The happy story that’s been ceaselessly promoted for 45 years is that financialization and globalization have been wunnerful for all of us, boosting wealth and saving a small fortune as the cost of products fell.

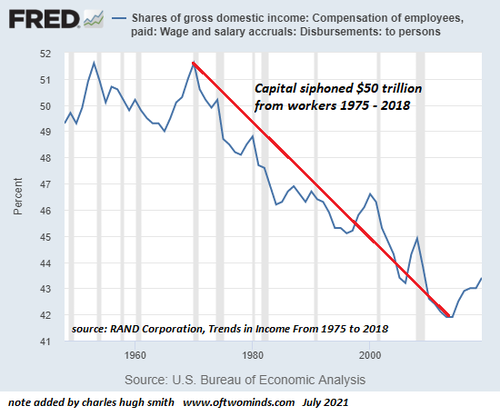

This is a remarkable distortion of reality. The fact is your household lost $500,000 in earnings and gained essentially nothing in supposed “cost savings.” The facts are presented in a study by the RAND Corporation: Trends in Income From 1975 to 2018 $50 trillion in earnings has been transferred to the Financial Aristocracy from the bottom 90% of American households over the past 45 years..

B-b-but wait, didn’t we all save a fortune on cheap jeans and TVs? No, you lost on that, too, as every product was crapified by globalization. I discussed the uncounted losses of the U.S. economy being crapified in my post The “Crapification” of the U.S. Economy Is Now Complete.

Let’s start by defining financialization and globalization. Financialization is the reaping of profits not by creating value by producing goods and services but by exploiting credit and leverage to reap unearned profits.

Here are two examples. Borrow $1 billion and then use this to do a leveraged buyout (LBO) of a $10 billion company. Break the company’s divisions into separate companies and sell them off or take them public via an IPO (initial public offering). Make $10 billion in pure profit from breaking up a company and selling its pieces, all from $1 billion in borrowed money. Note that this LBO didn’t generate any gains in productivity or any new goods and services, nor did it create any new jobs. All it did was greatly enrich a few financiers and Wall Street banks.

Here’s another example. Borrow $1 billion and use the money to buy back the shares of the corporation. The market value of the company’s shares rise from $10 billion to $15 billion. The top management exercises its immense hoard of stock options and skims billions of dollars in profits. Note that this stock buyback didn’t generate any gains in productivity or any new goods and services, nor did it create any new jobs. All it did was greatly enrich a few at the top of the heap.

This is the financialization of the U.S. economy in a nutshell. Financial games using other people’s money and leverage make the big money, producing goods and services that create jobs is for losers.

Globalization is the process of moving production of goods and services overseas to reap the gains of cheap labor, no environmental standards, corrupt politicians and the crapification of goods and services. Globalization is the process of exposing much of America’s labor force to 1 billion new workers who will work for next to nothing since they have no other means of earning cash.

Developing nations have limited means to enforce environmental regulations, so they are the convenient and cheap dumping grounds for global corporations maximizing profits by dumping toxic waste in landfills, rivers, etc. Should there be any spot of bother, comparatively low-cost bribes and payoffs to corrupt leaders insure the labor and land will continue to be exploited without any problems with labor unions, environmental standards, etc.

Globalization also means making the product look nice but strip out all quality as needless expense. Thin the paint so the steel rusts out in months, use the shoddiest materials so the veneer peels off, the screws snap, the commodity chip fails, taking the mother board and entire appliance down with it, and so on, in an endless and oh-so-profitable parade of crapification.

Well-paid shills tally up all the “savings” generated by crapification but they never look at the immense losses in utility and durability. An appliance that cost $500 and lasted 20 years without any repair is far less expensive over the 20 year lifespan than a $400 appliance that fails in 4 years and can’t be repaired, or the repair costs almost as much as a new appliance. The hapless consumer of crapified goods ends up paying $2,500 over the 20 years for poorly made junk that falls apart in a few years or mysteriously fails as cheap electronic components blink off.

In other words, I was being extremely charitable in granting $137.13 gains to each household in 45 years of globalization–in reality, each household lost thousands of dollars in utility and durability. No wealthy financier funds research into how much each American household lost in utility and durability because the financiers who fund their philanthro-capitalist foundations all made their fortunes by stripmining financialization and / or crapifying goods and services and establishing monopolies and cartels to exterminate any competition. (Cough, Gates Foundation, cough.)

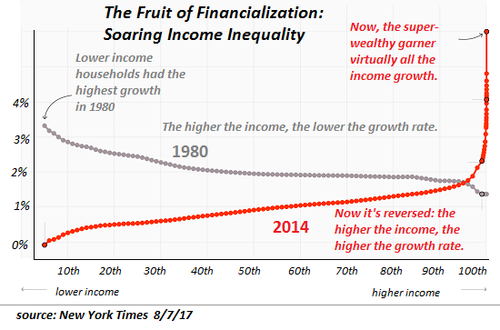

The well-paid shills tout the $100 savings but ignore the $2,000 in costs added by the collapse of quality and durability. Who makes out when consumers have to buy five appliances over 20 years instead of one? The shareholders of the financialized, globalized corporation, that’s who. And since the top 10% of households own roughly 90% of all corporate shares and bonds (and the top 0.1% own 40%), the gains are highly concentrated in the top, as the graphics below show.

If the labor force had retained its 1975 share of the economy’s income, each household would have $500,000 more in income than they ended up with in the fully financialized, globalized, crapified economy we’re stuck with. Let’s do the math: $50 trillion divided by 100 million households (the bottom 90% of households) is $500,000. Divide $500,000 by 45 years and that’s $11,110 a year for 45 years.

We can quibble about inflation and purchasing power and so on, but however you reckon it, $500,000 stripped from every household is a lot of money when we’re talking about 100 million households.

Next time you’re on hold with a crapified Corporate America or government service, and the next time your globalized, crapified device fails, ponder all the costs of financialization and globalization that have yet to be tallied. Ponder what a clawback of the $50 trillion might entail, and the immense benefits of returning to producing quality goods and services by completely unwinding financialization and globalization.

We could completely unwind financialization and globalization if we chose to. I explain how in my new book Global Crisis, National Renewal: A (Revolutionary) Grand Strategy for the United States.

* * *