The leaders of the European Union met last week to discuss how to rearrange the deck chairs on their political Titanic. While the decisions to continue to monetarily support Ukraine and now Israel dominated the headlines, the real story is that what they have to get right is the new budget rules.

And that discussion is important in the context of continued tight monetary policy by the Fed and now the potential for fiscal sanity coming from Capitol Hill with new Speaker of the House Mike Johnson than it was a year ago.

In January, suspension of the Maastricht Treaty budget rules ends, meaning harsh ‘austerity’ comes back into play for the 28 members of the EU. In short, it means targets for budget deficits of no more than 3% of GDP and a debt-to-GDP ratio of 60% are the law of the land…

Unless you’re France.

This is the thing hotly debated during last week’s European Commission summit in Brussels. How do we, as the EU, engineer a soft landing on budget rules while not alienating what’s left of our investor base?

The rules were suspended originally because of COVID-19, as part of, in my opinion, the planned destruction of the European middle class. The point of COVID-19 from a EU policy perspective was to create a crisis that demanded a pre-ordained solution: integration of Europe’s finances under the control of the European Commission (EC) and the European Central Bank (ECB).

SURE you are…

This was partially achieved by giving the EC limited taxing authority to issue pandemic loans under the €800 billion COVID recovery fund, the first tranche of which were called SURE bonds. The camel’s nose is now under the wall of the fiscal tent.

There is also a major push happening offscreen for these bonds to become indexed next to everyone else’s, i.e. to more easily sell them to Muppet investors, through the imprimatur of them being official and backed by the full faith and credit of the EC. Of course, the initial investors in them have lost their ass as the bulk of them were issued when the ECB was at -0.6%. (See Here).

The ECB just held rates at 4.5%. The bond math doesn’t work. So, the EU got the last big lot of blood and treasure after the COVID operation from its investor class, who are now sitting on massive losses. Some of these investors, of course, were the member central banks themselves.

Don’t believe me? A €7 billion 0.1% coupon SURE bond maturing in October of 2040 is now trading at a yield of 3.867%. Now that doesn’t look so bad until you grep the price of that bond, which is trading with a bid/ask spread of 0.54/0.55… or a 45% loss.

Well, when I say trading, I really mean quoted, because no one actually trades this hot garbage, certainly not with yields rising globally, inflation not tamed anywhere for anything that really matters, and the euro clinging to the cliffside of a precipitous fall against everything that isn’t the Japanese yen.

And the Bank of Japan is intervening daily to shift its monetary policy to defend the yen. And they will.

But don’t feel too bad folks, because the EU is so creditworthy you’ll get your money back in 17 years paid in full plus 0.1% compounded annually.

And they want these things listed as an index next to, you know, German bunds, UK gilts or US T-bills… Why? So people can laugh at them?

If these people actually had blood in their veins they would feel at least a modicum of pressure from the investors they swindled out of billions. But they don’t.

What they want now is to get more fiscal integration in order to reassure investors that their more perfect union will be that great bet for 2040.

This is why ECB President Christine Lagarde lobbied hard going in for more fiscal unity.

Ensuring a deal about the implementation of the Stability and Growth Pact would be an important signal of unity, Lagarde said — according to an official familiar with the conversation — observing that the bloc’s framework must promote both debt sustainability and investment.

EU countries are at loggerheads over how flexibly to enforce the fiscal regime, which normally limits deficits to 3% of gross domestic product. Such rules have been suspended since the onset of the pandemic, but are due to be reinstated at the start of 2024.

If you want to understand why the world hasn’t completely given up on the Eurobond markets it is precisely because of these budget rules, designed to reassure investors that they are the responsible party at the geopolitical table, at least compared to the Clown World that is Capitol Hill.

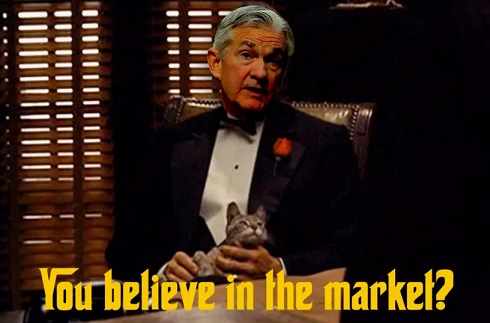

There’s only one problem with this, FOMC Chair Jerome Powell.

You can argue with me about why Powell raised rates the way he did. You can take the ‘black pill’ and say that he did this to effect a controlled demolition of the middle class and bring on the WEF’s Great Reset.

Or, you could actually be a grown up and realize that the world is more complicated than reducing it to cartoon levels of evil unity the world over. That the EU may use Powell’s aggressive US dollar policy for their own ends is not the same as saying that Powell was in on it.

Arguing everything is all part of the plan all the time is just cope for not being able to see complexity in human behavior.

What you can’t deny is the following:

A lot of these SURE and NGEU (Next Generation EU) bonds were issued at a time when it looked like Davos and the EU would not only gain political control over US policy by getting rid of Trump but also monetary control by sabotaging Powell’s quest for a second term as FOMC Chair.

I’m sure few were thinking we’d be where we are today even at Evil Oligarch Central in late 2021. Moreover, if the primary buyers of these SURE bonds were other central banks, rising yields only ensures they become insolvent and starved of capital that much faster, c.f. The Bundesbank needing a capital injection according to a recent audit firm.

The bonds fall in price hard, central banks balance sheets degrade rapidly…et voila, the need is created for more fiscal integration because the Italians can’t stop spending OPM — Other People’s Money.

At least that’s how the Germans will spin it.

You’ll know if these bonds have fallen far enough in price to attract the vultures, when you actually see them trading for real on European exchanges. And it will only be at that point when you’ll know that the EU has everyone gasping and wheezing for air enough to finally pull the trigger on real fiscal integration.

If/when that finally happens, the price of those bonds will skyrocket.

Because not only do you have to bankrupt everyone to get them to go along with the plan you put in motion, you have to make sure the only people left with any money can profit handsomely picking up the pieces at pennies on the dollar.

And therein lies the real problem. These SURE and NGEU bonds, much to the consternation of the EU Commission, continue to trade at far higher yields at similar maturities to German bunds, for example. Here’s a link to the latest report to the EC on the development of this market. The tone is anything but euphoric.

A lack of fiscal unity is what keeps the EU at a disadvantage to the US, ultimately. The lack of it keeps investors anxious. They want security. Lagarde and the EC want to give it to them.

The problem is they don’t have the backing of the people of Europe who never really signed up for being ruled by unelected Eurocratic Commies in Brussels. These SURE and NGEU bonds are meant to be the beginning of a real central EU borrower. But without direct taxing authority, slapping a AA+ rating on a bond doesn’t make it creditworthy.

And now you should be able to understand why this is the real war they need the kinetic war not just to cover up default and/or stricter capital controls but also for the US to fight that war alone.

Why else do you think France is sending support to Gaza?

Euro-Flogging

The problem, of course, with the Maastricht rules is the euro itself. Without the ability of the European Commission to have cross-border tax and spend authority, the ECB’s interest rate policy puts undue burden on those countries with lower labor efficiency.

It creates the very dynamic the rules were supposedly designed to prevent, fiscal disintegration. For countries like Greece or Italy, where a local lira or drachma would be cheaper than a German mark thereby normalizing the differences between them when they trade, the euro is too strong for Italian or Greek merchants and too cheap for German.

The former run perpetual, structural trade deficits relative to the other. Wealth is then transferred to the Germans at the expense of the Greeks and the Italians, in this example.

I’ve made this point before. The single currency with the monolithic interest rate system we have here in the US benefited California at the expense of Mississippi. When you hear shit-libs complain that blue states are tax producers and red states tax consumers they aren’t lying, but they are also ignoring the tilt of the playing field in California’s direction.

Germany had been the prime beneficiary of the euro until Powell began raising rates and acting like he runs the Fed for America’s benefit not Germany’s or China’s.

As predictable as the movements of the sun across the sky, German Chancellor Olaf Scholz demanded tighter fiscal rules while France and Germany are negotiating with themselves to screw the rest of the continent over.

Powell raising rates forced up everyone else’s who does business in US dollars, which is pretty much everyone. It means that the cost of obtaining dollars or hedging your other currency risk in dollars is more expensive than it was before.

This is why Lagarde has been so angry with Powell because as she was out there trying to help sell the world on nearly a trillion dollars worth of COVID relief bonds at 0% Powell was saying:

It’s why their plans to sell the world on unlimited spending to fight Climate Change isn’t working either. Without the Fed giving them the buy in, global investors aren’t going to pony up the cash. The whole EU air of inevitability just starts to reek like three-day-old fish, or a house guest.

Because, in this model of the world, the Bank of Italy may be subordinate to the ECB but the ECB is subordinate to the Fed.

This is why I think Powell is in the driver’s seat here. It’s why Mike Johnson being Speaker could be a very good thing. At the very least if he ends Project Ukraine it slows the descent into fiscal madness. If Johnson is serious about single issue spending bills and Congress going back to doing some real horse-trading, we could see a much different 2024 and beyond in the US than just about anyone, including me, could have dreamed of.

On the other hand, with this being another front in the war between central banks there are real dangers that leave me very worried about where we’ll be by year end. Hence the real threat any further escalation by Israel in Gaza represents. The US is trying to blame shift like they did after 9/11 to gin up the war they always wanted, this time with Iran playing the part of Iraq.

The EC is trying to supplant individual sovereign bonds with their own bonds. They have to get the next round of fiscal integration going this winter or lose the race for global capital to the US and/or China. If they pull it off — which I suspect they have no choice but to — it’s a signal the are trying to outlast Powell in the hope that they can present a unified front to European investors long enough for the US economy to implode while also hoping the Israeli Firsters in Congress ensure that the US goes to open war with someone… anyone … somewhere! Dammit!

That will keep bond spreads positively biased towards them versus the US as the US enters the throes of Silly Season and the reality TV shitshow as Davos et.al. pull out all the stops for sweeps week.

It’s not a bad bet, sadly.

By Tom Luongo