The US Federal Reserve has announced a 0.75% interest rate hike, the largest increase since 1994, with FED chief saying the rate increase is meant to combat rampant inflation.

The US Federal Reserve has announced a 0.75% interest rate hike, the largest increase in 28 years, as the central bank’s chairman stressed the need to avoid a recession and tame runaway price inflation.

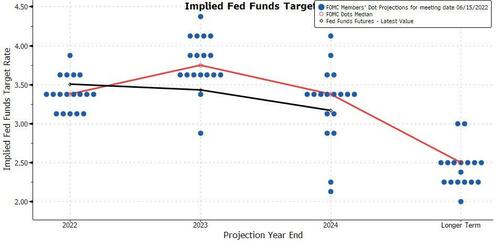

The Fed’s Open Market Committee announced the decision on Wednesday, saying it would raise short term rates by 75 basis points in a move aimed at reducing inflation to 2%. Prior projections suggested that figure could reach 3.4% by the end of the year.

“We’re not trying to induce a recession now, let’s be clear about that,” Fed Chairman Jerome Powell told reporters following the committee meeting, though noted that spikes in certain commodity prices could “take the decision out of our hands.”

While price inflation in the US had reached a 40-year high prior to Moscow’s attack on Ukraine in late February, the Fed committee went on to blame the “invasion of Ukraine” for “creating additional upward pressure on inflation,” also claiming that Covid-19 lockdowns in China “are likely to exacerbate supply chain disruptions” around the world, RT reports

However, the economists see this as too little too late: Former NY Fed president Bill Dudley said “I think the Fed’s forecasts are still remarkably optimistic… This is a very ‘soft landing’ sort of forecast.”

Powell prevaricated all over the place during his presser to persuade listeners that the US economy the US economy “is in a strong position” and “well-positioned to deal with higher interest rates.”

He then shifted from prevarication to total perjury when – on the day that retail sales printed negative and the Atlanta Fed GDPNOW model forecast tumbled to 0.0% – he dared to utter the following words:

“There is no sign of a broader slowdown in the economy that I can see.”

There’s just one thing, the US economic data has done nothing but signal collapse for over a month now… (remember when he kept saying that inflation was “transitory’ too?)

Source: Bloomberg

If everything’s so awesome, why are major firms announcing mass layoffs? And cutting guidance?

Anyway, it’s unclear if the markets paid much attention to anything he said as it all sounded like noise as stocks rallied, bond yields tumbled, the dollar plunged, and gold ripped…