And once again, as happens often with consequential news in the United States and the West, no one has noticed and no one seems to care.

If you’ve blinked over the last month, you may have missed it…

China and Russia are taking their shot at the U.S. dollar. And as often happens with consequential news in the United States and the West, no one seems to notice or even care.

Since the beginning of the year, I have been writing about the possibility of Russia and China challenging the US dollar’s global reserve status. Now, it’s happening.

It shouldn’t be any surprise to those paying attention that Russia and China are strengthening their economic ties amidst continued Western sanctions on Russia as a result of the country’s war in Ukraine.

What may surprise some people, however, is that Russia and the BRICS countries, including Brazil, Russia, India, China, and South Africa, are officially working on their own “new global reserve currency,” RT reported in late June. Nobody even seemed to notice.

And of course, as Russia has been cut off from the SWIFT system, it is also pairing with China and the BRIC nations to develop “reliable alternative mechanisms for international payments” in order to “cut reliance on the Western financial system.”

In the meantime, Russia is also taking other steps to strengthen the alliance between BRIC nations, including re-routing trade to China and India, according to CNN:

President Vladimir Putin said Wednesday that Russia is rerouting trade to “reliable international partners” such as Brazil, India, China and South Africa as the West attempts to sever economic ties.

“We are actively engaged in reorienting our trade flows and foreign economic contacts towards reliable international partners, primarily the BRICS countries,” Putin said in his opening video address to the participants of the virtual BRICS Summit.

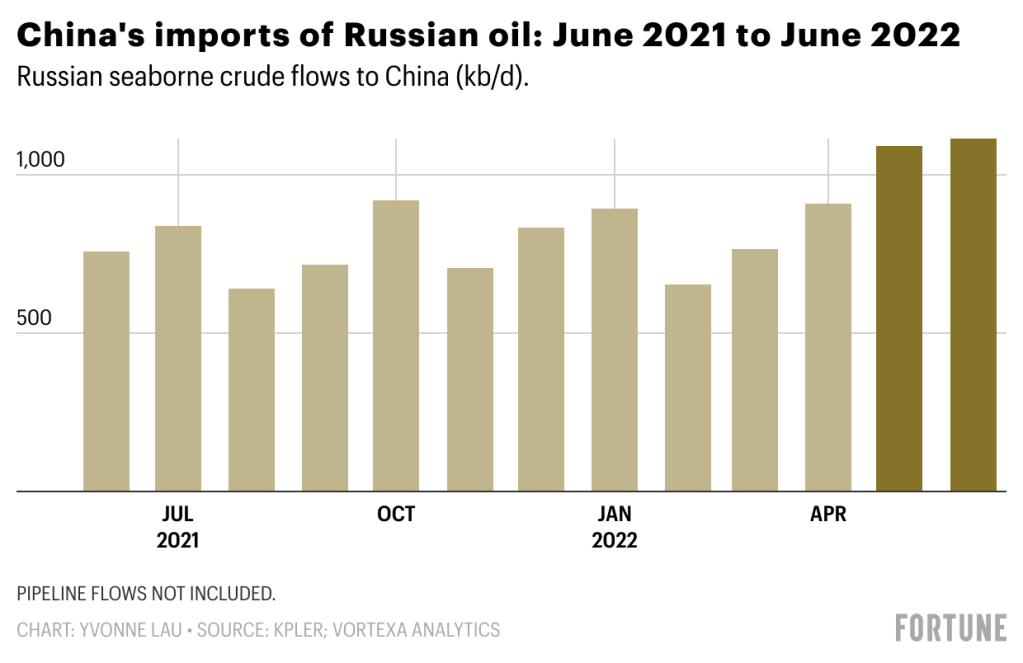

In fact, “trade between Russia and the BRICS countries increased by 38% and reached $45 billion in the first three months of the year” this year, the report says. Meanwhile, Russian crude sales to China have hit record numbers during Spring of this year, edging out Saudi Arabia as China’s primary oil supplier.

“Together with BRICS partners, we are developing reliable alternative mechanisms for international settlements,” Putin said.

Putin continued, stating last month: “Contacts between Russian business circles and the business community of the BRICS countries have intensified. For example, negotiations are underway to open Indian chain stores in Russia [and to] increase the share of Chinese cars, equipment and hardware on our market.”

In June, Putin also accused the West of ignoring “the basic principles of [the] market economy” such as free trade. “It undermines business interests on a global scale, negatively affecting the wellbeing of people, in effect, of all countries,” he said.

President Xi echoed Putin’s sentiments, according to a June writeup by Bloomberg:

“Politicizing, instrumentalizing and weaponizing the world economy using a dominant position in the global financial system to wantonly impose sanctions would only hurt others as well as hurting oneself, leaving people around the world suffering. Those who obsess with a position of strength, expand their military alliance, and seek their own security at the expense of others will only fall into a security conundrum.”

The developments obviously further my long held belief that a gold backed global reserve currency is on its way – something I have been writing about for months.

I’m also stunned that nobody seems to care that arguably the largest shift on the global macroeconomic playing field over the last half century may be taking place.

Sure, under the context of the conflict in Ukraine, the news may seem “par for the course” of sorts, which may result in the media and the financial world downplaying it. But put this piece of information out there on its own, without context – that there is a coordinated global challenge taking place to the U.S. dollar – and it would be the biggest news story in decades. Imagine if China and Russia just dropped this out of nowhere? Now, remember that both countries have been working on, and preparing for, this situation for years.

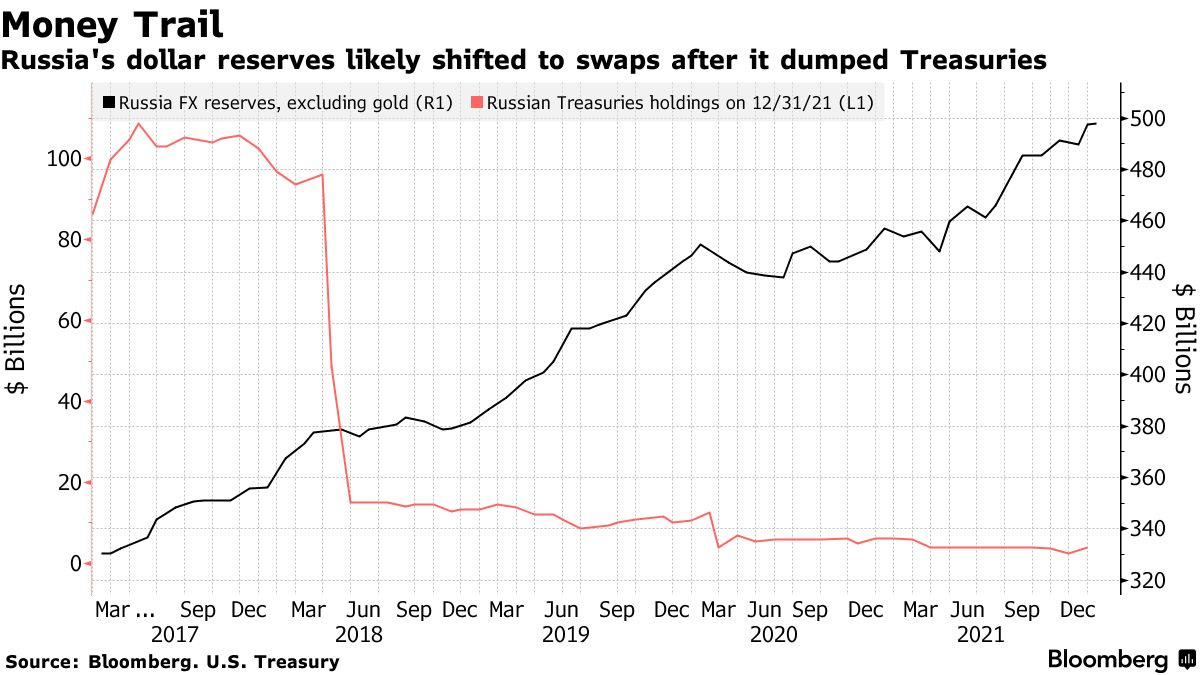

I mean, holy hell, look at Russia’s Treasury holdings as far back as 2018:

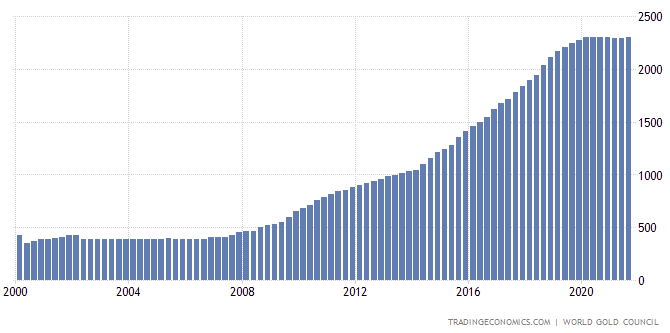

As I’ve noted before, Russia was also increasing its holdings of gold over the same period:

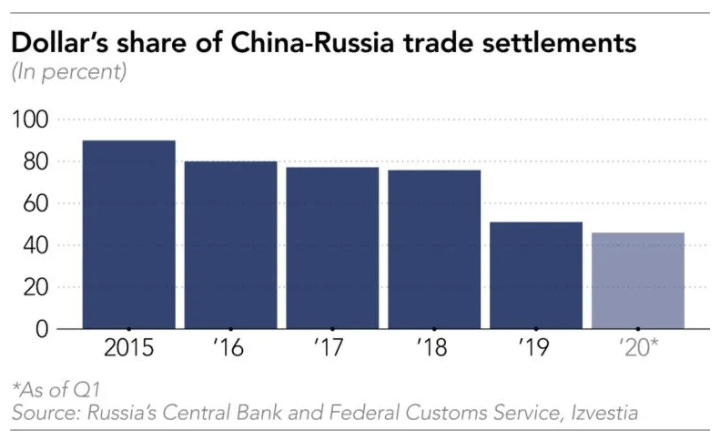

And this headline came out in 2020, just months before Russia’s invasion of Ukraine

Does anyone think it’s a coincidence?

Nikkei wrote at the time:

Dedollarization has been a priority for Russia and China since 2014, when they began expanding economic cooperation following Moscow’s estrangement from the West over its annexation of Crimea. Replacing the dollar in trade settlements became a necessity to sidestep U.S. sanctions against Russia.

Ergo, it seems to me that the BRIC nations understand exactly how precarious of a financial situation the U.S. – and our dollar – is in. Despite the dollar’s recent strengthening, these nations have been in the midst of a multi-decade-long plan to de-dollarize. Even before the Ukraine conflict started, both China and Russia were stockpiling gold and working on denominating transactions outside of the U.S. dollar. It was another “secret” that was out there in the open.

Remember how “insane” this headline was just 6 months ago when I predicted it for the first time?

Everybody told me that it was a stretch. Today, it isn’t so much anymore.

Meanwhile, since the BRIC conference, ties between Russia and China continue to tighten, with Japan even warning this week about the pair’s “strengthening of military ties” – at the same time China has closely scrutinized a planned trip by House Speaker Nancy Pelosi to Taiwan.

Japan said this past week:

“As a result of the current aggression, it is possible that Russia’s national power in the medium- to longterm may decline, and the military balance within the region and military cooperation with China may change.

In the vicinity of Japan, Russia has made moves to strengthen cooperation with China, such as through joint bomber flights and joint warship sails involving the Russian and Chinese militaries, as well as moves to portray such military cooperation as strategic coordination.”

Japan said this alignment between the two countries “must continue to be closely watched in the future.”

While the economic gears turn behind the scenes, China is also becoming increasingly cagey about Taiwan. The country “has sent warplanes into Taiwan’s self-declared air defense zone identification zone many times in recent months,” according to CNN, and recently alluded to the idea of a no-fly zone over Taiwan ahead of a planned visit by Nancy Pelosi.

President Biden commented on Pelosi’s travel plans this week, stating: “The military thinks it’s not a good idea right now. But I don’t know what the status of it is.”

We’re sure Pelosi will wind up going anyway. Remember, this is the same woman who danced her way through Chinatown while Covid was spreading to the U.S., from China, to prove she wasn’t racist.

I can hear her en route to Taiwan now:

“I negotiate million dollar stock trades for breakfast, I’m sure I can handle this Euro trash.”