U.S. policymakers are reportedly hunting around the world for alternative sources of gas in the event conflict between Russia and NATO over Ukraine interrupts pipeline supplies to Europe.

Top officials have approached rival producer Qatar as well as consuming countries in Asia, including Japan, South Korea and even China, about diverting liquefied natural gas (LNG) cargoes to Europe.

The diplomatic effort is likely intended to reassure European policymakers about security of supply and stiffen their resolve to threaten tough economic sanctions. It is also probably meant to signal NATO resolve to Russia as part of an escalate-to-negotiate strategy intended to demonstrate escalation dominance and convince the Russian government to back down.

Qatar has already been rewarded with a summit at the White House and formal designation under U.S. law as a major non-NATO ally, which could unlock a variety of economic, diplomatic and military benefits.

But while the highly publicized hunt for alternative supplies has value as diplomatic theatre it is unlikely to improve Europe’s energy security very much.

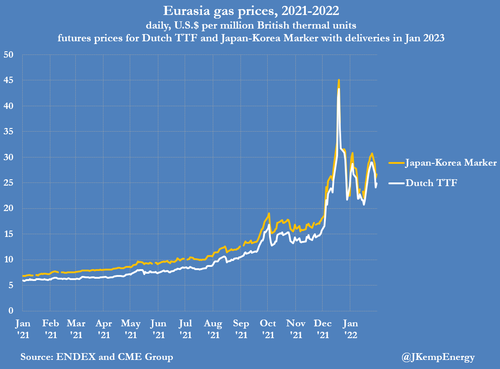

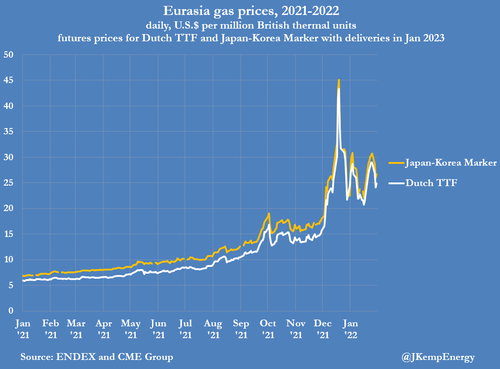

Energy security depends on prices as much as physical availability and any sustained interruption of Russian supplies would cause a damaging price spike in Europe and the rest of the world.

ZERO-SUM SUPPLIES

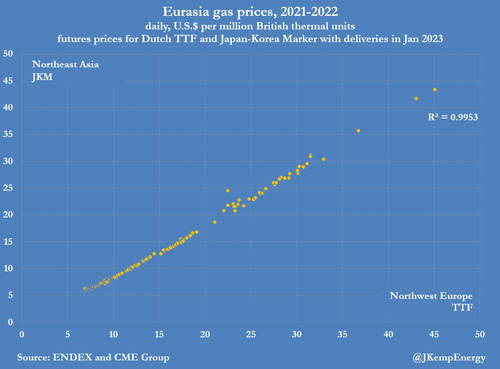

Globally, there is little spare capacity at any stage in the LNG supply chain, as recent record prices have shown, so increased supplies to Europe could only come at the expense of reduced supplies in other regions.

Unlike oil, where the consuming countries hold strategic stocks to offset the risk of an embargo, gas stocks are low and designed to deal with seasonal consumption swings rather than politically motivated supply interruptions. There is no equivalent for gas of the U.S. Strategic Petroleum Reserve and the network of other strategic petroleum stocks held by countries in the International Energy Agency.

Gas is more difficult and expensive to store than crude oil and liquid fuels, and until now has been treated as less of a national security issue. In the event a NATO/Russia conflict reduced or halted pipeline supplies to Europe for more than a few days, the global production-consumption balance would worsen and prices would surge higher for all consumers outside the United States.

Gas prices in Northwest Europe and Northeast Asia are already closely correlated because they both draw on the same suppliers of LNG (https://tmsnrt.rs/3AWT7qn).

Moreover, consumers in Asia could only agree to re-route LNG cargoes to Europe at the cost of reducing their own supply security next winter.

Short-term swaps in which consumers in Asia agreed to divert LNG to Europe on the understanding they will receive the cargoes back before next winter would only postpone Europe’s supply crunch until later in the year. Longer term swaps that saw consumers in Asia repaid after next winter would leave them facing unacceptably high risks to their own supply security between November 2022 and March 2023.

These strategies all emphasize the essentially zero-sum nature of limited gas supplies in the short term would leave all consuming countries as a group with lower gas inventories over the next twelve months.

In every scenario, a sustained interruption of Russian pipeline supplies would result in a significant increase in gas and electricity prices for consumers in Europe and Asia. While governments in Western Europe, Eastern Asia and the Middle East have played along with the gas diplomacy for the sake of their alliances with the United States, practical commitments have been limited.

Europe and Asia’s policymakers are understandably fearful of the economic and political fallout from sharply higher gas prices ― even if supplies could somehow be reallocated among them to avoid immediate shortages.

In the event of an interruption of pipeline supplies, U.S. and allied officials might make a rapid and high-profile announcement about LNG diversions to blunt the immediate spike in European prices.

But unless the interruption was likely to last for a short duration only, prices would quickly climb as traders adjusted to the prospect of a worldwide shortage by the end of 2022.

By John Kemp, Senior Market Analyst at Reuters

Read More