I’m sad for future generations of Americans who will pay for the mistakes that we are making under the sick, misguided and downright ignorant claim that we are ensuring their future prosperity.

When it comes to matters of mainstream monetary policy (and the fools who run it), if you don’t blindly accept that the US dollar is going to continue to be dominant on the world stage for the rest of eternity, you are automatically labeled a conspiracy theorist.

Just think about this: many of the people that advocate for keeping the monetary system the way that it is today often fall back onto the argument that everyone who has criticized the system over the last hundred years has been wrong.

They also are quick to assume that because this is how global monetary policy has been for the last hundred years, that this is how it’s going to stay.

Meanwhile, you can’t even so much as pick up a cup of coffee in the waiting room of any financial services firm without the warning “Past performance is not indicative of future results” written on it.

It seems like everyone is reading these warnings except those who actually set policy.

In fact, these people are so arrogant and sure of themselves that even raising the question of when the global monetary system – described last week as a “credit based ponzi scheme” – could potentially change in the future is often written off as hogwash.

Rather than see what is right in front of them, these advocates will be proudly proclaiming that the boat isn’t really sinking – that it’s all just our wild imaginations – while standing on the bow as the ship slowly takes on water, certain to plunge underwater.

As mentioned, being critical of the system doesn’t get you the title of “inquiring economic mind”, “critical thinker” or “constructive contrarian looking out for the country’s best interests”. Instead, it gets you the label of “permabear”, as has been appended to a long list of skeptics and Austrian economists who have been “wrong” for the better part of the last several decades.

If you are a believer that, mathematically, our system can’t hold up the way that it is structured today, then you’ve already committed to yourself, in your mind, that you’re right. For you, it’s just a question of when you’ll be proven right. The other side of the argument also thinks they’re right.

And so it becomes somewhat of quagmire for both sides, eliminating much hope that civil discourse and nuance would be able to affect change. After all, one side knows they’re right but hasn’t been proven right yet – the other side knows they’re right and uses history as an indicator of exactly what the future will hold.

Both arguments have their respective Achilles’ heels, but the argument that the monetary system is always going to stay the same and at the dollar is always going to be king is (1) far more arrogant than the idea that things could change and (2) stands at fundamental odds with the nature of our known universe, where change is constant.

“It is not impermanence that makes us suffer. What makes us suffer is wanting things to be permanent when they are not. We need to learn to appreciate the value of impermanence. If we are in good health and are aware of impermanence, we will take good care of ourselves. When we know that the person we love is impermanent, we will cherish our beloved all the more. Impermanence teaches us to respect and value every moment and all the precious things around us and inside of us.”

― Thich Nhat Hanh

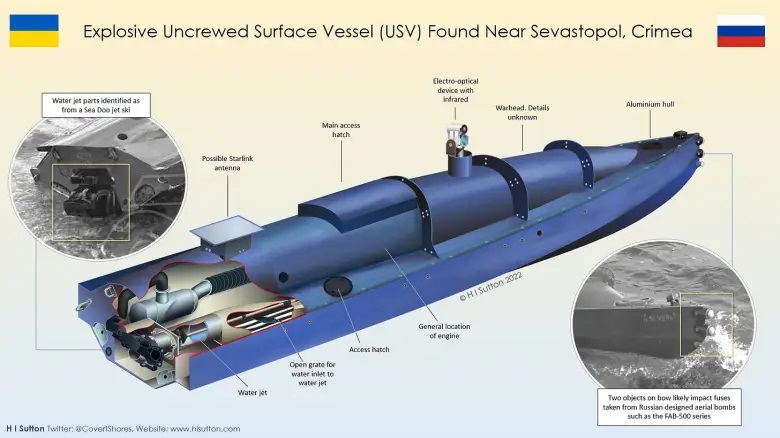

Over the last couple of months, since Russia has invaded Ukraine and appears to be attempting to start a new global economic system with China, one would expect that our leaders would see the same things that we do: that as long as you have a country replete with productive capacity, another major country it can sell to and commodities it can use to back its currency, you don’t need the U.S. dollar.

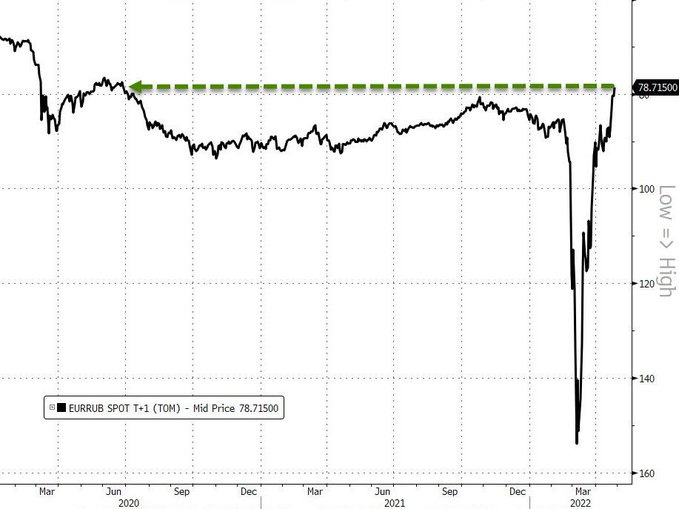

But it appears our leaders are still very blind to the fact that they don’t have the bargaining capacity and leverage that they think that they do. Our leaders still believe that sanctions on Russia are making a profound difference in the country’s efforts in the war. They aren’t. Just this morning, the ruble raged to near 52 week highs.

This chart from Zero Hedge shows Russia’s “new and improved” Ruble 2.0, now juiced to the tits with Russian crude oil and vodka like Barry Bonds’ was with human growth hormone back in the early 2000’s, raging back toward highs against the Euro (and maybe even eventually eyeing the home run record).

Russia is doing exactly what it was doing prior to the sanctions and, while the they may be an inconvenience for the country, they have failed to sway Putin from his decisions in Ukraine.

And now, again, we’re seeing the same arrogance when it comes to matters of the US dollar. Further proving my point that advocates for current monetary policy are arrogant, US Treasury Secretary Janet Yellen proclaimed last week that the dollar was at no risk of losing its reserve currency status, according to Bloomberg.

“I don’t think the dollar has any serious competition, and is not likely to for a long time,” she said earlier this month. “When you think about what makes the dollar a reserve currency, it’s that we have the deepest and most liquid capital markets of any country on earth. Treasury securities are safe, secure and immensely liquid. We have a well-functioning economic and financial system and the rule of law. There really is no other currency that can rival it as a reserve currency.”

Of course, Fed alumni have a wonderful track record of making such asinine and baseless predictions.

Janet Yellen herself called low inflation a “mystery” years ago while heading up the Fed. Today, inflation is at record highs. She’s also predicted that we wouldn’t have another financial crisis in our lifetimes. Just a couple years removed from that statement and we appear to be on the precipice.

So why wouldn’t she be wrong about the dollar?

But, like with everything else involving government or elected officials, we’re going to have to do this “the hard way”. As I said on my podcast with Larry Lepard last week, it’s only after we exhaust all of the wrong solutions before we arrive at the correct one.

And the old saying goes “pride goeth before the fall”.

Certainly, the hubris is dripping from Yellen‘s statements at a time when anybody with both eyes open and three brain cells to rub together understands that the dollar is facing its most significant challenge in decades and that we’re on the verge of a new global monetary system.

I can’t even say that I’m surprised that Janet Yellen doesn’t understand this, rather I’m just saddened at this point – sad for her, sad for the country, sad for the perpetual state of ethnocentrism we live in, sad for common sense and critical thinking, and sad for future generations of Americans who will pay for the mistakes that we are making under the sick, misguided and downright ignorant claim that we are ensuring their future prosperity.