The tiny island nation of Sri Lanka in the Indian Ocean released a statement Tuesday that said it would default on its foreign debt, including bonds and government-to-government borrowings, amid its worst economic crisis in over seven decades.

Sri Lanka’s finance ministry said it “has had an unblemished record of external debt service since independence in 1948.”

A confluence of factors has drained the South Asian island nation’s foreign exchange reserves by more than 70% since the virus pandemic began, including the collapse in tourism and poorly timed tax cuts.

“Recent events, however, including the effects of the Covid-19 pandemic and the fallout from the hostilities in Ukraine, have eroded Sri Lanka’s fiscal position that continued normal servicing of external public debt obligations has become impossible,” the statement said.

Last month, the Washington-based International Monetary Fund (IMF) warned Sri Lanka’s debt is unsustainable:

“Although the government has taken extraordinary steps in an effort to remain current on all of its external indebtedness, it is now clear that this is no longer a tenable policy,” IMF said.

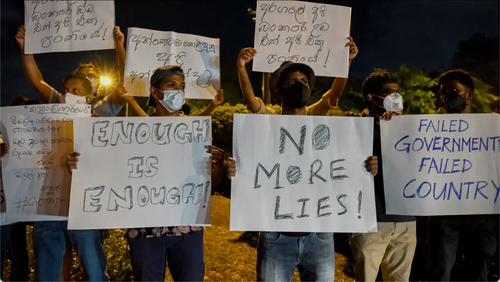

The socio-economic crisis unfolding on the island nation of 22 million people has already sparked mass unrest. It suffers from widespread food shortages, out-of-control inflation, and rolling blackouts.

Bloomberg notes the “unprecedented default and halted payments on foreign debt” is a move “to preserve its dwindling dollar stockpile for essential food and fuel imports.”

Newly appointed central bank governor, Nandalal Weerasinghe, said officials are set to negotiate with creditors. So far, credit rating agencies have yet to announce any downgrades. S&P Global Ratings told BBC that it had “nothing to say” about the developments in Sri Lanka.

The finance ministry said the move is “a last resort in order to prevent a further deterioration of the Republic’s financial position … It is now apparent that any further delay risks inflicting permanent damage on Sri Lanka’s economy and causing potentially irreversible prejudice to the holders of the country’s external public debts.”

Sri Lanka’s foreign reserves stood around $2bln at the end of March. However, it owes a whopping $4bln in foreign debt payments this year. Weerasinghe has increased interest rates to tackle inflation.

Sri Lanka’s dollar bonds due July 2022 hit a new record low of 46.07 cents on Tuesday. This week, the country’s stock market is halted for public holidays after shortened trading hours following rolling blackouts.

“The market was expecting this default to come,” said Carl Wong, head of fixed income at Avenue Asset Management.

“Now we have to see how the new government handles the onshore chaos while talking to IMF,” Wong said.

Nomura Holdings Inc. suggests an “Ecuador-style debt restructuring” could be on the table.

Unrest in the tiny island nation continues as protesters call for President Gotabaya Rajapaksa to resign over the mismanagement of the country’s finances.

As we’ve said before, the weakest countries break first in today’s high inflationary environment amid global commodity shortages. This could be the start of the domino effect as Peru, on the opposite side of the world, has been dealing with inflation riots. Here is a list of countries where social unrest could be imminent due to high inflation.

Read More