“Trapped!”

Authored by Charles Hugh Smith via OfTwoMinds blog,

Kill authentic price discovery, you also kill markets, and in killing markets, you kill allocation of capital and risk management, and in killing those, you kill the economy…

Back when prosperity was authentic, the Federal Reserve had little need for public relations. But now that “prosperity” is an illusion that must be managed lest the phantasm vanish, the Fed’s public relations pronouncements are a ceaseless flood as the The Babble-On 7 are the spokespeople for a propaganda machine bent on “managing expectations.”

Managing Expectations is the code phrase for “front-run what we say and your profits are guaranteed.” When the Fed says it’s going after X, then simply buy whatever will benefit from X happening, and for 12 long years, X unfolds and those who front-ran the FedSpeak reaped billions in essentially zero-risk profits.

Managing Expectations is part of the Fed’s shadow nationalization of key markets. If price discovery of credit and risk is allowed to live, the Fed’s carefully inflated speculative bubbles pop. And so the Fed’s Job One is killing all price discovery via shadow nationalization.

The first market shadow nationalized was the mortgage market, the foundation of the housing market. After Wall Street’s epic swindle (subprime mortgages) imploded in 2008, the Fed printed trillions of dollars out of thin air and bought hundreds of billions of dollars in mortgages. The federal government nationalized the quasi-governmental mortgage issuers Fannie Mae and Freddie Mac, and the net result was virtually the entire mortgage market was government guaranteed or owned.

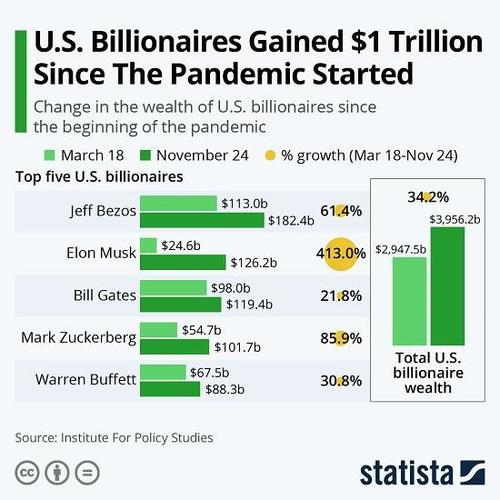

Since Wall Street’s fraud had nearly vaporized the entire global financial system, the Fed also shadow nationalized the stock market, which had imploded once the house of cards collapsed. Thus the S&P 500 has advanced from 667 to 3,850 with just enough brief wobbles to maintain the semblance of an organic market.

This shadow nationalization has been the most well-promoted PR campaign in the history of central banking. The flood of FedSpeak and trillions of dollars in direct purchases of assets over the past 12 years has relentlessly trained the Wall Street and retail rats to buy the dip because the Fed has your back, meaning the Fed will never let its nationalized stock market decline for more than a few weeks.

The profits from front-running FedSpeak are in the trillions of dollars. No wonder the Wall Street rats scurry over and frantically press the buy button–the rewards and have been both reliable and immense.

Now the Fed is in the process of shadow nationalizing the entire bond market. It signaled its intent long ago with quantitative easing, i.e. strangling price discovery in the Treasury market, and recently it began buying corporate bonds (proxies come in handy here).

Fed chair Powell and the rest of The Babble-On 7 have opened the floodgates of PR supporting the notion that the Fed will do “whatever it takes” to generate inflation–the higher the better. And so the Wall Street rats have been joined by millions of retail rats front-running the Fed’s pronouncements by chasing everything that will benefit from rising inflation.

The irony here is that this front-running is now overheating the very inflation the Fed has been saying it’s seeking. The Fed is getting the high inflation its PR claimed it seeks–laughably, the reason given is “to promote higher employment,” hahahaha–and so now it’s trapped by its very success in triggering front-running that unleashes a self-fulfilling feedback loop.

Fed says it will do “whatever it takes” to generate inflation, the well-trained rats front-run inflation, thereby creating the inflation they’re front-running.

Alas, inflation is the Monster Id of central banking: once you create it, it breaks free of your control and rampages through your technocrat-managed financial empire. The Fed can claim godlike powers of yield management but shadow nationalizing the bond market won’t stop the vast misallocation of capital or conjure creditworthy borrowers out of thin air or enable profitable lending opportunities.

The Fed is now trapped by the very success of its PR. The Fed wanted inflation, now it’s unleashed self-reinforcing feedback loops based on front-running Fed management of expectations, and so now the Fed will have to shadow nationalize the bond market with brute force.

But that will release rogue waves of unintended consequences that will sink the Fed and the economy. Kill authentic price discovery, you also kill markets, and in killing markets, you kill allocation of capital and risk management, and in killing those, you kill the economy.

* * *

If you found value in this content, please join me in seeking solutions by becoming a $1/month patron of my work via patreon.com.

* * *

My recent books:

A Hacker’s Teleology: Sharing the Wealth of Our Shrinking Planet (Kindle $8.95, print $20, audiobook $17.46) Read the first section for free (PDF).

Will You Be Richer or Poorer?: Profit, Power, and AI in a Traumatized World (Kindle $5, print $10, audiobook) Read the first section for free (PDF).

Pathfinding our Destiny: Preventing the Final Fall of Our Democratic Republic ($5 (Kindle), $10 (print), ( audiobook): Read the first section for free (PDF).

The Adventures of the Consulting Philosopher: The Disappearance of Drake $1.29 (Kindle), $8.95 (print); read the first chapters for free (PDF)

Money and Work Unchained $6.95 (Kindle), $15 (print) Read the first section for free (PDF).

Tyler Durden

Fri, 02/26/2021 – 16:20

“Trapped!”

Authored by Charles Hugh Smith via OfTwoMinds blog,

Kill authentic price discovery, you also kill markets, and in killing markets, you kill allocation of capital and risk management, and in killing those, you kill the economy…

Back when prosperity was authentic, the Federal Reserve had little need for public relations. But now that “prosperity” is an illusion that must be managed lest the phantasm vanish, the Fed’s public relations pronouncements are a ceaseless flood as the The Babble-On 7 are the spokespeople for a propaganda machine bent on “managing expectations.”

Managing Expectations is the code phrase for “front-run what we say and your profits are guaranteed.” When the Fed says it’s going after X, then simply buy whatever will benefit from X happening, and for 12 long years, X unfolds and those who front-ran the FedSpeak reaped billions in essentially zero-risk profits.

Managing Expectations is part of the Fed’s shadow nationalization of key markets. If price discovery of credit and risk is allowed to live, the Fed’s carefully inflated speculative bubbles pop. And so the Fed’s Job One is killing all price discovery via shadow nationalization.

The first market shadow nationalized was the mortgage market, the foundation of the housing market. After Wall Street’s epic swindle (subprime mortgages) imploded in 2008, the Fed printed trillions of dollars out of thin air and bought hundreds of billions of dollars in mortgages. The federal government nationalized the quasi-governmental mortgage issuers Fannie Mae and Freddie Mac, and the net result was virtually the entire mortgage market was government guaranteed or owned.

Since Wall Street’s fraud had nearly vaporized the entire global financial system, the Fed also shadow nationalized the stock market, which had imploded once the house of cards collapsed. Thus the S&P 500 has advanced from 667 to 3,850 with just enough brief wobbles to maintain the semblance of an organic market.

This shadow nationalization has been the most well-promoted PR campaign in the history of central banking. The flood of FedSpeak and trillions of dollars in direct purchases of assets over the past 12 years has relentlessly trained the Wall Street and retail rats to buy the dip because the Fed has your back, meaning the Fed will never let its nationalized stock market decline for more than a few weeks.

The profits from front-running FedSpeak are in the trillions of dollars. No wonder the Wall Street rats scurry over and frantically press the buy button–the rewards and have been both reliable and immense.

Now the Fed is in the process of shadow nationalizing the entire bond market. It signaled its intent long ago with quantitative easing, i.e. strangling price discovery in the Treasury market, and recently it began buying corporate bonds (proxies come in handy here).

Fed chair Powell and the rest of The Babble-On 7 have opened the floodgates of PR supporting the notion that the Fed will do “whatever it takes” to generate inflation–the higher the better. And so the Wall Street rats have been joined by millions of retail rats front-running the Fed’s pronouncements by chasing everything that will benefit from rising inflation.

The irony here is that this front-running is now overheating the very inflation the Fed has been saying it’s seeking. The Fed is getting the high inflation its PR claimed it seeks–laughably, the reason given is “to promote higher employment,” hahahaha–and so now it’s trapped by its very success in triggering front-running that unleashes a self-fulfilling feedback loop.

Fed says it will do “whatever it takes” to generate inflation, the well-trained rats front-run inflation, thereby creating the inflation they’re front-running.

Alas, inflation is the Monster Id of central banking: once you create it, it breaks free of your control and rampages through your technocrat-managed financial empire. The Fed can claim godlike powers of yield management but shadow nationalizing the bond market won’t stop the vast misallocation of capital or conjure creditworthy borrowers out of thin air or enable profitable lending opportunities.

The Fed is now trapped by the very success of its PR. The Fed wanted inflation, now it’s unleashed self-reinforcing feedback loops based on front-running Fed management of expectations, and so now the Fed will have to shadow nationalize the bond market with brute force.

But that will release rogue waves of unintended consequences that will sink the Fed and the economy. Kill authentic price discovery, you also kill markets, and in killing markets, you kill allocation of capital and risk management, and in killing those, you kill the economy.

* * *

If you found value in this content, please join me in seeking solutions by becoming a $1/month patron of my work via patreon.com.

* * *

My recent books:

A Hacker’s Teleology: Sharing the Wealth of Our Shrinking Planet (Kindle $8.95, print $20, audiobook $17.46) Read the first section for free (PDF).

Will You Be Richer or Poorer?: Profit, Power, and AI in a Traumatized World (Kindle $5, print $10, audiobook) Read the first section for free (PDF).

Pathfinding our Destiny: Preventing the Final Fall of Our Democratic Republic ($5 (Kindle), $10 (print), ( audiobook): Read the first section for free (PDF).

The Adventures of the Consulting Philosopher: The Disappearance of Drake $1.29 (Kindle), $8.95 (print); read the first chapters for free (PDF)

Money and Work Unchained $6.95 (Kindle), $15 (print) Read the first section for free (PDF).

Tyler Durden

Fri, 02/26/2021 – 16:20

Read More