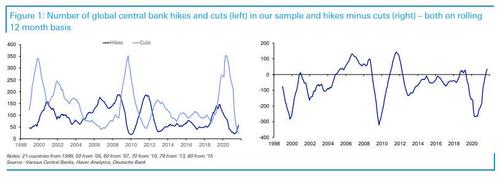

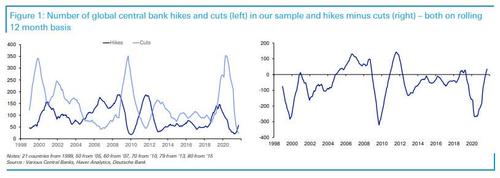

Maybe the market has been too hypnotized by the promise of cheap free money flowing forever, or maybe it remembers how the Fed stepped in last March to ensure that nobody lost any money and thus nobody wants to sell this time, or maybe it is just too used to buying every single dip so that news of the Fed’s taper actually sent stocks higher. But all that may soon change, because as Deutsche Bank’s Jim Reid calculates in terms of global central bank hikes exceeding cuts, we are now at the highest differential for a decade on a rolling 12-month basis.

In other words, we are now entering the most aggressively global hiking cycle in a decade.

Some points on the data:

The last 12 months have actually seen a historically low number of central bank rate moves in either direction. Never have global central banks been so inactive on that score. This is now starting to pick up though.

Since May 2012, global central banks have only seen the rolling 12m hike totals exceed cuts on 10% of occasions. We have just entered such a net hiking zone.

Central bank cuts have overwhelming exceeded hikes over the last couple of decades.

So its quite clear that a global hiking cycle had already started before the recent mini energy crisis. Will this renewed spike in energy costs mean central banks accelerate this (e.g. BoE guidance last week) or will it hit demand enough that it actually slows them down as stocks slide?

The answer is unclear but as Reid concludes, “this is an incredibly delicate and difficult period for central banks.” As a minimum, Reid notes, rates markets are finally waking up to the asymmetric risk/reward that had developed over the summer months given all the global inflation in the system and the evidence that we were in a global hiking cycle. One wonders when stocks will do the same.