Just four months into fiscal 2023 and the US federal budget deficit is already approaching half a trillion dollars. This is a big problem for the Federal Reserve that few people seem to be talking about.

The federal government ran a $38.78 trillion deficit in January. That pushed the total deficit for the fiscal year to $460.19 billion. That’s up 9% over the same period last year and on a trajectory to blow past the $1.38 trillion fiscal 2022 deficit.

January is not typically a high deficit month. Last year, Uncle Sam ran a surplus of nearly $119 billion, and there were surpluses in the four Januarys prior to January 2020.

The US government is being hit with a double-whammy of falling revenues and increased spending. Through the first four months of fiscal 2023, tax receipts and other federal revenues are down 3% while spending is up 9%.

In January, the government took in $447.29 billion. That was down slightly from December’s receipts and 4% year-on-year.

The federal government enjoyed a revenue windfall in fiscal 2022. According to a Tax Foundation analysis of Congressional Budget Office data, federal tax collections were up 21%. Tax collections also came in at a multi-decade high of 19.6% as a share of GDP. But CBO analysts warned it won’t last.

Individual income tax receipts are projected to decline as a share of GDP over the next few years because of the expected dissipation of some of the factors that caused their recent surge. For example, realizations of capital gains (profits from selling assets that have appreciated) are projected to decline from the high levels of the past two years to a more typical level relative to GDP. Subsequently, from 2025 to 2027, individual income tax receipts are projected to rise sharply because of changes to tax rules set to occur at the end of calendar year 2025. After 2027, those receipts remain at or slightly below the 2027 level relative to GDP.”

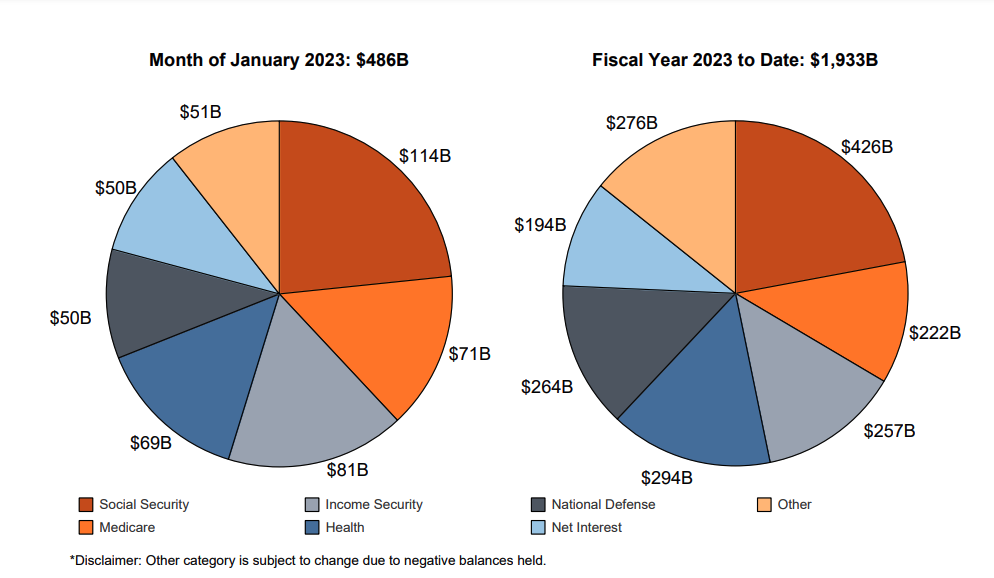

But the real problem is on the spending side of the ledger. The Biden administration is blowing through roughly a half-trillion dollars every single month. In January, the US government spent $486.07 billion. That was down slightly from December, but up 4% from January 2022.

There is no indication that the spending freight train will slow down any time soon. Congress passed a $1.7 trillion omnibus spending bill for 2023 that increased outlays by about $1.5 billion over fiscal 2022.

Of course, this is only one component of federal expenditures. The US government is still handing out COVID stimulus money, and in March 2021, Congress approved $1.9 trillion in spending to address the pandemic. Last year, it passed the euphemistically named “Inflation Reduction Act.” Meanwhile, the US continues to shower money on Ukraine and other countries around the world. All of that spending will pile on top of this most recent allocation of funding.

And the Biden administration is adept at finding new things to spend money on. In January, it forked out a $36 billion bailout of the Central States Pension Fund to prevent cuts to the pensions of over 350,000 Teamsters Union members and retirees.

Meanwhile, the Federal Reserve raised interest rates by another 25 basis points in February. That will add to the quickly ballooning interest cost.

According to an analysis by the New York Times, net interest costs rose by 41% in 2022. According to the Peterson Foundation, the jump in interest expense was larger than the biggest increase in interest costs in any single fiscal year, dating back to 1962.

Annualizing the January net interest expense of $50 billion comes to $600 billion. That’s just the cost of servicing the national debt for one year. And that cost will almost certainly rise once Congress raises the debt ceiling. At that point, the US Treasury will have to sell a significant number of bonds to catch up with its deficit spending. Currently, the Treasury is running “extraordinary measures” to fund government spending since it is against its borrowing limit.

If interest rates remain elevated or continue rising, interest expenses could climb rapidly into the top three federal expenses. (You can read a more in-depth analysis of the national debt HERE.)

In October, the national debt blew past $31 trillion. It now stands at $31.46 trillion. It will remain there until the fake debt ceiling fight resolves and it will then spike quickly toward $32 trillion.

According to the National Debt Clock, the debt-to-GDP ratio stands at 120.4%. Despite the lack of concern in the mainstream, debt has consequences. More government debt means less economic growth. Studies have shown that a debt-to-GDP ratio of over 90% retards economic growth by about 30%. This throws cold water on the conventional “spend now, worry about the debt later” mantra, along with the frequent claim that “we can grow ourselves out of the debt” now popular on both sides of the aisle in DC.

To put the debt into perspective, every American citizen would have to write a check for $94,344 in order to pay off the national debt.

A Big Problem for the Fed

The soaring national debt and the US government’s spending addiction are big problems for the Federal Reserve as it battles price inflation.

As you’ve already seen, the push to raise interest rates is putting a strain on Uncle Sam’s borrowing costs. But there is an even bigger problem. The Fed can’t slay monetary inflation — the cause of price inflation — with rate cuts alone. The US government also needs to cut spending.

This is why I keep saying the cooling trend in price inflation is transitory.

The US government can’t keep borrowing and spending without the Fed monetizing the debt. It needs the central bank to buy Treasuries to prop up demand. Without the Fed’s intervention in the bond market, prices will tank, driving interest rates on US debt even higher.

A paper published by the Kansas City Federal Reserve Bank acknowledged that the central bank can’t slay inflation unless the US government gets its spending under control. In a nutshell, the authors argue that the Fed can’t control inflation alone. US government fiscal policy contributes to inflationary pressure and makes it impossible for the Fed to do its job.

Trend inflation is fully controlled by the monetary authority only when public debt can be successfully stabilized by credible future fiscal plans. When the fiscal authority is not perceived as fully responsible for covering the existing fiscal imbalances, the private sector expects that inflation will rise to ensure sustainability of national debt. As a result, a large fiscal imbalance combined with a weakening fiscal credibility may lead trend inflation to drift away from the long-run target chosen by the monetary authority.”

This clearly isn’t in the cards.

Something has to give. The Fed can’t simultaneously fight inflation and prop up Uncle Sam’s spending spree. Either the government will have to cut spending or the Fed will eventually have to go back to creating money out of thin air in order to monetize the debt.