This is the latest from Harris Kupperman, founder of Praetorian Capital, a hedge fund focused on using macro trends to guide stock selection. Mr. Kupperman is also the chief adventurer at Adventures in Capitalism, a website that details his investments and travels.

Harris is one of my favorite Twitter follows and I find his opinions – especially on macro and commodities – to be extremely resourceful. I’m certain my readers will find the same. I was excited when he offered up his latest to Fringe Finance about, in his words, why “the Fed is fuct”.

Harris On Why The Fed Is Screwed

The Fed is trapped in a box of their own creation. As a result, they may want to talk tough, but their ability to maneuver is severely restricted. The Fed claims that they’re targeting a terminal rate of 4.6% for Fed Funds, but if they did that for any period of time, they’d only succeed in blowing up the Treasury.

Our government has run obscene deficits over the past two decades. This was only made possible by the Fed suppressing interest rates. Despite a succession of Treasury Secretaries, the US debt was never termed out. The majority of the debt is actually quite short term. During 2021, the Federal government paid $392 billion in interest on $21.7 trillion of average debt outstanding—or an average interest rate of 1.8%.

Now imagine if Fed Funds actually got to the terminal rate and stayed there for any period of time. What would paying an average rate of 4.6% on year-end 2021 debt do to the interest expense? Well, it rises by $636 billion to $1.028 trillion or the more than the cost of our entire military spending of $801 billion in 2021. Ignoring the budget pressure, the interest cost would then be 4.5% of total GDP, up from 1.7% in 2021. That’s like tying a lead weight around the neck of our economy.

Both political parties have engaged in a drunken spending spree. There is zero political desire to reduce spending and it seems almost inevitable that deficits will continue and even expand into the future. The question is, “who then funds the increased cost of interest expense in addition to the already egregious annual deficits?”

Over the past few years, our deficits have increasingly been funded by the Federal Reserve purchasing government bonds through their QE, which is quite inflationary as we’re now learning. Except, QE is now going in reverse as the Fed claims that they’ll be selling off bonds as they conduct QT. If they’re selling bonds while the Treasury needs to accelerate their own debt issuances to cover the increased cost of interest, then rates will be forced higher—potentially much higher.

As rates go higher, government interest costs will increase, and the cycle will accelerate the cash drain from the Treasury. At some point, the Fed will be forced to step in and monetize this debt as the buyer of last resort—which is effectively what happens in most Emerging Market crises—often making the crisis much worse. This is a cycle that once started, gets ugly quite fast.

Just look at how fiercely the Japanese are defending the interest rate on their own sovereign debt. The Japanese must know that once rates rise, the whole game is over. The Bank of England belatedly came to a similar conclusion after only testing QT. Over here in the states, I’m not sure if the Fed has actually done any math on the issue.

Look, Powell may want to be Volcker. He may want to crush inflation. However, he’s trapped. The Fed simply cannot take rates up beyond a certain point without blowing up the Treasury and then being forced back into even more aggressive QE to absorb the bonds from the Treasury—which would only accelerate inflation. Besides, despite Powell desiring a recession to crimp inflation, he must realize that a recession will certainly crimp tax receipts—only making the deficits worse.

It’s all quite reflexive and low rates are what’s stopping the snowball from rolling down the hill. Raising rates will set an avalanche in motion. When your debt to GDP exceeds 100%, your ability to maneuver is restricted. The US is on the precipice of an Emerging Markets debt crisis and Powell seems determined to be the one who sets it all in motion, but only after he first blows up every other global Central Bank.

I am always reminded that the Fed is full of useless academics, but in the end, it’s a highly political institution and they’ll craft the white papers to justify whatever idiotic course they choose to take. As the above scenario begins to unfold, the political class will force Powell to back down. They will decide that increased inflation is preferable to detonating the treasury. The Pause is coming and it will send equities parabolic. There will be a few more nasty moments between then and today. The trick is to survive and then max it out when the Fed admits that they’re trapped. It’s going to be one of the great wealth transfers of all time. Who’s ready?

Harris On OPEC’s “Counterattack”

The Federal Reserve has been attacking inflation. The problem is that after printing trillions of dollars, they’re ill-equipped to succeed at their task. Partly, this is because all that cash has to go somewhere and partly this is because their mandate does not extend into ensuring that global energy production expands.

While Owners’ Equivalent Rent and wages have remained elevated, those are often seen as the “good” sort of inflation—or at least the benign sort. Meanwhile, all other forms of inflation tend to be characterized as “bad” and frequently the “bad” inflation is caused by elevated energy prices, which then increase the costs of producing and transporting everything else. Therefore, despite the Fed ignoring the inflation they caused for well over a year, when oil cleared $100 a barrel, the Fed finally felt that they had no choice but to do something.

The problem is that the only ways to reduce the price of oil are to produce more of it or consume less of it. It’s hard to produce more when the President and many of his powerful oligarch buddies are aggressively intervening to ensure that it’s difficult to expand or finance production. Meanwhile, no one wants to invest when there are constant threats of excess profits taxes, carbon taxes, expropriation and price caps. Since the obvious solution has been made so impossible, the Fed has been forced to embark on a plan to reduce global energy consumption.

How do you reduce oil consumption? Well, it seems that their plan is to create a global depression. So, after a decade of paying lip-service to “inclusive economics” and “closing the wealth gap,” the Fed has been forced to pivot and destroy the finances of the world’s poor, in the hopes that they’ll consume less oil. For the past half-year, this plan has unfolded with the usual crescendo of mini-temblors as global growth screeches to a halt and over-leveraged institutions find themselves on the wrong side of asset depreciation. The Fed is now well on its way towards creating an economic crisis that will reduce global energy consumption—consequences be damned.

Naturally, most global citizens do not want a lower standard of living so that US consumers can continue their orgy of excess. In fact, many global citizens owe their current standard of living due to elevated energy prices. Hence, after watching Biden liquidate the Strategic Petroleum Reserve in order to improve his polling numbers, while watching the Fed directly target their standard of living and that of their customers, OPEC has had enough. They’re going to do something about the Fed and its war on oil. OPEC has finally launched a counterattack. Last month, they agreed to cut output by 100,000 bbl/d. It was meant as a warning that went unheeded. Tomorrow, they’re going to Blitzkrieg the Fed.

No one knows how big the cuts will be and frankly, it doesn’t matter how large they are. Instead, the message is clear—the Fed can crash global GDP in their fight against oil, but OPEC wields a much larger stick and will cut production even faster. In fact, OPEC will DO WHATEVER IT TAKES if the Fed continues on this path. OPEC has drawn a line under the price of oil and told the Fed that it’s wasting its time. OPEC controls the price of oil and oil is the world’s Central Banker, not the Fed.

[Last] Monday morning, the market heard that message loud and clear. The Fed is trapped, oil is going higher, and the Fed is powerless to contain it. Why would the Fed continue trying to blow up the world’s financial markets if oil will not bend to their will?

Let’s look at a country like India that imports almost all of its energy. The Federal Reserve has effectively been saying, “they’re a poor country, we’ll break them and then global oil consumption will decline and US citizens will have cheaper oil.” Meanwhile, OPEC is saying, “India is a large and growing customer of ours. We’ll defend them against the Fed. Sure, they’ll pay more for their oil, but that’s much better than having the Fed detonate their currency, banking system and economy.” The battle lines are now drawn and OPEC is taking the mantle from the Fed. The market is loving it.

The Fed tends to be the last ones to realize anything when it comes to economics and the markets, so they likely haven’t internalized what OPEC just told them. However, the stock market understood it instantly, having one of the largest 2-day rallies in years. We’re getting much closer to The Pause.

The Fed still needs to break something before they can declare victory and reduce rates, but The Pause is near—maybe not near in terms of price, but certainly in terms of when they pause. OPEC’s counterattack has changed the calculus and the Fed is now on the backfoot. If you can’t win at something, why try? Especially if you’re going to leave casualties all over the financial markets.

On the topic of OPEC, here’s some quick math. Global supply and demand are roughly in balance today. Add in 1.5 million bbl/d of global SPR releases that will end soon, add in 2 million bbl/d of reduced demand from Chinese covid lock-downs that appear to be ending, add in 1 million bbl/d that Russian oil will decline by in 2023 (at a minimum), add in the 1 million bbl/d that global demand seems to expand by each year and assume that global supply somehow grows by 1 million bbl/d (though it isn’t clear where that growth would be coming from) and you have a 4.5 million bbl/d swing in 2023. Now add in whatever OPEC chooses and you realize that there’s an imminent and exponential crisis for the consumers of oil.

Of course, the Fed could destroy enough global GDP to erase 4.5 million bbl/d of global oil demand and stop the price from exploding, but OPEC just told them that they’ll DO WHATEVER IT TAKES.

Do you think the Fed continues its war on GDP when they now know they’ll fail to contain the price of oil?

In 2023, energy will be the only thing that matters to investors. Everything else, including the Fed will be a side-show. Who’s ready for the insanity wave? Ever since Monday, I’ve been maxing it all out in energy.

I’ve been ripping right-tails all over the screen. Oil is going to wreck all the other CUSIPS. The S&P is partying this week because the Fed is cornered by OPEC, but that’s only because speculators don’t realize what this means for the price of oil.

We just had a half-year pause in my oil thesis, now it’s about to resume with the sort of vigor that comes from a good long nap. Hope you’re ready…

It’s This Simple: “Higher Interest Rates Blow Up The System”

Friend of Fringe Finance Lawrence Lepard released his most recent investor letter this week, with his updated take on the monetary miasma spreading across the globe.

For those that missed it, Larry also talked with me on my podcast just days ago. I believe him to truly be one of the muted voices that the investing community would be better off for considering. He’s the type of voice that gets little coverage in the mainstream media, which, in my opinion, makes him someone worth listening to twice as closely.

Larry was kind enough to allow me to share his thoughts heading into Q4 2022. The letter has been edited ever-so-slightly for formatting, grammar and visuals.

This is Part 2 of his letter, Part 1 can be found here.

WEIMAR GERMANY PARALLELS

The quote below summarizes Weimar Germany’s dilemma in the early 1920s in a nutshell. As you read it, notice how similar it is to the problems faced by global central banks today – including the Bank of England last month.

“Von Havenstein faced a real dilemma. Were he to refuse to print the money necessary to finance the deficit, he risked causing a sharp rise in interest rates as the government scrambled to borrow from every source.

The mass unemployment that would ensue would bring on a domestic economic & political crisis, which in Germany’s current fragile state might precipitate a real political convulsion. As the prominent Hamburg banker Max Warburg, a member of the Reichsbank’s board of directors, put it, the dilemma was “whether one wished to stop the inflation & trigger the revolution,” or continue to print money. Loyal servant of the state that he was, Von Havenstein had no wish to destroy the last vestiges of the old order.

Faced with these confusing & competing considerations, Von Havenstein decided to play for time, supplying the government with whatever money it needed. Contrary to popular myth, he was perfectly aware that printing money to finance the deficit would bring on inflation. But he hoped it would be modest, & that in the meantime, something would turn up to induce the

Allies to lower their demands or at least agree to a moratorium on actual payments, giving Germany some breathing space.”

Now to be clear, we do not think the US is going to become Weimar Germany (yet). There are a lot of steps between where we are today and a full-fledged hyperinflationary event.

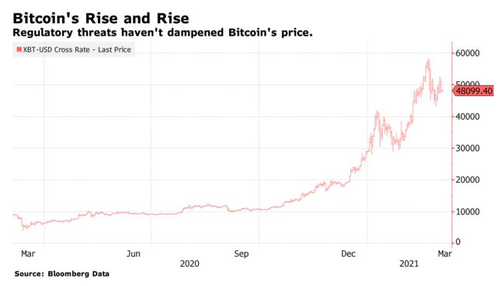

However, we do believe that the situational math suggests that we cannot solve this without severe inflation or a massive debt restructuring (similar thing). This is depicted graphically in the chart below.