But inflation is eating it up.

Before factoring in inflation, personal income from all sources rose by 2.7% in July year-on-year. The month-on-month gain was a solid 1.1%. This includes wages, stimulus payments, transfer payments (unemployment, Social Security benefits, etc.) along with income from other sources such as interest, dividends, and rental income.

Sounds great, right? The economy really is recovering!

But after factoring in rising prices, “real” personal income fell by 1.4% from a year ago, despite a modest 0.7% increase from June to July.

No wonder consumer confidence plunged to a 6-month low in August. According to an analyst quoted by Reuters, a “resurgence of COVID-19 and inflation concerns have dampened confidence.”

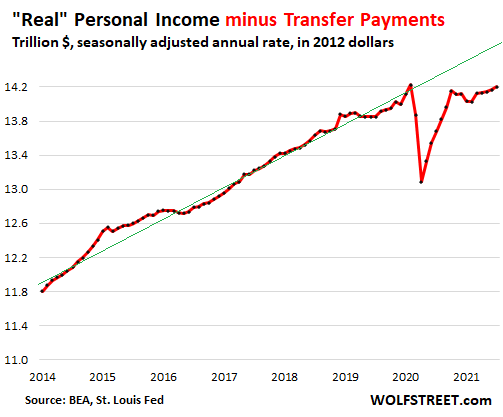

If you pull stimulus and other government transfer payments out of the equation, inflation-adjusted personal income rose 3.8% year-over-year. This reflects more Americans returning to work and higher wages. But it also reveals how much government stimulus distorted earnings earlier in the year.

Despite the apparent improvement, as WolfStreet pointed out, personal incomes haven’t improved at all since last October and they remain below the pre-pandemic peak.

The green line represents the pre-pandemic trend.

Meanwhile, consumers spent more money in July, but that was largely due to rapidly increasing prices.

Before adjusting for inflation, consumer spending was up 0.3% on the month to a seasonally adjusted annual rate of $15.8 trillion.

After factoring in inflation, consumer spending fell 0.1% in July. That dropped it back to March levels. As WolfStreet put it, American consumers spent heroically — but inflation ate all the growth plus some.

Americans have also shifted their spending from goods to services.

“Real” spending on durable goods fell 2.6% in July. It was the fourth month of decline. Spending on durable goods has sunk to January levels. It peaked in March after a stimulus-fueled spending spree. Since then, it has dropped nearly 10%.

“Real” spending on services rose 0.6% month-on-month in July and was up 7.6% year-over-year. Despite the improvement, it remains 3.1% below pre-pandemic levels.

Jerome Powell spent most of his much-anticipated Jackson Hole speech trying to prop up his inflationary transition narrative. But according to WolfStreet, this shift in spending from goods to services does not bode well for the future trajectory of inflation.

The continued sharp increase in spending on services, after they’d gotten hammered last year, points at the next source of inflation pressures. Services dominate consumer spending, unlike durable goods such as used vehicles, sofas, or electronics, and they weigh much more in the inflation indices, and as prices of services begin to rise, they will impact overall inflation and core inflation measures much more than durable goods.”

While most American investors have faith that the Federal Reserve can and will successfully tighten monetary policy to fight inflation — or have simply bought into the “transitory” inflation narrative — Germans are loading up on gold as a hedge against growing inflationary pressures.

While most American investors have faith that the Federal Reserve can and will successfully tighten monetary policy to fight inflation — or have simply bought into the “transitory” inflation narrative — Germans are loading up on gold as a hedge against growing inflationary pressures.