When the system can’t borrow more and distribute the insolvency, it implodes

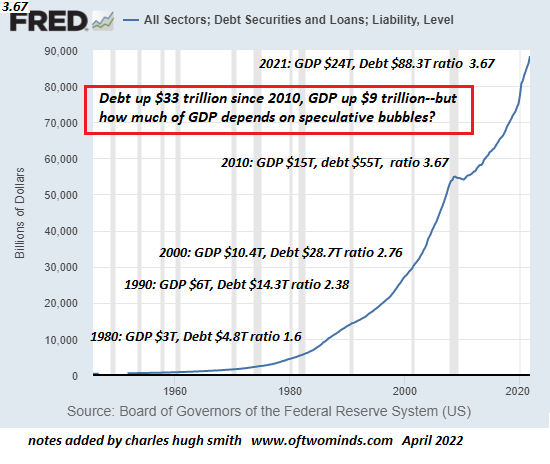

I started writing about debt saturation back in 2011. The basic idea is we can continue to borrow and spend as long as one of two conditions hold: 1) real (inflation-adjusted) income is rising, so there’s more income to service additional debt, or 2) the cost of borrowing declines so the same income can support more debt.

After 13 long years of declining interest rates and stagnant incomes for the bottom 90%, we’ve finally reached debt saturation: after dropping to near-zero, interest rates are now rising, pushing the cost of debt service higher, while wages are losing purchasing power (a.k.a. inflation), so there’s less disposable income left to service debt.

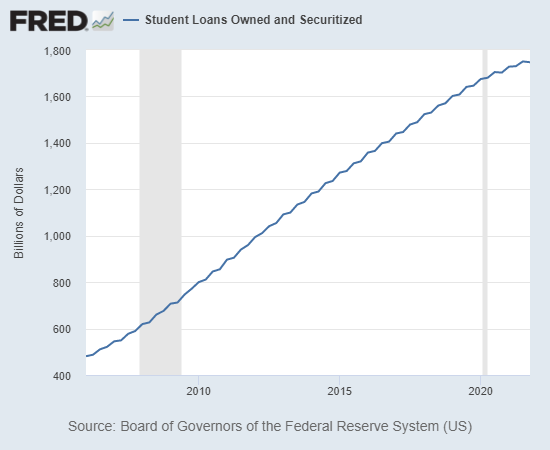

The game plan for the past 13 years was to fund “growth” today by borrowing vast sums from future incomes: the $1.6 trillion in student loan debt, for example, was supposed to be paid by the soaring wages of all those student-loan-serfs, and all the sovereign debt was supposed to be paid by the soaring tax revenues from rapidly expanding economies.

These fantasies have now run aground on the unforgiving shoals of reality. There’s no way to expand debt if income is losing ground and the cost of borrowing is soaring.

As I observed in 2012, Spreading Insolvency Around Does Not Create Solvency (August 23, 2012). In 2011, I used a different analogy: The World Is Drowning in Debt, and Europe Laces On Concrete Boots (November 14, 2011).

Saturation is an interesting phenomenon. You keep adding more and more to a system that seems to absorb “more” with no ill effects, and then suddenly the whole mountainside gives way and rumbles off the cliff.

There’s a runaway feedback loop aspect to debt saturation. Think of a planetary atmosphere where you keep adding greenhouse gases. The atmosphere keeps absorbing more greenhouse gases with little effect until a saturation point is reached and then the atmosphere loses its negative feedback mechanisms that kept the system stable.

At that point, the feedback is all positive, i.e. every additional unit of greenhouse gases doesn’t just trap an additional unit of heat, it multiplies the effect. (The atmosphere of Venus is hot enough to melt lead–900 F or 475 C.)

We see this same dynamic in debt saturation: the breakdown is accelerating rapidly. Since households burned through their stimulus bonanza, the savings rate has fallen and credit card balances are soaring. But this is not low-cost debt, it’s high-cost debt, so those additional credit card balances will soon stripmine disposable income, leaving less for additional spending or debt service.

The “temporary debt forgiveness” ploy is staving off the day of reckoning in student loan serfdom. Rather than admit the student loan scam is unsustainable, the status quo plays an absurd game of pushing the date that student loan interest will have to be paid forward. This works until it doesn’t.

Meanwhile, with mortgage rates over 5% for the first time in a decade, the housing bubble is popping. The runaway feedback of higher mortgages and slowing sales will accelerate price declines and mortgage delinquencies far faster than the mainstream anticipates.

Rising bond yields will push the cost of government borrowing higher, too. Borrowing money to pay the interest on borrowing money is another feedback loop of doom: it’s downright inconvenient when most of the income tax revenues are devoted to servicing government debt, leaving little for the rest of the government’s vast spending.

There’s a lot of shuck and jive in income and wealth statistics to mask the doom-loop of debt saturation. Oh, the household is still doing just fine, we’re told: look at all the luscious wealth and income available to service more debt.

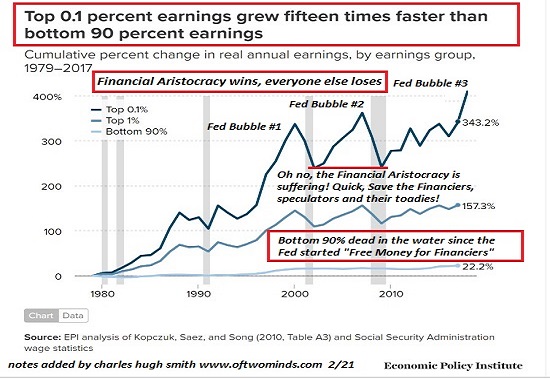

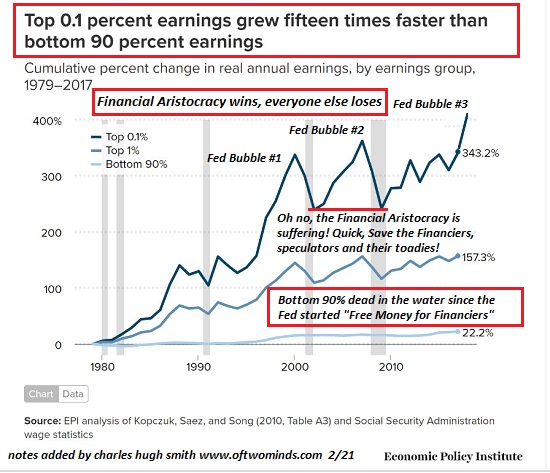

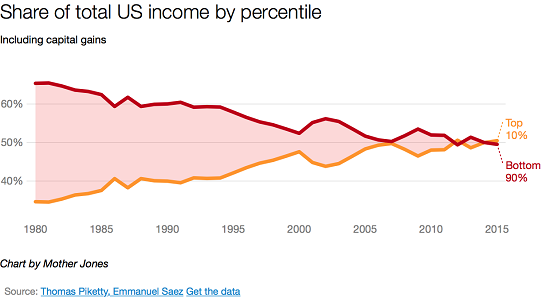

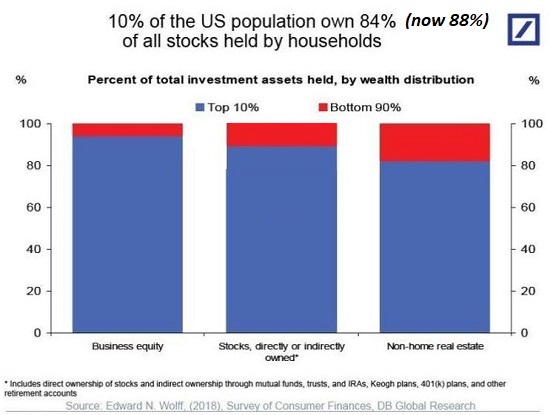

What punctures the pretty fantasy is the reality that only the top 5% have plenty of income and wealth. The top 1% collect around 20% of all income and own 50% of all financial wealth, and the top 10% collect over 50% of all income and own roughly 90% of financial assets.

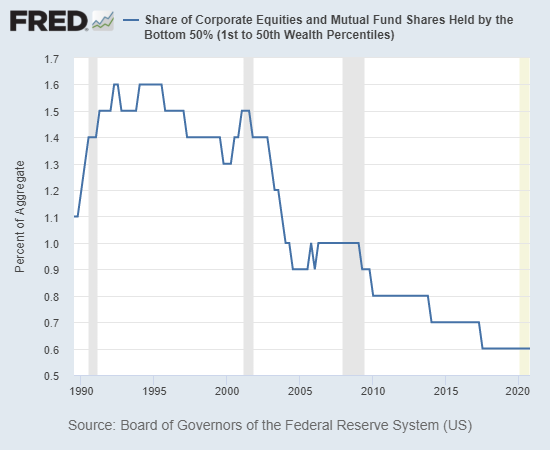

The bottom 50% of households own less than 1% of financial wealth and the bottom 90% will discover how much of their “wealth” is phantom when the stock and housing bubbles pop.

The point is wealth and income are highly concentrated in the U.S., so claiming households have plenty of wealth and income is a gross distortion. Yes, the top 5% (7 million households) could borrow more, but they have enough wealth and income that they don’t need to borrow more.

Those who need to borrow more to survive can’t borrow more: households, zombie corporations, and local znd national governments.

Top 1% of U.S. Earners Now Hold More Wealth Than All of the Middle Class

The U.S. Income Distribution: Trends and Issues

There’s no tricks left to keep expanding debt: rates are rising, not falling, and wages are losing ground to the soaring costs of rent, adjustable mortgages, healthcare, childcare, food, energy, junk fees, property taxes, etc. As for the phantom wealth of bubbles: as rates rise and the Federal Reserve trims its stimulus, all the bubbles will pop.

When the system can’t borrow more and distribute the insolvency, it implodes. And so off the cliff we go.

Tip of the hat to Adam Taggart of wealthion.com for suggesting it was an appropriate moment to revisit this topic–thank you, Adam.

* * *