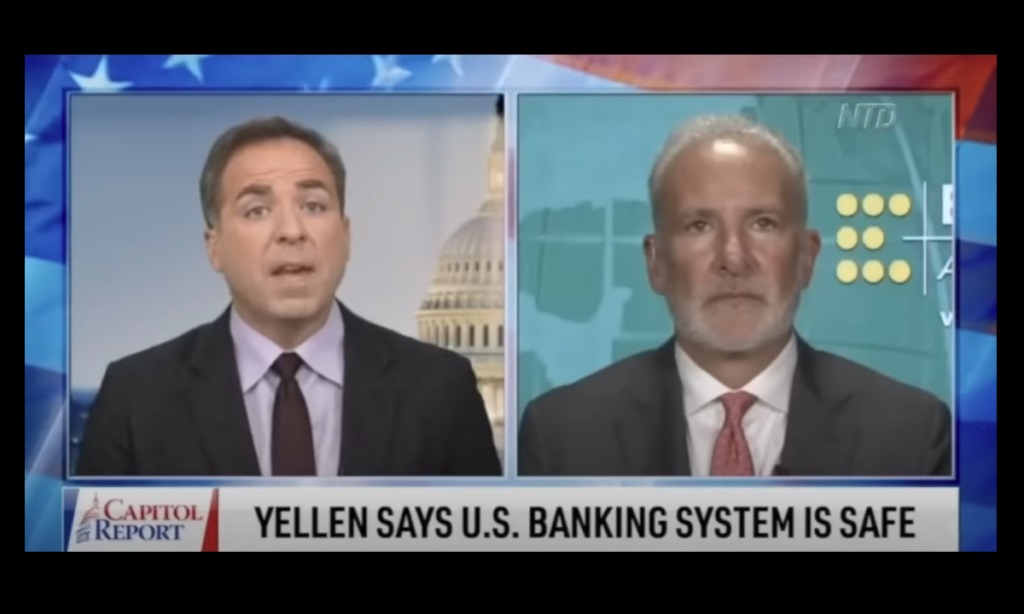

Peter Schiff appeared on the Capitol Report on NTD News to talk about the bank bailouts and the possible ramifications. He said that no matter what President Joe Biden and others tell you, Americans are going to pay for this.

The interview started with a clip of Treasury Secretary Janet Yellen assuring Congrees that the banking system is safe. So, should we feel confident in our banking system?

Peter said, “not at all!”

In fact, that comment is as accurate as her earlier comments that inflation was transitory or the comments in the days leading up to the ‘o8 financial crisis when she and everybody else at the Fed was saying not to worry about subprime because it was contained.”

Peter noted that Yellen kept interest rates at zero for virtually her entire term as Federal Reserve chair.

That’s the reason that we had such a big bubble. Those low interest rates and quantitative easing, and she was part of that, that’s why all these banks are loaded up with now underwater long-term Treasuries and mortgage-backed securities so the banking system is a house of cards. It couldn’t be less sound, and partially, Janet Yellen is to blame for the current state of affairs.”

The host noted the falling CPI and asked what that said about the state of the US economy.

The economy is literally a house of cards. It’s imploding. But inflation is going to get much worse because the Fed has already returned to quantitative easing, whether they admit it or not. The way they are bailing out all the banks is by printing new money and adding it into the economy and taking on mortgages and government debt onto their already bloated balance sheet. So, the Fed’s balance sheet is going to go up. The money supply is going to go up. And that means consumer prices are going to go way up.”

Meanwhile, President Joe Biden keeps insisting that Americans aren’t going to have to pay the cost of these bailouts.

He’s lying. They’re going to pay the cost through higher prices. And when he says that everybody’s bank account is now safe, it’s not. It’s in more danger than ever before because your bank account is going to be eroded in value because of inflation. So, even if your bank doesn’t fail, and you don’t lose your money, your money is going to lose its value.”

Why exactly did SVB fail? Peter said it was due to the low interest rate and QE environment it operated in for a decade.

It was the Federal Reserve that created all these distortions by its artificial suppression of interest rates, and it caused financial institutions to take incredible risks in order to get a return.”

US government regulations also encouraged these banks to load up on Treasuries and mortgages through favorable accounting

So, this whole thing was a byproduct of bad monetary and fiscal policy.”