The “Great Reset” Is Here, Part 1: The New Blueprint For Worldwide Inflation

Authored by James Rickards via DailyReckoning.com,

For years, currency analysts (myself included) have looked for signs of an international monetary “reset” that would diminish the dollar’s role as the leading reserve currency and replace it with a substitute, which would be agreed upon at some Bretton Woods-style monetary conference.

Now, it looks like the move towards the long-expected Great Reset is accelerating.

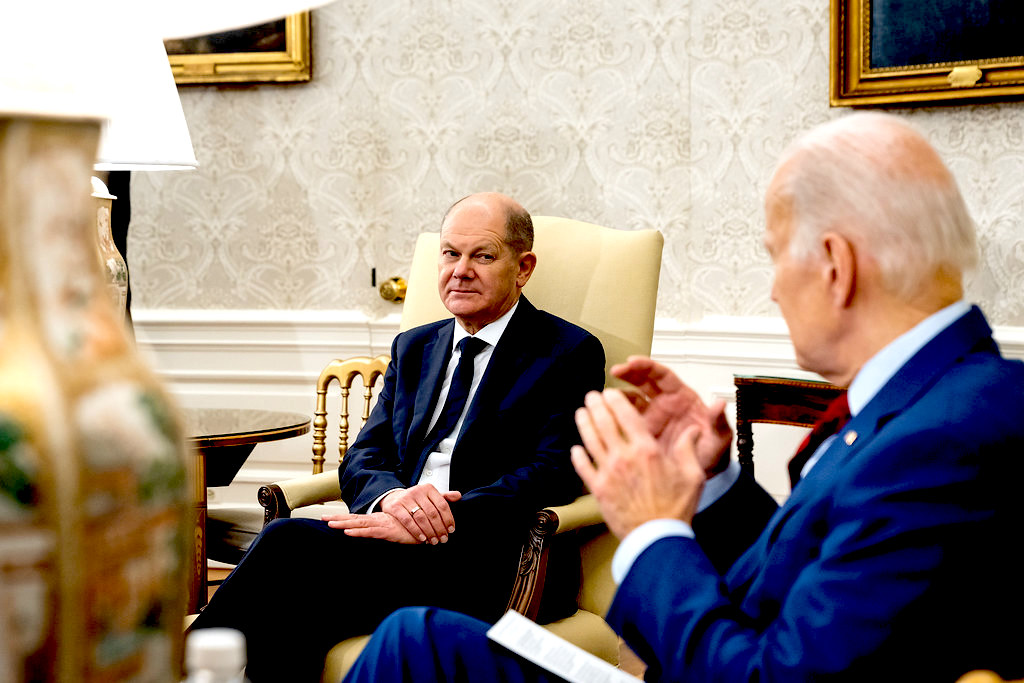

At the recent G7 summit in the UK, G7 leaders gave their blessings to a $100 billion allocation of IMF special drawing rights (SDRs) to help lower-income countries address the COVID-19 crisis.

President Biden fully supports the idea. The White House issued the following statement:

The United States and our G7 partners are actively considering a global effort to multiply the impact of the proposed Special Drawing Rights (SDR) allocation to the countries most in need…

At potentially up to $100 billion in size, the proposed effort would further support health needs – including vaccinations…

A separate press release from the same day continued the same sentiment, stating, “We strongly support the effort to recycle SDRs to further support health needs.”

In another development, IMF Managing Director Kristalina Georgieva said last Wednesday that she expected the fund’s governors to approve a $650 billion allocation of SDRs in mid-August.

What exactly are SDRs?

Basically, they’re world money.

In 1969, the IMF created the SDR, possibly to serve as a source of liquidity and alternative to the dollar.

In 1971, the dollar did devalue relative to gold and other major currencies. SDRs were issued by the IMF from 1970 to 1981. None were issued after 1981 until 2009 during the global financial crisis.

The 2009 issuance was a case of the IMF “testing the plumbing” of the system to make sure it worked properly. Because zero SDRs were issued from 1981–2009, the IMF wanted to rehearse the governance, computational, and legal processes for issuing SDRs.

The purpose was partly to alleviate liquidity concerns at the time, but it was also to make sure the system works in case a large, new issuance was needed on short notice. The 2009 experiment showed the system worked fine.

Since 2009, the IMF has proceeded in slow steps to create a platform for massive new issuances of SDRs and establish a deep liquid pool of SDR-denominated assets.

On January 7, 2011, the IMF issued a master plan for replacing the dollar with SDRs.

This included creating an SDR bond market, SDR dealers, and ancillary facilities such as repos, derivatives, settlement and clearance channels, and the entire apparatus of a liquid bond market.

A liquid bond market is critical. U.S. Treasury bonds are among the world’s most liquid securities, which makes the dollar a legitimate reserve currency.

The IMF study recommended that the SDR bond market replicate the infrastructure of the U.S. Treasury market, with hedging, financing, settlement and clearance mechanisms substantially similar to those used to support trading in Treasury securities today.

In August 2016, the World Bank announced that it would issue SDR-denominated bonds to private purchasers. Industrial and Commercial Bank of China (ICBC), the largest bank in China, will be the lead underwriter on the deal.

In September 2016, the IMF included the Chinese yuan in the SDR basket, giving China a seat at the monetary table.

So, the framework has been created to expand the SDR’s scope.

The SDR can be issued in abundance to IMF members and used in the future for a select list of the most important transactions in the world, including balance-of-payments settlements, oil pricing, and the financial accounts of the world’s largest corporations, such as Exxon Mobil, Toyota, and Royal Dutch Shell.

The basic idea behind the SDR is that the global monetary system centered around the dollar is inherently unstable and needs to be reformed.

Part of the problem is due to a process called Triffin’s Dilemma, named after economist Robert Triffin. Triffin said that the issuer of a dominant reserve currency had to run trade deficits so that the rest of the world could have enough of the currency to buy goods from the issuer and expand world trade.

But, if you run deficits long enough, you would eventually go broke. This was said about the dollar in the early 1960s. The SDR would solve Triffin’s Dilemma.

I wrote about SDRs and the global elite plans for them in the second chapter of my 2016 book, The Road to Ruin.

Over the next several years, we will see the issuance of SDRs to transnational organizations, such as the U.N. and World Bank, for spending on climate change infrastructure and other elite pet projects outside the supervision of any democratically elected bodies.

I call this the New Blueprint for Worldwide Inflation.

But Triffin’s Dilemma is not the only dynamic that’s pushing the world away from the dollar.

In Part 2, we show you why the weaponization of the dollar by the U.S. government is pushing the world to seek alternatives.

Tyler Durden

Wed, 06/23/2021 – 19:20

The “Great Reset” Is Here, Part 1: The New Blueprint For Worldwide Inflation

Authored by James Rickards via DailyReckoning.com,

For years, currency analysts (myself included) have looked for signs of an international monetary “reset” that would diminish the dollar’s role as the leading reserve currency and replace it with a substitute, which would be agreed upon at some Bretton Woods-style monetary conference.

Now, it looks like the move towards the long-expected Great Reset is accelerating.

At the recent G7 summit in the UK, G7 leaders gave their blessings to a $100 billion allocation of IMF special drawing rights (SDRs) to help lower-income countries address the COVID-19 crisis.

President Biden fully supports the idea. The White House issued the following statement:

The United States and our G7 partners are actively considering a global effort to multiply the impact of the proposed Special Drawing Rights (SDR) allocation to the countries most in need…

At potentially up to $100 billion in size, the proposed effort would further support health needs – including vaccinations…

A separate press release from the same day continued the same sentiment, stating, “We strongly support the effort to recycle SDRs to further support health needs.”

In another development, IMF Managing Director Kristalina Georgieva said last Wednesday that she expected the fund’s governors to approve a $650 billion allocation of SDRs in mid-August.

What exactly are SDRs?

Basically, they’re world money.

In 1969, the IMF created the SDR, possibly to serve as a source of liquidity and alternative to the dollar.

In 1971, the dollar did devalue relative to gold and other major currencies. SDRs were issued by the IMF from 1970 to 1981. None were issued after 1981 until 2009 during the global financial crisis.

The 2009 issuance was a case of the IMF “testing the plumbing” of the system to make sure it worked properly. Because zero SDRs were issued from 1981–2009, the IMF wanted to rehearse the governance, computational, and legal processes for issuing SDRs.

The purpose was partly to alleviate liquidity concerns at the time, but it was also to make sure the system works in case a large, new issuance was needed on short notice. The 2009 experiment showed the system worked fine.

Since 2009, the IMF has proceeded in slow steps to create a platform for massive new issuances of SDRs and establish a deep liquid pool of SDR-denominated assets.

On January 7, 2011, the IMF issued a master plan for replacing the dollar with SDRs.

This included creating an SDR bond market, SDR dealers, and ancillary facilities such as repos, derivatives, settlement and clearance channels, and the entire apparatus of a liquid bond market.

A liquid bond market is critical. U.S. Treasury bonds are among the world’s most liquid securities, which makes the dollar a legitimate reserve currency.

The IMF study recommended that the SDR bond market replicate the infrastructure of the U.S. Treasury market, with hedging, financing, settlement and clearance mechanisms substantially similar to those used to support trading in Treasury securities today.

In August 2016, the World Bank announced that it would issue SDR-denominated bonds to private purchasers. Industrial and Commercial Bank of China (ICBC), the largest bank in China, will be the lead underwriter on the deal.

In September 2016, the IMF included the Chinese yuan in the SDR basket, giving China a seat at the monetary table.

So, the framework has been created to expand the SDR’s scope.

The SDR can be issued in abundance to IMF members and used in the future for a select list of the most important transactions in the world, including balance-of-payments settlements, oil pricing, and the financial accounts of the world’s largest corporations, such as Exxon Mobil, Toyota, and Royal Dutch Shell.

The basic idea behind the SDR is that the global monetary system centered around the dollar is inherently unstable and needs to be reformed.

Part of the problem is due to a process called Triffin’s Dilemma, named after economist Robert Triffin. Triffin said that the issuer of a dominant reserve currency had to run trade deficits so that the rest of the world could have enough of the currency to buy goods from the issuer and expand world trade.

But, if you run deficits long enough, you would eventually go broke. This was said about the dollar in the early 1960s. The SDR would solve Triffin’s Dilemma.

I wrote about SDRs and the global elite plans for them in the second chapter of my 2016 book, The Road to Ruin.

Over the next several years, we will see the issuance of SDRs to transnational organizations, such as the U.N. and World Bank, for spending on climate change infrastructure and other elite pet projects outside the supervision of any democratically elected bodies.

I call this the New Blueprint for Worldwide Inflation.

But Triffin’s Dilemma is not the only dynamic that’s pushing the world away from the dollar.

In Part 2, we show you why the weaponization of the dollar by the U.S. government is pushing the world to seek alternatives.

Tyler Durden

Wed, 06/23/2021 – 19:20

Read More