CEOs and corporate insiders are dumping stock at a far faster rate than we’ve seen in recent years, and the twist is, they’re ramping up selling as their own companies engage in record stock buybacks.

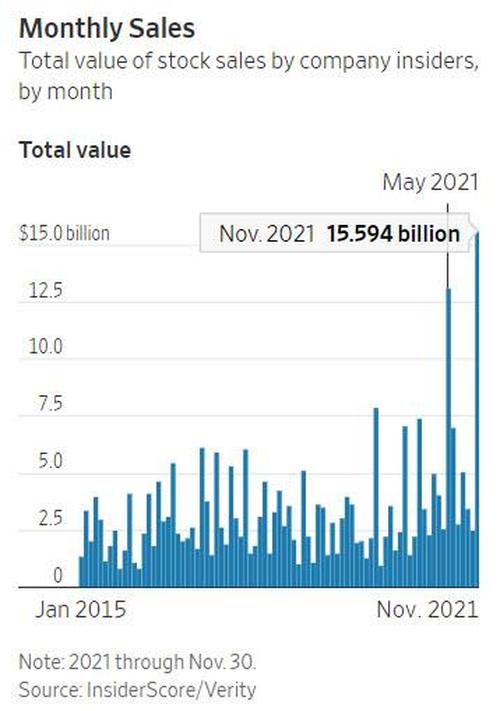

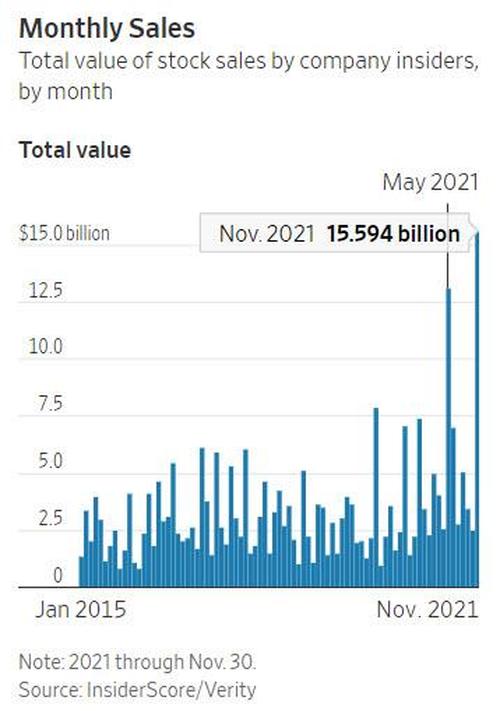

In November, insiders unloaded a collective $15.59 billion – an all-time record…

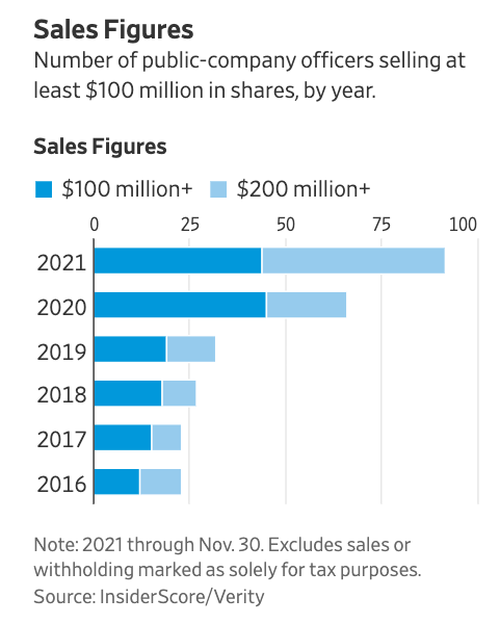

Forty-eight top executives have disposed of more than $200 million each in stock sales this year, about four times the average versus insider from 2016 through 2020, according to a new report via WSJ, citing data from the research firm InsiderScore.

The tsunami of insider selling consists of Google co-founders Larry Page and Sergey Brin, cosmetics billionaire Ronald Lauder, Walton family heirs to Walmart, and Mark Zuckerberg, chief executive of Facebook parent Meta Platforms Inc, among others. Many of them have dramatically accelerated stock sales.

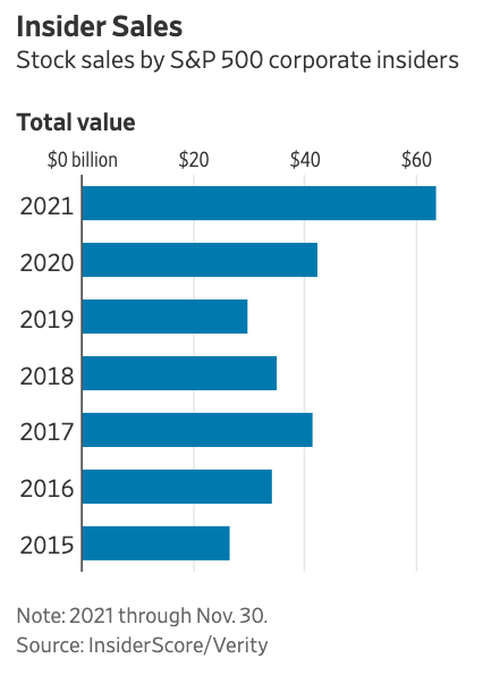

InsiderScore data shows corporate insiders sold a mindboggling $63.5 billion in shares through November, a 50% jump versus all of 2020. The selling comes as major equity stock indexes are hovering near record highs and stock buybacks continue at breakneck speeds. Most of the insider dumping was in the technology sector, amounting to $41 billion in sales.

“What you’re seeing is unprecedented” in recent years, said Daniel Taylor, an accounting professor at the University of Pennsylvania’s Wharton School who monitors corporate execs. He said 2021 resembles a selling wave seen nearly two decades ago during the Dotcom bubble.

Taylor said insiders have impeccable timing of selling tops and buying bottoms. We outlined this in a note not too long ago called “Corporate Insiders With Impeccable Trading Records Send Clear Signal “Stock Market Is Rigged.””

Who’s Buying?

The wave of insider selling comes as Goldman Sachs points out that a staggering amount of stock buybacks have been purchased this year, between $885 to $925 Billion. What this suggests is that insiders are dumping stock to their own companies on secondary markets.

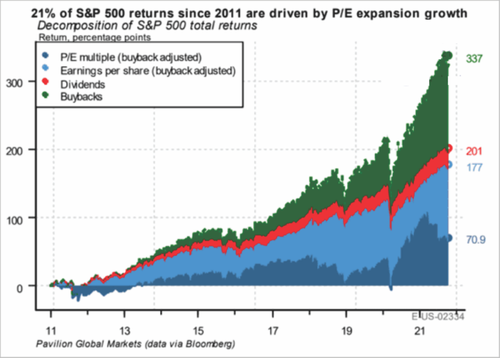

If it wasn’t for stock buybacks, corporate insiders would never be able to dump their stock at mind-numbing valuations. As shown below, 40% of the current bull market is entirely due to buybacks.

In other words, corporate insiders would have trouble selling in the absence of share repurchases due to liquidity issues. For instance, Tesla CEO Elon Musk has sold more than $10 billion worth of stock over the last month to cover taxes on option exercised, which has crushed the stock by 18%. Take note. Tesla doesn’t engage in a share buyback program.

The Ponzi-like scheme corporate insiders are engaging in to increase stock buybacks so they can sell their stock is a massive misallocation of capital. This money could’ve been used to spark new investments in future growth but rather panic hoarded by financial elites.

And while the buyback bid has helped corporate execs unload their stocks, Goldman was quick to caution, “The buyback open window for 2021 ends on Dec 10.”

For investors betting on higher stock prices, the question is what happens if “stock buybacks” reverse?