The Data Shows The Fed Is Behind The Surging Wealth Gap

Authored by Lance Roberts via RealInvestmentAdvice.com,

The data shows the Fed is behind the surging wealth gap. Such is despite protestations “Quantitative Easing” and “Zero Interest Rate Policy” do not affect the financial markets. Such was noted previously by Minneapolis Fed President Neel Kashkari:

“QE conspiracists can say this is all about balance sheet growth. Someone explain how swapping one short-term risk-free instrument (reserves) for another short-term risk-free instrument (t-bills) leads to equity repricing. I don’t see it.”

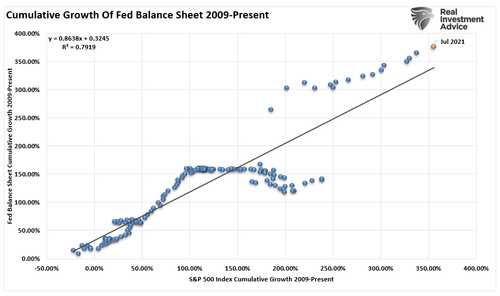

While he may be “technically correct,” there is ample evidence of a direct impact on financial markets. As discussed in “Past Performance Is A Guarantee:”

“Given the high correlation between the financial markets and the Federal Reserve interventions, there is credence to Minsky’s theory. With an R-Square of nearly 80%, the Fed is impacting financial markets.“

There is little question the Fed is behind surging asset prices. However, are they to blame for rising inequality and the “wealth gap?” Kenneth Rogoff suggested the Fed is not responsible. To wit:

“Recently, a steady stream of commentaries point central-bank policies as a major driver of inequality. The logic is that hyper-low interest rates push up the prices of stocks, houses, fine art, yachts, and just about everything else. The well-off, and especially the ultra-rich, thus benefit disproportionately.

This argument may seem compelling at first glance. But on deeper reflection, it does not hold up.”

While Rogoff suggests fiscal policy should be used (i.e., a wealth tax), such distributional policies harm economic growth and a widening of inequality.

Animal Spirits

While there is ample evidence the liquidity from the Fed’s actions does indeed directly impact asset prices, we will focus on the non-direct impact.

In 2010, then-Fed Chairman Ben Bernanke made the following statement as they prepared to launch the second round of QE.

“This approach eased financial conditions in the past and, so far, looks to be effective again. Stock prices rose, and long-term interest rates fell when investors began to anticipate the most recent action. Easier financial conditions will promote economic growth. For example, lower mortgage rates will make housing more affordable and allow more homeowners to refinance. Lower corporate bond rates will encourage investment. And higher stock prices will boost consumer wealth and help increase confidence, which can also spur spending.”

What he is referring to is known as “Animal Spirits.”

Animal spirits came from the Latin term “spiritus animalis” which means the “breath that awakens the human mind.” Its modern usage came about in John Maynard Keynes’ 1936 publication, “The General Theory of Employment, Interest, and Money.” Ultimately, “animal spirits was adopted by Wall Street to describe the psychological factors driving investor actions.

Specifically, Ben Bernanke realized that investors would respond to that stimulus and push asset prices higher by providing accommodation. Such is the “Theory Of Reflexivity” in action.

“One is that in situations with thinking participants, the participants’ view of the world is always incomplete and distorted. That is fallibility. The other is that these distorted views can influence the situation they relate to, and distorted views lead to inappropriate actions. That is reflexivity.” – George Soros

In other words, as long as individuals “believe” the Fed is lifting asset prices higher, they take action buying stocks and driving asset prices higher. Thus, investor actions deliver the desired outcome.

The Exacerbated The Wealth Gap

However, while the Federal Reserve got the desired outcome of increasing asset prices, “quantitative easing” failed to “trickle down.” Despite the massive expansion of the Fed’s balance sheet and the surge in asset prices, there was relatively little translation into wages, full-time employment, or corporate profits after tax which ultimately triggered very little economic growth.

The problem, of course, is the surge in asset prices remained confined to those with “investible wealth” but failed to deliver a boost to the roughly 90% of American’s who have experienced little benefit.

Since 2007, the stock market has returned nearly 200%, which is more than twice the growth in GDP and nearly 4-times the growth in corporate revenue. (I use SALES growth as it happens at the top line of income statements and is not subject to as much manipulation.)

This disconnect is a function of the nearly $8 trillion increase in the Fed’s balance sheet, hundreds of billions in stock buybacks, PE expansion, and ZIRP. With “Price-To-Sales” ratios at the highest level in history, one should question the ability to continue borrowing from the future?

See the problem?

Top 10% Or Bust

As noted by the WSJ previously:

“As of December 2019, households in the bottom 20% of incomes saw their financial assets, fall by 34% since the end of the 2007-09 recession. This is according to Fed data adjusted for inflation. Those in the middle of the income distribution saw just 4% growth.” – WSJ

As stated, the Fed’s actions have exacerbated the wealth gap by enormous proportions. The chart below is the inflation-adjusted household equity ownership to GDP ratio by brackets versus the Fed balance sheet.

What is clear, given the massive ownership of financial assets by the top 10%, and particularly the top 1%, the “rich” benefit the most from monetary accommodation. However, it isn’t just financial assets where the top 10% accrue their wealth.

If you review the quote by Ben Bernanke above, you will note:

“For example, lower mortgage rates will make housing more affordable and allow more homeowners to refinance. In addition, lower corporate bond rates will encourage investment.”

With housing prices at all-time highs, hundreds of billions pushed into businesses through a multitude of Government bailouts, and trillions provided to consumers through stimulus payments, the real total net worth of the top 10% has exploded.

We can see the invisible hand of the Fed’s balance sheet once again.

Not Quite Reality

Every three years, the Federal Reserve releases a study on consumer finances. The study is a stockpile of data on everything from household net worth to incomes. While the mainstream media contends surging asset prices boost economic growth, the reality is quite different.

If we strip out the impacts caused by outliers, the value of financial assets fell sharply since the turn of the century.

The Federal Reserve hoped inflating asset prices would boost consumer confidence, consumption, and economic growth. The problem is that with falling incomes and rising living costs, the ability to save and invest eluded most families.

It is also stated with regularity that “most families” own assets through their company retirement plans and are therefore building wealth. But, again, the reality is quite different. The percentage of families with retirement accounts is lower today than in 2001, despite surging asset prices.

Unless you happen to be in the top 10-20% of income earners.

Lastly, a large chunk of wealth for the top 10% of income earners comes from business equity. The Fed’s ongoing suppression of interest rates has led to extremely cheap financing costs to leverage businesses and boost profitability.

The lack of economic improvement is evident across all data points. However, the evidence is clear the Fed’s financial engineering has created a massive wealth gap within the economy. Furthermore, the ongoing interventions fueled the demand for speculative risks by those with capital but left most American families behind.

The Fed’s Biggest Challenge

While the Federal Reserve will occasionally feign concern over the “wealth gap” and “speculative market risks,” they are aware they are responsible for it. The problem remains the inability to remove the accommodative policy as the “bubble” begins to deflate rapidly.

Given the amount of debt currently required to sustain current economic growth, the Fed has no choice but to continue monetization of the Federal debt indefinitely.

Such leaves only TWO possible outcomes from here, both of them are not good.

Powell & Co. continues to keep rates at zero. As aging demographics strain the pension and social welfare systems, the debt will continue to stifle inflation and economic growth. The cycle that started nearly 40-years ago will continue as the U.S. adopts the “Japan Syndrome.”

The second outcome is far worse, an economic decoupling that leads to a massive deleveraging process. Such an event started in 2008 but was cut short by Central Bank interventions. In 2020, the Fed arrested the deleveraging process once again. Both events lead to an even more debt-laden system, which at some point, the Fed’s interventions may not stop.

The Fed continues to state that monetary accommodation will continue until “such time as the dual mandates of full employment and price stability achieved.”However, given that economic stability was not achieved in the last decade, it is highly unlikely that doubling the Fed’s balance sheet will improve future outcomes.

Unfortunately, given we now have a decade of experience of watching the “wealth gap” worsen under the Federal Reserve’s policies, the next decade will likely not show an improvement. We now know that surging debt and deficits inhibit organic growth. The massive debt levels added to the backs of taxpayers will only ensure the Fed remains trapped at the zero bound.

Conclusion

The rise and fall of stock prices have very little to do with the average American’s participation in the domestic economy. Interest rates and inflation are entirely different matters.

Since interest rates affect “payments,” and inflation increases the “costs of living,” increases negatively impact consumption, housing, and investment, which ultimately deters economic growth.

Given the current demographic, debt, pension, and valuation headwinds, the future growth rates will be low over the next couple of decades. Even the Fed’s own “long-run” economic growth rates currently run below 2%.

The catalysts needed to create the economic growth required to “grow our way” out of the debt problem are not available today. Nor will they be in the future.

Ultimately, the Federal Reserve, and the Administration, will have to face hard choices to extricate the economy from the current “liquidity trap.” However, history shows that political leadership never makes the choices until they get forced upon them.

You don’t have to look much further than Japan for a clear example of what I mean.