Тhe most profound seismic shift in the global monetary bedrock is happening right before our eyes, and no one seems to notice or care. Eventually, they will have to.

No sooner was it that I wrote an article talking about how Russia was going to back the ruble with gold than “one of the Russia’s most powerful security/intelligence officers and a close ally of Putin” has admitted the country’s intentions to do just that.

And I’m predicting that no sooner will the gravity of this decision finally sink in with the West that China will follow closely in Russia’s footsteps and do the same.

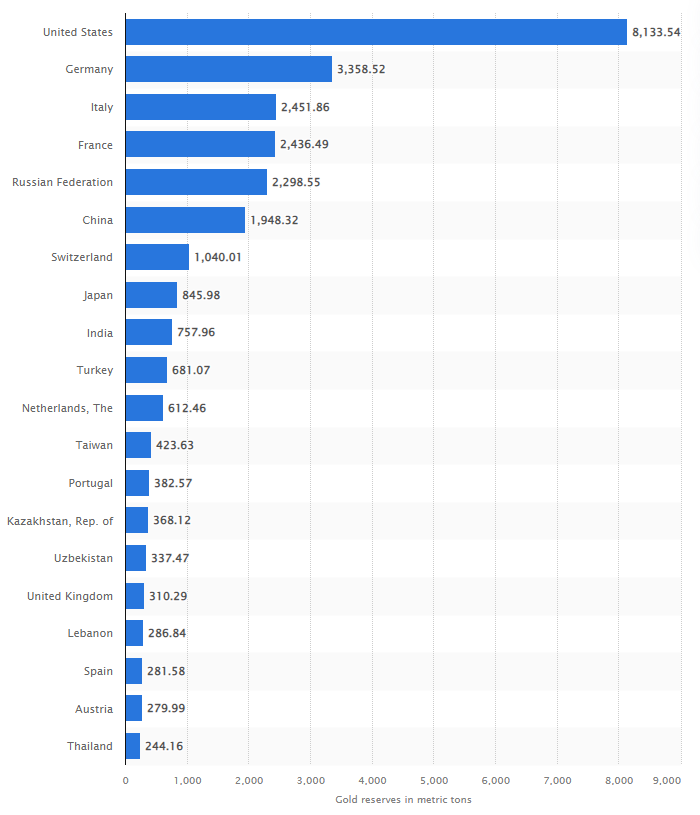

Russia backing its currency with gold represents one of the most drastic changes to the foreign currency market in decades. As of 2022, precisely zero countries still adhere to a gold standard, though many countries still hold gold in reserve.

The new global monetary system is likely going to look like Russia, China, India, Saudi Arabia and other countries with commodity-backed, sound money on one side – and the west and our allies, with our “infinite” fiat, under the tutelage of rocket surgeon Neel Kashkari, on the other.

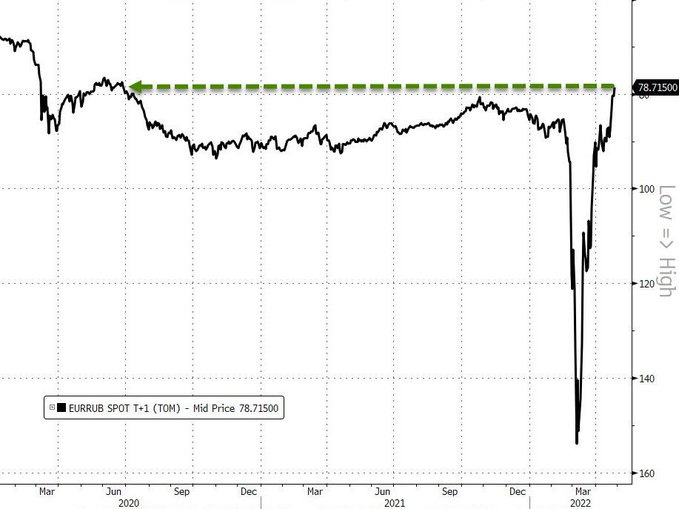

Despite the enormity of the situation, the news hasn’t really been digested by global markets yet. The FX market has been relatively calm, but for the ruble strengthening, and gold prices have crashed so far this week, with front month futures falling nearly $50/oz. on Monday, back down to about $1,860/oz.

Aside from the FX market, the news also hasn’t been digested by US politicians or financial “thought leaders” yet.

However, there are underground rumblings starting to catch the ears of those who are actively listening. Ronan Manly wrote for BullionStar.com last week:

On Tuesday 26 April in an interview with newspaper Rossiyskaya Gazeta (RG), the Secretary of the Russian Federation’s Security Council, Nikolai Patrushev, said that Russian experts are working on a project to back the Russian ruble with gold and other commodities.

Manly was kind enough to translate the interview with RG, which stated Russia’s intentions to back the ruble with gold in crystal clear fashion:

RG Question: And what do we need to do to ensure the ruble’s sovereignty?

Nikolai Patrushev: “For any national financial system to be sovereignized, its means of payment must have intrinsic value and price stability, without being pegged to the dollar.

Now experts are working on a project proposed by the scientific community to create a two-circuit monetary and financial system.

In particular, it is proposed to determine the value of the ruble, which should be backed by both gold and a group of goods that are currency values, and to put the ruble exchange rate in line with the real purchasing power parity.”

Manly concludes, matter-of-factly:

So there you have it. The Russian Government is actively working on creating a gold and commodity backed Russian ruble with intrinsic value which is outside the orbit of the US dollar.

…

What we are seeing now is Nikolai Patrushev and the Kremlin confirming this simple equation of linking the Russian ruble to gold and commodities. In other words, the beginning of a multilateral gold and commodity backed monetary system, i.e. Bretton Woods III.

And to take Manly’s analysis one step further, I think China isn’t going to be far behind.

Going back to last summer, before the invasion of Ukraine happened and before inflation was an issue, I wrote an article arguing that it was the most common sense scenario for China to affix its new digital currency to gold.

That was before Russia decided they were ready to take a stand against the west’s monetary policies and before China became interested in buying distressed strategic oil assets from Russia while the rest of the globe tries to shut the country down economically.

Now, Russia and China are closer than they’ve ever been and arguably more unified in their interests of keeping the U.S., the west and NATO in check than they’ve ever been.

Meanwhile, as Russia accepts payment for oil only in rubles or gold, “the digital yuan has already been piloted in various Chinese cities and was used in more than $8 billion worth of transactions in the second half of 2021,” CNN reported earlier this year.

Is the picture becoming clear yet, or do I need to spell it out for you?