The US Bureau of Labor Statistics released new Producer Price Index (PPI) data last week, and it’s not good news for consumers.

The PPI is a measure of prices at the production phase of goods and services, and is often an indicator of where consumer prices are headed. Prior to 1978, the index was known as the Wholesale Price Index.

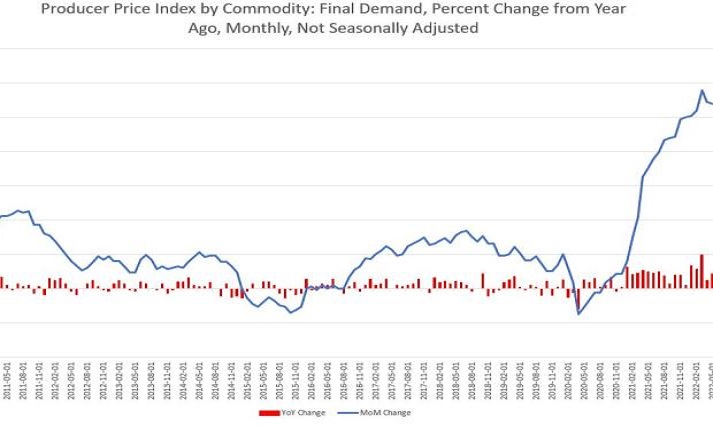

This May, year-over-year PPI growth came in at over 10 percent for the sixth month in a row, reaching 10.8 percent. This was a small drop from April’s year-over-year rate of 10.9 percent, but continues to suggest ongoing upward pressure in prices. The month-over-month change for May was 0.8 percent, which was up from April’s month-over-month change of 0.5 percent. Movement remains upward, and from a very elevated base.

Year-over-year changes in the PPI have been over 7 percent for twelve months.

As with the Consumer Price Index, the narrative among optimistic analysists was that PPI measures would moderate significantly in May and signal a downward turn. That does not appear to be the case so far. Indeed, consumer prices showed few signs of moderating in May, as CPI inflation surged near to a forty-one-year high of 8.6 percent. Continued growth in the PPI points toward ongoing growth in consumer prices as well.

Changes, of course were not uniform, and the AP reports today:

A 1.4% jump in the prices of goods accounted for nearly two-thirds of the rise in the PPI. Goods prices, which rose 1.3% in April, were driven by soaring costs for energy products.

Wholesale gasoline prices rebounded 8.4% after falling 3.0% in April, making up 40% of the rise in the costs of goods. Jet fuel increased 12% after shooting up 14.8% in April. There were also increases in the cost of residential natural gas, steel mill products and diesel fuel.

Wholesale food prices were unchanged after increasing 1.4% in the prior month as the cost of beef and veal fell 9.5%, offsetting an increase in processed young chickens. Excluding food and energy, goods prices rose 0.7% after increasing 1.1% for two straight months.

These numbers will put further pressure on the Biden administration and the Federal Reserve to “do something” about price inflation. It is unclear what this means for the Fed, however, which has signaled it is reluctant to depart from its ongoing policy of extremely timid moves toward slowly ratcheting up the federal funds rate and selling off Fed assets. Rather, the Fed is increasingly behind the curve. It is truly remarkable to have a CPI inflation rate of 8.6 percent while the federal funds rate sits at 1 percent and the Fed portfolio remains near $9 trillion in assets.

The Fed will meet this Wednesday, and the consensus is that the Federal Open Market Committee will raise the target rate by 50 basis points. The Wall Street Journal even reported yesterday that there is growing evidence that the FOMC could raise rates by 75 basis points. If this happens, we’ll be in uncharted territory, since the Fed will then be raising rates just as the S&P500 (a leading economic index) enters a bear market, and as the yield curve is showing signs of inversion and flashing warning signs for a recession. On the other hand, if the Fed elects to do nothing, it will have no room to maneuver as economic conditions continue to worsen. That is, the Fed routinely cuts the target rate by more than 200 basis points going into recessions, but the Fed will be in negative territory if it cuts even 100 basis points, given the current target rate. One could now easily imagine a scenario in which the Fed raises the target rate by one or two percentage points midyear this year only to cut by the same amount later this year. This would follow the Fed’s usual playbook of resorting to easy-money stimulus whenever the economy shows signs of slowing down. The problem the Fed now faces, however, is that price inflation will continue until the Fed truly scales back on its easy-money efforts—which will likely cause a significant downturn.

There is no easy way out. No matter what the Fed does, the economy will still have to deal with the countless malinvestments and bubbles that have sprung up on the back of easy money over the past decade—and which accelerated in 2020 and 2021. Simply raising the target rate won’t make this difficult adjustment go away. We must also acknowledge that the Fed cannot pick the “correct” target rate that will “fix” the economy. The only fix is for the Fed to altogether stop using open market operations to manipulate market interest rates and let the market set prices.