On top of that, and as many market participants will remember, the US surprised the oil market by issuing temporary oil sanction waivers to Iran in an effort to pressure prices lower. The ploy ultimately sent the market into a free-fall, in large part due to the extreme “long” positioning that had to be unwound in short order.

Fast forward to today though, and the backdrop couldn’t be more different and the same is true of our bullish outlook this time around. As for fundamentals, OPEC+ has much more pricing power now and is in full control of the supply-side given US production is well off the pre-pandemic highs with much slower growth expected in the coming years as ESG investor pressures and local court rulings stifle production growth from the shale drillers and oil majors. On the demand side, we can now throw price insensitive Chinese buying into the equation as well. On the macro front, an inflationary backdrop has taken a strong hold, resulting in significant money flows into commodity index products in the first half of the year.

This is a trend we fully expect to continue into 2022 as asset managers and institutional money play catch up and increase commodity allocations albeit on a lag.

Finally, on the positioning side of markets, the “long” oil trade remains far from “crowded” by many metrics. In fact, the current net position held at money managers sits well below the highs of 2018 at just 610k contracts, so nearly 500mb off the highs. This is perhaps the most important aspect as speculators have plenty of dry powder at hand to bid the market higher, especially in light of the recent buying directive out of China coupled with tremendous amounts of central bank liquidity flushing through global financial markets. As such, we are viewing this as a rare setup for oil markets where fundamentals and quantitative signals are bullish, the macro backdrop for commodities is as strong as its been in over a decade, and speculators are underinvested.

Looking Forward

Looking forward, we see scope for a potential bullish OPEC+ surprise at next week’s supply meeting, as we explained here. Beyond that though, we are viewing the recent directive out of China to secure energy supplies at all costs, as very bullish for oil and commodity markets in the months ahead. Furthermore, this new policy has the potential to trigger panic buying in physical markets, which will likely spill over into financial markets as institutional money chases returns.