It had all the markings of a “perfect setup”; the kind that only come around once every decade or so…

Most of you are probably familiar with the story of how Soros and Druckenmiller “broke the Bank of England” in 92’.

The two bet against the pound believing that it couldn’t maintain its peg to the Deutsche Mark in the European Exchange Rate Mechanism (ERM). They were right. The Bank of England was forced to stop defending the peg and the pound plummeted. The Quantum Fund (Soros and Druckenmiller) netted over a billion dollars over the course of a few days. The rest is history.

It was an amazing trade. It had all the markings of a “perfect setup”; the kind that only come around once every decade or so. It was extremely asymmetric in that the risk was clearly defined by the upper-band of the ERM peg. And if the lower bound broke, like they expected, they knew the pound would collapse due to all the investors on the wrong side forced to liquidate.

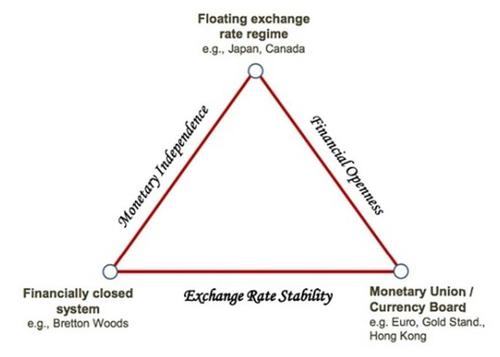

It was also a fundamentally compelling trade. The thesis was based on an economic law derived from the Mundell-Fleming model. It states that in a world of high capital mobility, a central bank can target the exchange rate or the interest rate but not both. This economic reality is also known as the policy trilemma (depicted in the pyramid above). Here’s the following explanation from The Economist.

The policy trilemma, also known as the impossible or inconsistent trinity, says a country must choose between free capital mobility, exchange-rate management and monetary autonomy. Only two of the three are possible. A country that wants to fix the value of its currency and have an interest-rate policy that is free from outside influence cannot allow capital to flow freely across its borders. If the exchange rate is fixed but the country is open to cross-border capital flows, it cannot have an independent monetary policy. And if a country chooses free capital mobility and wants monetary autonomy, it has to allow its currency to float .

To understand the trilemma, imagine a country that fixes its exchange rate against the US dollar and is also open to foreign capital. If its central bank sets interest rates above those set by the Federal Reserve, foreign capital in search of higher returns would flood in. These inflows would raise demand for the local currency; eventually the peg with the dollar would break. If interest rates are kept below those in America, capital would leave the country and the currency would fall.

Where barriers to capital flow are undesirable or futile, the trilemma boils down to a choice: between a floating exchange rate and control of monetary policy; or a fixed exchange rate and monetary bondage.

In the Bank of England’s case in 92’, England was in a recession, but the BOE was forced to run constrictive monetary policy (high interest rates) in alignment with Germany in order to maintain the peg. This exacerbated the recession which led to more downward pressure on the pound (which was overvalued when the peg was set).

The BOE was confronted with the choice of (1) try to maintain the peg and as a result, deepen the recession or (2) stop defending the pound, move to more accommodative monetary policy, and benefit from a more competitively priced pound.

The BOE went with the latter and Britain’s economy ended up better off for it.

Had the BOE not made that decision, it’s likely that the market would have made it for them. Since England did not have capital controls and allowed money to flow freely across its borders, the BOE had to actively engage in the currency market to counteract the downward pressure from pounds being converted into other currencies. They had limited FX reserves and eventually would have run out of their ability to defend the peg anyway.

The policy trilemma is one of those things in economics that’s so logical it’s self-evident. Yet it’s still somehow forgotten or ignored by the very people who pull the financial and monetary levers of our world.

China is a prime example. The People’s Bank of China (PBoC) is fighting tooth and nail to maintain its crawling peg to the dollar. Their goal is to carry out a slow coordinated devaluation.

China has chosen exchange rate management and monetary autonomy. This means they can’t have capital mobility.

This is why the CCP has been strengthening its capital controls and cracking down on money fleeing the country. The problem is… when your country is the number one trading partner with over 100 other countries, there’s a lot of capital holes to try and plug. It’s nearly an impossible task.

Simply put, if money wants to leave China, it’ll find a way.

And if fighting the economic laws of the policy trilemma weren’t enough, China is facing another unsolvable problem that’ll eventually drag down its currency like a 100-ton anvil.

I once saw a Bloomberg interview with Hedge Fund manager Kyle Bass. Bass is a smart dude and one of the few managers I have a lot of respect for.

One of his higher conviction themes over the last year has been the implosion of the Chinese banking system and the subsequent devaluation of the yuan — a theme I agree with and have written extensively about.

The premise is simple; Chinese banks are sitting on trillions of bad debt. Exactly how much bad debt nobody quite knows. The data coming out of the country is iffy but we at least we know it’s in the trillions… which is a lot.

These banks have been rolling over bad loans by adding new debt. They’re playing the old game of “a rolling loan gathers no loss”. But we all know that game can only go on for so long.

China has been forced to go to greater and greater lengths to paper over this problem and keep the dam from breaking.

Over the last 18 months alone, credit in China has grown by $6.5 trillion while deposits have increased by less than half that. As Bass notes in the interview, “China has to fund enormous moves in credit growth just to keep in roughly the same place. We call it running to stand still.”

All it’ll take is a catalyst and these banks will go bust and will need to be recapitalized. This means printing a lot more money which will result in a much depreciated yuan.