The Ugly And Difficult Hunt For The True Economy

Authored by Bruce Wilds via Advancing Time blog,

Good luck with acquiring a clear view of our economic future. It is shrouded and cloaked under an ocean of often irrelevant facts and figures. Somewhere between what we are told is occurring in the economy and what we see happening on Main Streets across America is the real and true authentic economy. It is ironic that every sign the economy is not getting better only reinforces the idea that the Fed needs to goose things and pour even more fuel on the fire. This is exactly what many of us oppose and consider pure insanity.

A false economy of fraud is created by seizing on a few positive numbers that can be spun and hyped to convince people all is well. Even as I’m writing this, a MarketWatch article just came out saying the U.S. stock-index futures were trading higher after a report on June retail sales came in stronger than expected. To that, I say, what do you expect, people are busy spending what they see as “free money.” Sadly, people buying goods made in China from Amazon does little to enrich our communities or the American economy.

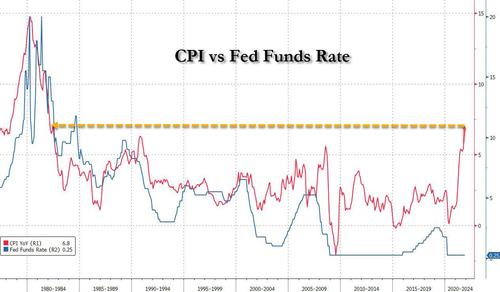

The justification for continued Fed intervention is often attributed to the idea inflation is not a threat and further action poses little risk. Those behind increased and continued easing say more action is needed or a loop will develop that feeds on itself and ends in a deflationary depression.

Most of us are familiar with former President Bill Clinton’s infamous line; “It depends on what the meaning of the word ‘is’ is.” Well, when it comes to the hunt for the true economy, it all depends on your definition of true. In a true economy things such as sustainability matter, deficits matter, savers being able to get a reasonable return on their savings without taking on undue risk also matters. Simply put, the economy currently before our eyes is as false as it can get.

Before us is an illusion created by papering over the truth with unbelievable amounts of newly printed money. Of course, it is not just money, it is a combination of things. Artificially low interest-rates, the creation of new and easy to obtain credit, and promises that these policies will continue. The fact is, since 2008, even after years of expanding money supplies and dropping interest rates the economy has not fared as well as many top politicians have led us to believe.

We have witnessed some major distortions in the economy since 2008 that have rendered many of the comparisons used in the past as obsolete. An example of this can be found in healthcare. Following the passage of Obamacare, the money flowing into healthcare massively added to America’s GDP, this went on for years. While many people are wowed by these huge expensive new buildings, on the flip side, it has resulted in the shuttering of many smaller local and rural hospitals and clinics that were adequate to care for patients at a much lower cost. Today many of these massive new hospitals standing as monuments to Obamacare run far below capacity again confirming that planners with little skin in the game love to overspend the money of others and we have the healthcare bills to prove it.

Those that see beyond the illusion created by easy credit and money printing, often loudly state that in the future both the economy and society will pay dearly for the sins of the Fed and that no options exist to get out of the box they have put us in. The fact is low-interest rates have punished the very people who have done the right thing by saving and sacrificing to put away money for future needs. It must be noted savers have been encouraged and forced to take on risky investments as they search for higher yields that are unavailable in safer more conservative options.

This debate continues to polarized those who study the economy and play in the dangerous land of investments. Meanwhile, the failure of a crash to materialize and bring markets back to reality over the years has caused a breaking in the ranks. The songs of the market sirens that promise both wealth and profit has lulled many into complacency. We have reached the point where many of the nonbelievers in current policy are capitulating and joining with those who live by mantras like, don’t fight the Fed, buy the dip, and to the “fear of missing out.” Each day more investors surrender to lure of the markets and buying into what they had only a short time ago seen as the dark-side.

Surging inequality is not an indicator of economic health and neither is the sign that millions of jobs are about to vanish due to automation. Economic inequality is not only a profound social and economic issue but flows into forces that affect financial-market stability. Unfortunately, current trends indicate we should not expect improvement in economic equality.

Wealth inequality now stands at the worst it has been during the entire U.S. post-war period. Studies show that the U.S. middle class has been “hollowed out.” In terms of income “by manufacturing jobs” it appears any gains made by the lower-middle class were sharply reversed after 2007. Using certain data we get the picture that racial economic-equality disparities are as bad as they were before the civil rights era. Driving a decent car doesn’t make a person middle-class or economically equal, especially if they are up to their eyeballs in debt to do so.

Covid-19 has moved into the rear-view mirror for many of us but for political reasons Washington will not move on. When all is said and done many people object to the way the pandemic was handled and the huge financial burden it created. Still, it is difficult to deny the damage wrought by Covid-19 continues to remain an excuse for continuing a rash of policies that are responsible for bringing us where we are today.

It is likely the true state of the economy will only be resolved after abundant solid undisputed growth is evident or we have sunk into a mess so dire that financial Armageddon is upon us. Our current perplexing economic state continues to confound and confuse. It seems every time the numbers fail to meet expectations or fall short those in power or the media raise the bar and crank out the fairy dust, some hype, or spin a tale of coming promises and stories of better times soon to come. This has postponed the day of reckoning and a resolution to this debate.

The conundrum we face is how to resolve this toxic mess in the least damaging way. To those of us troubled by the direction the Fed has chosen to take, the massive problem of how to exit the current path remains. Adding to our concern is that rather than warning politicians of the danger involved in spending trillions of dollars on “human infrastructure,” a program that sounds akin to welfare, the Fed has remained silent. Going forward with such spending is likely to yield little other than weaken the dollar and endanger its status. Grant’s Interest Rate Observer founder and editor, Jim Grant, has stated; “I think that the 40-year bond bull market is arguably over or ending and what lies ahead of us is important inflation with rising interest rates.”

The original formula for measuring economic growth was full of flaws but over the years we have allowed even more numbers that mean “nothing” to seep into how the GDP is calculated. The motivation for such adjustments has always been to move forward the illusion of growth. In 1962 Kuznets, the chief architect of how to measure the GDP again emphasized the importance of keeping in mind the difference between quantity and the quality of growth. We need to face the fact the illusion the economy is continuing to strengthen is completely based on “government deficit spending” coupled with the Fed’s very easy monetary policy.

To say the economy we witnessed during 2020 was a bit bizarre is an understatement. Nobody ever predicted anything like what unfolded. As money continues to be created out of thin air we are witnessing bailouts and crony capitalism on full display. Every trillion dollars the Federal Reserve and our government injects into the economy adds approximately $3,333 per man woman and child in America. Recently aid packages from Washington alone have put about three times that into the mix. With this in mind, the whopping ten thousand dollar bang dished out for each of us was bound to move the economic needle.

Adding to this distortion is Fed policy has enabled countries throughout the world to enact similar stimulus packages without lowering the value of their currencies in relation to the dollar. Adding to the bizarre nature of this economy is that this is the first recession where incomes have gone up rather than down. Many seasoned investors feel we have entered the area of “peak insanity.” We are in the kind of market that only emerges during credit bubbles and no method exists to adjust the skewed data we are fed. One lesson we have learned is we should not expect things to revert to normal anytime soon.

Tyler Durden

Sun, 07/18/2021 – 11:40

The Ugly And Difficult Hunt For The True Economy

Authored by Bruce Wilds via Advancing Time blog,

Good luck with acquiring a clear view of our economic future. It is shrouded and cloaked under an ocean of often irrelevant facts and figures. Somewhere between what we are told is occurring in the economy and what we see happening on Main Streets across America is the real and true authentic economy. It is ironic that every sign the economy is not getting better only reinforces the idea that the Fed needs to goose things and pour even more fuel on the fire. This is exactly what many of us oppose and consider pure insanity.

A false economy of fraud is created by seizing on a few positive numbers that can be spun and hyped to convince people all is well. Even as I’m writing this, a MarketWatch article just came out saying the U.S. stock-index futures were trading higher after a report on June retail sales came in stronger than expected. To that, I say, what do you expect, people are busy spending what they see as “free money.” Sadly, people buying goods made in China from Amazon does little to enrich our communities or the American economy.

The justification for continued Fed intervention is often attributed to the idea inflation is not a threat and further action poses little risk. Those behind increased and continued easing say more action is needed or a loop will develop that feeds on itself and ends in a deflationary depression.

Most of us are familiar with former President Bill Clinton’s infamous line; “It depends on what the meaning of the word ‘is’ is.” Well, when it comes to the hunt for the true economy, it all depends on your definition of true. In a true economy things such as sustainability matter, deficits matter, savers being able to get a reasonable return on their savings without taking on undue risk also matters. Simply put, the economy currently before our eyes is as false as it can get.

Before us is an illusion created by papering over the truth with unbelievable amounts of newly printed money. Of course, it is not just money, it is a combination of things. Artificially low interest-rates, the creation of new and easy to obtain credit, and promises that these policies will continue. The fact is, since 2008, even after years of expanding money supplies and dropping interest rates the economy has not fared as well as many top politicians have led us to believe.

We have witnessed some major distortions in the economy since 2008 that have rendered many of the comparisons used in the past as obsolete. An example of this can be found in healthcare. Following the passage of Obamacare, the money flowing into healthcare massively added to America’s GDP, this went on for years. While many people are wowed by these huge expensive new buildings, on the flip side, it has resulted in the shuttering of many smaller local and rural hospitals and clinics that were adequate to care for patients at a much lower cost. Today many of these massive new hospitals standing as monuments to Obamacare run far below capacity again confirming that planners with little skin in the game love to overspend the money of others and we have the healthcare bills to prove it.

Those that see beyond the illusion created by easy credit and money printing, often loudly state that in the future both the economy and society will pay dearly for the sins of the Fed and that no options exist to get out of the box they have put us in. The fact is low-interest rates have punished the very people who have done the right thing by saving and sacrificing to put away money for future needs. It must be noted savers have been encouraged and forced to take on risky investments as they search for higher yields that are unavailable in safer more conservative options.

This debate continues to polarized those who study the economy and play in the dangerous land of investments. Meanwhile, the failure of a crash to materialize and bring markets back to reality over the years has caused a breaking in the ranks. The songs of the market sirens that promise both wealth and profit has lulled many into complacency. We have reached the point where many of the nonbelievers in current policy are capitulating and joining with those who live by mantras like, don’t fight the Fed, buy the dip, and to the “fear of missing out.” Each day more investors surrender to lure of the markets and buying into what they had only a short time ago seen as the dark-side.

Surging inequality is not an indicator of economic health and neither is the sign that millions of jobs are about to vanish due to automation. Economic inequality is not only a profound social and economic issue but flows into forces that affect financial-market stability. Unfortunately, current trends indicate we should not expect improvement in economic equality.

Wealth inequality now stands at the worst it has been during the entire U.S. post-war period. Studies show that the U.S. middle class has been “hollowed out.” In terms of income “by manufacturing jobs” it appears any gains made by the lower-middle class were sharply reversed after 2007. Using certain data we get the picture that racial economic-equality disparities are as bad as they were before the civil rights era. Driving a decent car doesn’t make a person middle-class or economically equal, especially if they are up to their eyeballs in debt to do so.

Covid-19 has moved into the rear-view mirror for many of us but for political reasons Washington will not move on. When all is said and done many people object to the way the pandemic was handled and the huge financial burden it created. Still, it is difficult to deny the damage wrought by Covid-19 continues to remain an excuse for continuing a rash of policies that are responsible for bringing us where we are today.

It is likely the true state of the economy will only be resolved after abundant solid undisputed growth is evident or we have sunk into a mess so dire that financial Armageddon is upon us. Our current perplexing economic state continues to confound and confuse. It seems every time the numbers fail to meet expectations or fall short those in power or the media raise the bar and crank out the fairy dust, some hype, or spin a tale of coming promises and stories of better times soon to come. This has postponed the day of reckoning and a resolution to this debate.

The Spring of 2020 Sell-off

The conundrum we face is how to resolve this toxic mess in the least damaging way. To those of us troubled by the direction the Fed has chosen to take, the massive problem of how to exit the current path remains. Adding to our concern is that rather than warning politicians of the danger involved in spending trillions of dollars on “human infrastructure,” a program that sounds akin to welfare, the Fed has remained silent. Going forward with such spending is likely to yield little other than weaken the dollar and endanger its status. Grant’s Interest Rate Observer founder and editor, Jim Grant, has stated; “I think that the 40-year bond bull market is arguably over or ending and what lies ahead of us is important inflation with rising interest rates.”

The original formula for measuring economic growth was full of flaws but over the years we have allowed even more numbers that mean “nothing” to seep into how the GDP is calculated. The motivation for such adjustments has always been to move forward the illusion of growth. In 1962 Kuznets, the chief architect of how to measure the GDP again emphasized the importance of keeping in mind the difference between quantity and the quality of growth. We need to face the fact the illusion the economy is continuing to strengthen is completely based on “government deficit spending” coupled with the Fed’s very easy monetary policy.

To say the economy we witnessed during 2020 was a bit bizarre is an understatement. Nobody ever predicted anything like what unfolded. As money continues to be created out of thin air we are witnessing bailouts and crony capitalism on full display. Every trillion dollars the Federal Reserve and our government injects into the economy adds approximately $3,333 per man woman and child in America. Recently aid packages from Washington alone have put about three times that into the mix. With this in mind, the whopping ten thousand dollar bang dished out for each of us was bound to move the economic needle.

Adding to this distortion is Fed policy has enabled countries throughout the world to enact similar stimulus packages without lowering the value of their currencies in relation to the dollar. Adding to the bizarre nature of this economy is that this is the first recession where incomes have gone up rather than down. Many seasoned investors feel we have entered the area of “peak insanity.” We are in the kind of market that only emerges during credit bubbles and no method exists to adjust the skewed data we are fed. One lesson we have learned is we should not expect things to revert to normal anytime soon.

Tyler Durden

Sun, 07/18/2021 – 11:40

Read More