Rabo: “Transitory” Inflation Today; Price Controls And Rationing Tomorrow?

By Michael Every of Rabobank

Pricing and Poetic Justice

With global cargo routes log-jammed; a key US oil pipeline still shutdown, leading to another backlog of ships idling off-shore; log-jammed cargo ships off the Israeli port of Ashkelon watching missiles being fired overhead; the US navy interdicting a ship full of Iranian-supplied weapons in the Red Sea (as sanctions may be about to be lifted); Aussie iron ore at a price level three times above what was considered toppy until recently; lumber prices higher than the roofs they build; copper the new ‘gold’; semiconductors not available at all; and many agri commodity prices shooting up vertically like green shoots from the ground (though rain may dampen that move for some), today is the latest look at “transitory” inflation.

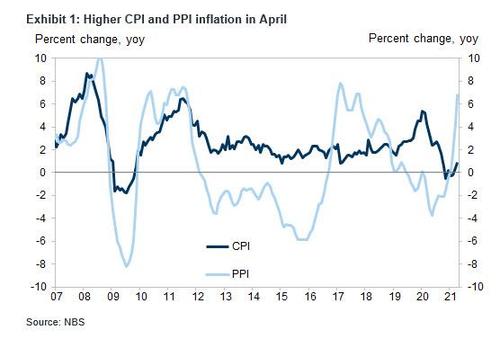

Chinese data saw CPI rise 0.9% y/y vs. expectations of a 1.0% increase, and up from 0.4% in March. PPI was higher, rising 6.8% y/y vs. a 6.5% consensus and up from 4.4%. So somebody is seeing margins squeezed by an unpleasant amount: but for so many heavily-indebted Chinese firms at least it’s better than PPI being stuck in negative territory when the interest rates they pay are positive. The global impact of that PPI move is somewhat muted by the upward move in CNY – for now.

Tomorrow, it’s the turn of the US. According to the media meme, US tech stocks tanked yesterday on the basis that inflation is now a real concern, despite the fact that US payrolls just said the opposite, and both the Fed and the Treasury emphatically said the same. So are the US tech companies that don’t pay attention to even simple balance sheet matters, like what they sell their services for and what it costs to produce them, really looking at the disconnect between nominal US 10-year yields remaining relatively low while the 5-year breakeven rate headed for 2.77% intra-day, the highest since 2008? (It is back at 2.73% at time of writing, so all is well, techies!) Does it really disrupt their disruptive business model if rates stay too low, which is the lifeblood of much of this tech bubble, and then have to rise years down the line, at a time when each firm involved likes to dream the little dream that it will be the next Bezos/Gates/Musk?

Not that this means we shouldn’t be concerned by inflation. As we wrote early in 2020, the Covid crisis was like fighting a war, fiscally. And when wars are over, there is a deflationary demand collapse, not a boom. Yet that is not the case today because:

This war is far from over. Only some territory has been partially ‘liberated’. 100 countries have yet to receive a single vaccine shot – and some vaccinated countries are still seeing cases surge. It’s a race against time, as new strains try to work their way round vaccines;

Global supply chains are going to remain disrupted for a long time;

We are rolling the war straight into a Cold War, with all of the disruption that entails; and

We are also getting post-war fiscal rebuilding before the war is even over.

However, none of this means we have avoided the post-war slump that history usually provides us with. Can a key product really triple in price and then nobody pay more for it? Can a swathe of inputs double and nobody pay more? The only question is who pays the price, and where, and how soon.

If it is consumers, then real wages are going to fall, and demand follow. Even if CPI doesn’t record much of an impact, in the real world people will feel it. If it is firms, profits will collapse instead, and then investment. Or perhaps the government and central bank will resolve these issues: during wars we often see price controls, rationing, and/or industrial policy – which combination will it be this time? Indeed, what is the fairest resolution to this mess? How should the imminent price pain be apportioned in a scarred society? By markets? By regulators? If yes, based on what political philosophy? “Social justice”? “One Nation-ism”? “National security”? “I’m Alright Jack”? Rock, paper, scissors? Best out of three? Let justice be served!

In short, if a post-war period usually sees a slump and a pile of debt to fight over, for now we are still at the earlier stage, where we fight over supply chains and the impact of inflation instead. The debt issue can wait a while longer.

Meanwhile, as this all plays out in public view and yet to very little public discussion, firms in China are apparently vulnerable to more than inflation. There is also poetry. Shares in Meituan have slumped after its CEO posted, then deleted, a poem on social media about ancient Chinese emperor Qin Shi Huang burning books. Bloomberg wonders if this is going to be ‘Jack Ma 2.0’ as a result. This may be regarded quizzically by the West. However, how free is the average Western CEO to use Twitter to opine on anything beyond a certain Overton Window without major market ramifications? There is no room for “Roses are red, violets are blue” comments without instant ‘poetic justice’; which has seen its own inflation-like surge in recent years.

Tyler Durden

Tue, 05/11/2021 – 09:01

Rabo: “Transitory” Inflation Today; Price Controls And Rationing Tomorrow?

By Michael Every of Rabobank

Pricing and Poetic Justice

With global cargo routes log-jammed; a key US oil pipeline still shutdown, leading to another backlog of ships idling off-shore; log-jammed cargo ships off the Israeli port of Ashkelon watching missiles being fired overhead; the US navy interdicting a ship full of Iranian-supplied weapons in the Red Sea (as sanctions may be about to be lifted); Aussie iron ore at a price level three times above what was considered toppy until recently; lumber prices higher than the roofs they build; copper the new ‘gold’; semiconductors not available at all; and many agri commodity prices shooting up vertically like green shoots from the ground (though rain may dampen that move for some), today is the latest look at “transitory” inflation.

Chinese data saw CPI rise 0.9% y/y vs. expectations of a 1.0% increase, and up from 0.4% in March. PPI was higher, rising 6.8% y/y vs. a 6.5% consensus and up from 4.4%. So somebody is seeing margins squeezed by an unpleasant amount: but for so many heavily-indebted Chinese firms at least it’s better than PPI being stuck in negative territory when the interest rates they pay are positive. The global impact of that PPI move is somewhat muted by the upward move in CNY – for now.

Tomorrow, it’s the turn of the US. According to the media meme, US tech stocks tanked yesterday on the basis that inflation is now a real concern, despite the fact that US payrolls just said the opposite, and both the Fed and the Treasury emphatically said the same. So are the US tech companies that don’t pay attention to even simple balance sheet matters, like what they sell their services for and what it costs to produce them, really looking at the disconnect between nominal US 10-year yields remaining relatively low while the 5-year breakeven rate headed for 2.77% intra-day, the highest since 2008? (It is back at 2.73% at time of writing, so all is well, techies!) Does it really disrupt their disruptive business model if rates stay too low, which is the lifeblood of much of this tech bubble, and then have to rise years down the line, at a time when each firm involved likes to dream the little dream that it will be the next Bezos/Gates/Musk?

Not that this means we shouldn’t be concerned by inflation. As we wrote early in 2020, the Covid crisis was like fighting a war, fiscally. And when wars are over, there is a deflationary demand collapse, not a boom. Yet that is not the case today because:

This war is far from over. Only some territory has been partially ‘liberated’. 100 countries have yet to receive a single vaccine shot – and some vaccinated countries are still seeing cases surge. It’s a race against time, as new strains try to work their way round vaccines;

Global supply chains are going to remain disrupted for a long time;

We are rolling the war straight into a Cold War, with all of the disruption that entails; and

We are also getting post-war fiscal rebuilding before the war is even over.

However, none of this means we have avoided the post-war slump that history usually provides us with. Can a key product really triple in price and then nobody pay more for it? Can a swathe of inputs double and nobody pay more? The only question is who pays the price, and where, and how soon.

If it is consumers, then real wages are going to fall, and demand follow. Even if CPI doesn’t record much of an impact, in the real world people will feel it. If it is firms, profits will collapse instead, and then investment. Or perhaps the government and central bank will resolve these issues: during wars we often see price controls, rationing, and/or industrial policy – which combination will it be this time? Indeed, what is the fairest resolution to this mess? How should the imminent price pain be apportioned in a scarred society? By markets? By regulators? If yes, based on what political philosophy? “Social justice”? “One Nation-ism”? “National security”? “I’m Alright Jack”? Rock, paper, scissors? Best out of three? Let justice be served!

In short, if a post-war period usually sees a slump and a pile of debt to fight over, for now we are still at the earlier stage, where we fight over supply chains and the impact of inflation instead. The debt issue can wait a while longer.

Meanwhile, as this all plays out in public view and yet to very little public discussion, firms in China are apparently vulnerable to more than inflation. There is also poetry. Shares in Meituan have slumped after its CEO posted, then deleted, a poem on social media about ancient Chinese emperor Qin Shi Huang burning books. Bloomberg wonders if this is going to be ‘Jack Ma 2.0’ as a result. This may be regarded quizzically by the West. However, how free is the average Western CEO to use Twitter to opine on anything beyond a certain Overton Window without major market ramifications? There is no room for “Roses are red, violets are blue” comments without instant ‘poetic justice’; which has seen its own inflation-like surge in recent years.

Tyler Durden

Tue, 05/11/2021 – 09:01

Read More