US Services Sector Jobs Slide As Input Prices Explode Higher

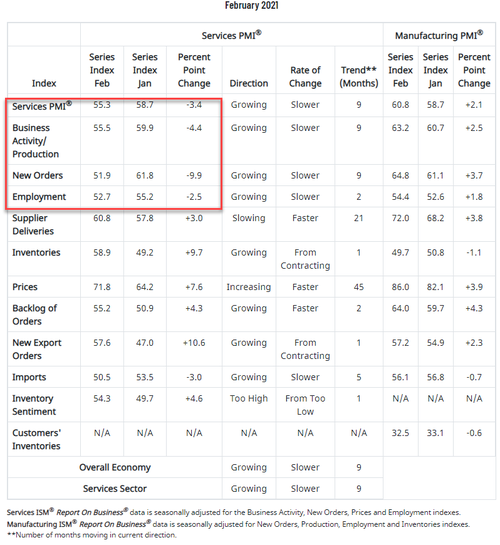

After a mixed picture from US Manufacturing (PMI down, ISM up), expectations for February Services data were positive and Markit delivered with a better than expected 59.8 final print, but, we we have got used to, ISM disappointed notably, dropping from 58.7 to 55.3.

The Soft Survey data is completely mixed…

-

Markit US Manufacturing PMI fell to 58.6 from 59.2 (this was above the 58.5 flash print)

-

Markit US Services PMI rose to 59.8 from 58.3 (highest since 2014)

-

ISM Manufacturing rose to 60.8 from 58.7 (highest since 2004)

-

ISM Services fell to 55.3 from 58.7 (lowest since May 2020)

Take your pick…

Source: Bloomberg

Under the hood, employment slowed notably as prices soared and new orders tumbled…

The main headline was soaring inflationary pressures:

Cost pressures remained marked in February, with the rate of input price inflation accelerating to the fastest since data collection began in October 2009.

Firms were able to pass on higher costs through a robust rise in output charges. The pace of increase was the second-steepest on record, behind November 2020.

Source: Bloomberg

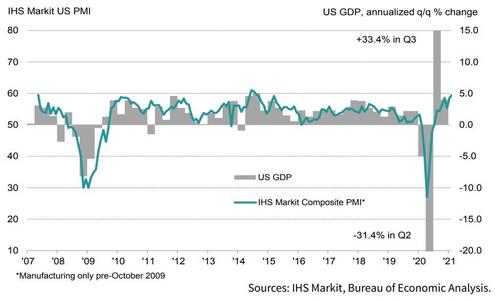

The Composite PMI Output Index posted 59.5 in February, up from 58.7 in January, to signal a substantial upturn in private sector business activity. A further robust expansion in manufacturing production and a faster increase in service sector activity helped boost total output.

Commenting on the latest survey results, Chris Williamson, Chief Business Economist at IHS Markit, said:

“US business activity is growing at the fastest rate for six-and-a-half years, setting the economy up for a strong start to 2021. Although consumer-facing sectors, notably hospitality, travel, and tourism, continue to be adversely affected by COVID-19 restrictions, and will be for some time to come, other parts of the economy are springing back into life. Financial services and business services are faring well, accompanying a strong manufacturing recovery. Even some hard hit consumer-facing sectors are enjoying some loosening of restrictions or adapting to life with the virus.

“A wide variety of costs are rising, however, putting additional pressure on companies across the board. Many materials prices are sharply higher, transport costs are increasing and wage pressures are building as firms struggle to hire suitable staff, resulting in the largest monthly rise in service sector costs since comparable data were first available in 2009.

“Some of these higher costs will inevitably prove transitory as pandemic-related disruptions to supply start to ease, but it remains unclear how long these price pressures will persist for due to uncertainties over the duration of social distancing requirements and the strength of demand over the coming months.”

Finally, we note that, despite all the excitement, business confidence moderated from that seen in January due to service sector concerns regarding the longevity of the pandemic and success of the vaccine roll-out.

Tyler Durden

Wed, 03/03/2021 – 10:05

US Services Sector Jobs Slide As Input Prices Explode Higher

After a mixed picture from US Manufacturing (PMI down, ISM up), expectations for February Services data were positive and Markit delivered with a better than expected 59.8 final print, but, we we have got used to, ISM disappointed notably, dropping from 58.7 to 55.3.

The Soft Survey data is completely mixed…

Markit US Manufacturing PMI fell to 58.6 from 59.2 (this was above the 58.5 flash print)

Markit US Services PMI rose to 59.8 from 58.3 (highest since 2014)

ISM Manufacturing rose to 60.8 from 58.7 (highest since 2004)

ISM Services fell to 55.3 from 58.7 (lowest since May 2020)

Take your pick…

Source: Bloomberg

Under the hood, employment slowed notably as prices soared and new orders tumbled…

The main headline was soaring inflationary pressures:

Cost pressures remained marked in February, with the rate of input price inflation accelerating to the fastest since data collection began in October 2009.

Firms were able to pass on higher costs through a robust rise in output charges. The pace of increase was the second-steepest on record, behind November 2020.

Source: Bloomberg

The Composite PMI Output Index posted 59.5 in February, up from 58.7 in January, to signal a substantial upturn in private sector business activity. A further robust expansion in manufacturing production and a faster increase in service sector activity helped boost total output.

Commenting on the latest survey results, Chris Williamson, Chief Business Economist at IHS Markit, said:

“US business activity is growing at the fastest rate for six-and-a-half years, setting the economy up for a strong start to 2021. Although consumer-facing sectors, notably hospitality, travel, and tourism, continue to be adversely affected by COVID-19 restrictions, and will be for some time to come, other parts of the economy are springing back into life. Financial services and business services are faring well, accompanying a strong manufacturing recovery. Even some hard hit consumer-facing sectors are enjoying some loosening of restrictions or adapting to life with the virus.

“A wide variety of costs are rising, however, putting additional pressure on companies across the board. Many materials prices are sharply higher, transport costs are increasing and wage pressures are building as firms struggle to hire suitable staff, resulting in the largest monthly rise in service sector costs since comparable data were first available in 2009.

“Some of these higher costs will inevitably prove transitory as pandemic-related disruptions to supply start to ease, but it remains unclear how long these price pressures will persist for due to uncertainties over the duration of social distancing requirements and the strength of demand over the coming months.”

Finally, we note that, despite all the excitement, business confidence moderated from that seen in January due to service sector concerns regarding the longevity of the pandemic and success of the vaccine roll-out.

Tyler Durden

Wed, 03/03/2021 – 10:05

Read More