“The Coming High-Pressure Economy”: Morgan Stanley Sees Imminent Spike In Inflation

By Chetan Ahya, Morgan Stanley chief economist

The Coming High-PressureEconomy

After hunkering down for much of 2020, people are eager to make up for lost time. Much the same can be said of policy-makers, who are taking action to recoup lost economic output and return to maximum employment as quickly as possible. To get there, we think they are aiming for a high-pressure economy – an environment of stronger-than-average economic growth that helps to reduce unemployment. That’s exactly where we think the US economy is headed in the coming quarters.

Based on the experience of the past cycle, policy-makers believe that a high-pressure economy can help them to achieve a broad-based and inclusive economic growth environment. With the low rates of headline unemployment during 2017-19 came better employment opportunities for lower-income households. Even undershooting the estimated natural rate of unemployment failed to produce substantial inflationary pressures, and the natural rate of unemployment saw regular downward revisions.

This belief has spawned a regime shift in both monetary and fiscal policy. The Fed has moved to a flexible average inflation targeting framework, making a temporary overshoot of the 2%Y inflation target an explicit policy goal. The Fed has also redefined its employment mandate from full to maximum employment, which Chair Powell called a more “broad-based and inclusive goal.” Similarly, fiscal policy is being deployed to address the pre-existing issue of inequality – witness the large-scale government transfers to low- and middle-income households.

While any counter-cyclical policy response should be sizeable enough to fill the output hole, this time around, policy-makers have done much more. Cumulatively, the Covid-19 recession has cost US households US$400 billion in income, but they have already received more than US$1 trillion in transfers (even before the late December and forthcoming rounds of stimulus). Households have already accumulated US$1.5 trillion in excess saving, which is set to rise to US$2 trillion (9.5% of GDP) by early March once the additional fiscal package is enacted. These policy-making regime shifts also mean that policy-makers will tighten much later in the recovery than in the previous cycle.

In the last cycle, a common complaint was that while the monetary policy response was aggressive, it didn’t transmit to the real economy. Risk-aversion meant that the boost in liquidity didn’t spur credit growth, instead ending up as excess reserves. In this cycle, critics are making a similar argument that despite fiscal transfers boosting excess saving, households will ultimately hold on to these funds.

In contrast, we have argued that the policy response has averted significant scarring effects. Moreover, the impact of the exogenous shock is likely to fade, and we foresee a surge in demand as the economy reopens this spring. Spending patterns indicate that households have been forced to accumulate excess saving as restrictions on mobility have limited their opportunities to go out and spend. With warmer temperatures coming and vaccinations set to cover a large part of the vulnerable population, we are confident that the relaxation of restrictions, which has begun in the states with the tightest controls, will pick up speed as spring approaches.

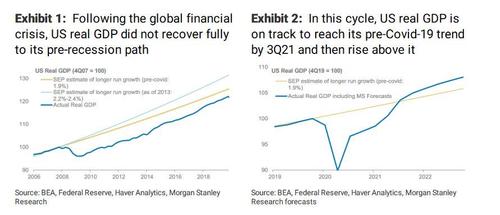

Our Chief US Economist Ellen Zentner now projects US GDP to grow by 6.5%Y in 2021 (7.6% 4Q/4Q) and 5%Y in 2022 (2.9% 4Q/4Q). These estimates imply that US GDP will rise meaningfully above its pre-Covid-19 path after 3Q21 and will be higher in 2022 than what we would have expected in the absence of the pandemic. That’s a particularly remarkable outcome, especially when you consider that in the post-GFC period the US economy never really returned to its pre-recession path.

But running a high-pressure economy is not without risks.

The speed and strength of the demand recovery will put a strain on the supply side, which has limited time to respond, and accelerated labor market restructuring will likely push the natural rate of unemployment higher in the near term. Against this backdrop, inflationary pressures will build up very quickly. In our base case, we expect core PCE inflation to overshoot 2%Y starting this year and into next, in line with the Fed’s stated policy goals. But the nature of the recovery – transfer-driven consumption – implies that inflation risks are to the upside. If underlying inflation momentum enters the acceleration phase after crossing the 2%Y mark in combination with low unemployment, it may precipitate a disruptive shift in Fed tightening expectations, raising the probability of a recession. In the end, whether the acceleration phase unfolds will depend on the extent and the pace at which households convert their savings into spending. The size of the prospective fiscal stimulus increases the chances that it will.

Tyler Durden

Sun, 02/14/2021 – 17:50

“The Coming High-Pressure Economy”: Morgan Stanley Sees Imminent Spike In Inflation

By Chetan Ahya, Morgan Stanley chief economist

The Coming High-PressureEconomy

After hunkering down for much of 2020, people are eager to make up for lost time. Much the same can be said of policy-makers, who are taking action to recoup lost economic output and return to maximum employment as quickly as possible. To get there, we think they are aiming for a high-pressure economy – an environment of stronger-than-average economic growth that helps to reduce unemployment. That’s exactly where we think the US economy is headed in the coming quarters.

Based on the experience of the past cycle, policy-makers believe that a high-pressure economy can help them to achieve a broad-based and inclusive economic growth environment. With the low rates of headline unemployment during 2017-19 came better employment opportunities for lower-income households. Even undershooting the estimated natural rate of unemployment failed to produce substantial inflationary pressures, and the natural rate of unemployment saw regular downward revisions.

This belief has spawned a regime shift in both monetary and fiscal policy. The Fed has moved to a flexible average inflation targeting framework, making a temporary overshoot of the 2%Y inflation target an explicit policy goal. The Fed has also redefined its employment mandate from full to maximum employment, which Chair Powell called a more “broad-based and inclusive goal.” Similarly, fiscal policy is being deployed to address the pre-existing issue of inequality – witness the large-scale government transfers to low- and middle-income households.

While any counter-cyclical policy response should be sizeable enough to fill the output hole, this time around, policy-makers have done much more. Cumulatively, the Covid-19 recession has cost US households US$400 billion in income, but they have already received more than US$1 trillion in transfers (even before the late December and forthcoming rounds of stimulus). Households have already accumulated US$1.5 trillion in excess saving, which is set to rise to US$2 trillion (9.5% of GDP) by early March once the additional fiscal package is enacted. These policy-making regime shifts also mean that policy-makers will tighten much later in the recovery than in the previous cycle.

In the last cycle, a common complaint was that while the monetary policy response was aggressive, it didn’t transmit to the real economy. Risk-aversion meant that the boost in liquidity didn’t spur credit growth, instead ending up as excess reserves. In this cycle, critics are making a similar argument that despite fiscal transfers boosting excess saving, households will ultimately hold on to these funds.

In contrast, we have argued that the policy response has averted significant scarring effects. Moreover, the impact of the exogenous shock is likely to fade, and we foresee a surge in demand as the economy reopens this spring. Spending patterns indicate that households have been forced to accumulate excess saving as restrictions on mobility have limited their opportunities to go out and spend. With warmer temperatures coming and vaccinations set to cover a large part of the vulnerable population, we are confident that the relaxation of restrictions, which has begun in the states with the tightest controls, will pick up speed as spring approaches.

Our Chief US Economist Ellen Zentner now projects US GDP to grow by 6.5%Y in 2021 (7.6% 4Q/4Q) and 5%Y in 2022 (2.9% 4Q/4Q). These estimates imply that US GDP will rise meaningfully above its pre-Covid-19 path after 3Q21 and will be higher in 2022 than what we would have expected in the absence of the pandemic. That’s a particularly remarkable outcome, especially when you consider that in the post-GFC period the US economy never really returned to its pre-recession path.

But running a high-pressure economy is not without risks.

The speed and strength of the demand recovery will put a strain on the supply side, which has limited time to respond, and accelerated labor market restructuring will likely push the natural rate of unemployment higher in the near term. Against this backdrop, inflationary pressures will build up very quickly. In our base case, we expect core PCE inflation to overshoot 2%Y starting this year and into next, in line with the Fed’s stated policy goals. But the nature of the recovery – transfer-driven consumption – implies that inflation risks are to the upside. If underlying inflation momentum enters the acceleration phase after crossing the 2%Y mark in combination with low unemployment, it may precipitate a disruptive shift in Fed tightening expectations, raising the probability of a recession. In the end, whether the acceleration phase unfolds will depend on the extent and the pace at which households convert their savings into spending. The size of the prospective fiscal stimulus increases the chances that it will.

Tyler Durden

Sun, 02/14/2021 – 17:50

Read More