Friend of Fringe Finance Lawrence Lepard released his most recent investor letter a few weeks ago with his updated take on the monetary miasma spreading across the globe.

Larry was kind enough to allow me to share his thoughts heading into 2022.

Before Russia invaded Ukraine, Larry predicted that a “crack up boom” could be on its way and also offered his take on gold, inflation, monetary policy, bitcoin, fiscal policy, the ongoing supply chain crunch, and much, much more. That analysis is included.

Now, the invasion of Ukraine has helped catalyze a number of his predicted scenarios.

Here are several Fringe Finance excerpts from Larry’s thoughts on the Ukraine invasion and the markets heading into 2022, from prior to the invasion.

Russia Invading Ukraine Has Caused A ‘Monetary Earthquake’

What just happened in the last two weeks is enormously important and misunderstood by many investors.

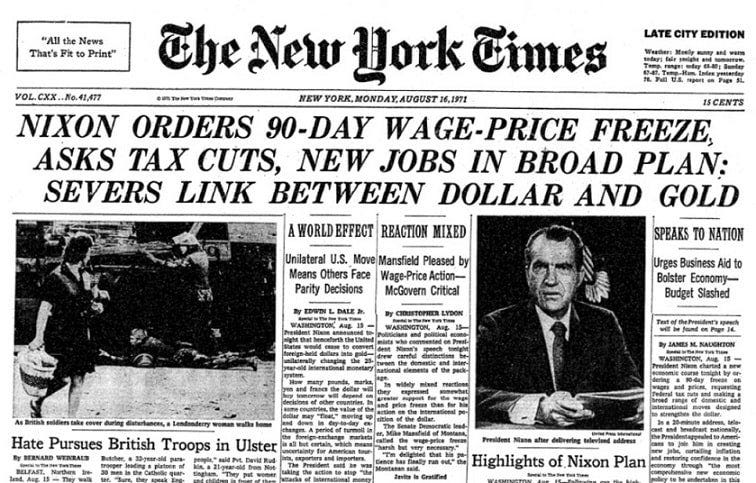

The Russian invasion of Ukraine and the corresponding Western sanctions and seizure of Russian FX reserves are nothing short of a monetary earthquake. The last comparable event was Nixon’s abandonment of the gold standard in 1971.

Russia, with the backing and support of China, just told the world that it is no longer going to sell its oil, gas and wheat for Western currencies which are programmed to debase.

The West in its response just said to all countries around the world: “If you have foreign exchange reserves, held in our system, they are no longer safe if we disagree with your politics.”

It is similar to what the Canadians did when they moved to seize the bank accounts of Canadians who had demonstrated support for the truckers without due process of law.

Both of these political moves are blatant advertisements for what I call “non state controlled money without counterparty risk”, like gold and bitcoin. If governments can weaponize their money when they do not like what you are doing, what is the natural defense?

Gold Will Rip Higher Because Of What Russia Is Doing

The US Dollar has been the reserve currency of the world since WW II and the Bretton Woods agreement. This has given the US an enormous advantage and subsidy from the rest of the world because everyone else needs to produce goods and services to obtain dollars and the US can simply produce dollars at no cost by printing them.

Putin is now cast in the role of Charles de Gaulle who complained about the “exorbitant privilege” of the US with its dollar hegemony. As we all know, de Gaulle demanded gold in exchange for France’s US dollar FX surpluses and this outflow forced Nixon to close the gold window.

Recall that post this event, gold went from $35 per ounce to $800 per ounce (23x). Russia’s move will lead to a similar move in favor of gold. Putin could see that the US fiscal and monetary situation was becoming untenable and he decided to use this to create an existential threat to the US and the world financial system.

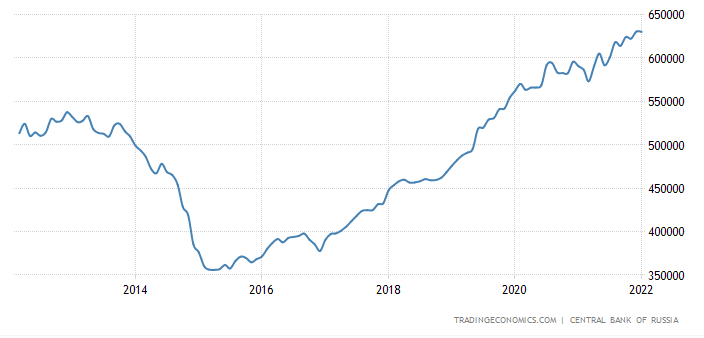

He undoubtedly knows that the West has artificially suppressed the price of gold and that is why he has been building his gold reserves steadily for the past 20 years.

Putin just shot “King Dollar” in the head.

We can see it in the financial markets, as the price of everything commodity related is going up relentlessly in dollar terms.

Russia is long commodities, long gold and doesn’t need fiat currency. His debt to GDP ratio is low and taxes are low. If the world financial markets collapse on a relative basis, the position of Russia will be improved significantly. This is what I believe he is playing for. If investors do not recognize this they will be caught wrong footed as I believe many are today.

The implications for investors are quite clear. None of us own enough gold, real assets or commodities. Fiat currencies are going to fail spectacularly, and soon, in my opinion.

Before Russia invaded Ukraine, Larry predicted that a “crack up boom” could be on its way and also offered his take on gold, inflation, monetary policy, bitcoin, fiscal policy, the ongoing supply chain crunch, and much, much more.

Now, the invasion of Ukraine has likely catalyzed a number of his scenarios.

A Crack Up Boom Could Be Coming

The bottom line is that the monetary system is exhibiting many of the early characteristics of a crack-up boom.

A crack-up boom is the crash of the credit and monetary system due to continual credit expansion and price increases that cannot be sustained long-term.

In the face of excessive credit expansion, consumers’ inflation expectations accelerate to the point that money becomes worthless and the economic system crashes.

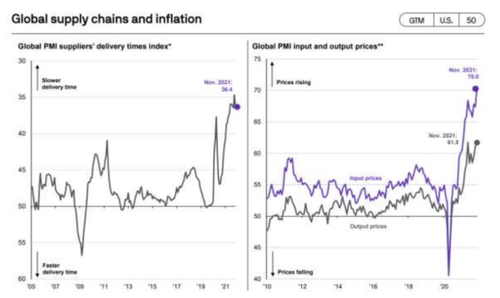

Wow, does that sound familiar? “Real resource crunch” – do we have any shortages in commodities or labor? Well, ask the people in Europe who are worried about their costs for electricity, natural gas and heating oil this winter. Or, how about the labor shortages that we are seeing develop everywhere? How about the shortages of goods that are backed up in ships off the California coast? Supply chain issues have been blamed on COVID and government officials have, until recently, tried to spin the resulting inflation as transitory.

Certainly some of the current rip-roaring inflation could abate as supply chain delivery times improve (left chart below) which may permit PMI Input / Output prices to soften (right chart below): But to date there is little evidence of abatement.

But perhaps there is also something else going on.

Labor and product supply shortages can easily lead to further price increases and there is the potential for a vicious “cost-push” spiral upward. Eventually businesses may not be able to operate and business failures begin to occur. (They cannot get the necessary inputs, or properly price their goods and services). When highly levered businesses fail, the destruction of credit and demand soon follow.

Historically, the Government response is to print more in a vain attempt to prevent failures – as if money printing could produce goods and services.

We are seeing some of this in our personal observations. We know of builders who cannot get needed supplies to build houses. One builder in Las Vegas reported that his cost of building a house went up 40% LAST QUARTER. We know of an interior designer who cannot source products (furniture delivery times of 6 months plus) and so his business is likely to fail.

We are concerned that if inflationary expectations continue to grow, the path to a crack up will become clear. We believe that inflation expectations will continue to grow as this present inflation is “cost-push” rather than the more temporary “demand-pull” form of inflation.

Today’s blog post has been published without a paywall because I believe the content to be far too important. However, if you have the means and would like to support my work by subscribing, I’d be happy to offer you 22% off to become a subscriber in 2022: Get 22% off forever

While we may not be on the precipice of a Crack Up Boom (yet), the probabilities of it occurring have certainly increased. We believe investors must begin to consider the “tail risk” that all confidence could be lost in our current monetary system.

When price signals are so distorted that markets no longer function, the only possible outcome is total collapse of the market structure. We believe that the US Treasury and Federal Reserve see these risks and that is why they are trying hard to control Government spending, and are accelerating the pace of tapering the extraordinary QE that was initiated in March 2020 when Jerome Powell vowed to do whatever it takes to keep the markets functioning (the Third Fed Mandate).

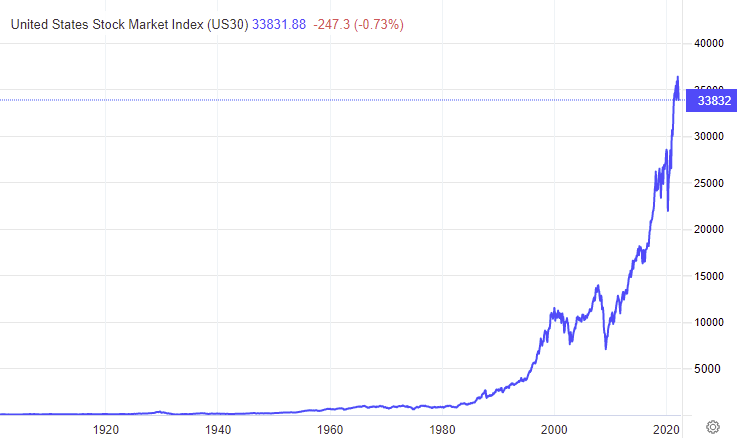

So, just how probable is a crack up boom? Sometimes it is easier to see these things visually. The US stock market below:

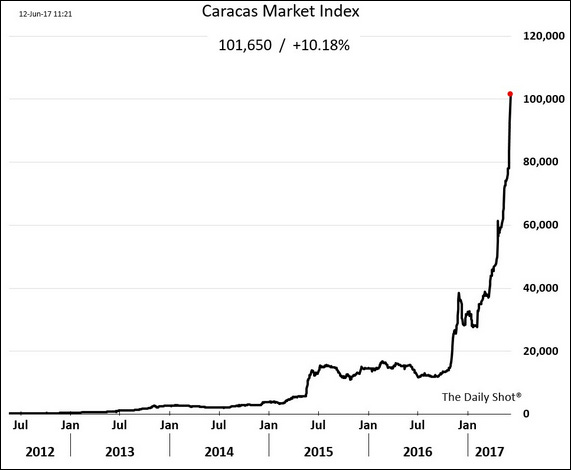

And the Venezuelan Stock market just before its currency became worthless as a result of hyperinflation:

The important driver here is inflationary expectations. Note the earlier quote on Crack Up Booms, “consumers’ inflation expectations accelerate to the point that money becomes worthless”. This is the major point of the Austrian School Economists: when individuals discover that not only is inflation occurring, but it is the policy of government, and that inflation cannot and will not be reversed. Then there becomes a rush to substitute their store of value savings of the inflated fiat money with stores of value that are of more limited supply and will hold value for the future.

This is Gresham’s Law: bad money drives out good. If people perceive that the money is becoming worthless they will spend it as quickly as possible on any tangible good before prices rise further.

We are not at or near that point yet, but inflation awareness and inflation expectations are growing.

Here are some of Larry’s additional observations about 2021:

- The last time an inflation print came in at 7.0% (June 1982), 10-year Treasury yields exceeded 14%. Ten-year yields ended 2021 at 1.51%, with inflation-adjusted “real” yields deeply into negative territory. (-5.49%)

- Producer Price Index (PPI) was up 13.3% in November y-o-y (highest since 1980). The Bloomberg Commodities Index jumped 27.1% in 2021.

- The S&P hit over 70 new all-time highs, ending the year up 27%. Off the March 2020 low, the S&P is now up 113% and trading at 21.2x forward P/Ex, near its March 2000 peak P/Ex.

- The 2021 federal fiscal deficit reached $2.77 TN, with a historic $5.9 TN two-year shortfall (28% of GDP). The federal deficit was $3.1T in fiscal 2020 (September year-end). Recall that US Federal Tax Revenues totaled $3.86T in 2021. Budget deficit was 42% of total fiscal spending.

- The Fed’s balance sheet inflated an astonishing $5.015 TN, or 135%, in the 120 weeks since QE was restarted in September 2019. Federal Reserve Assets have now inflated nearly 10x since the mortgage finance Bubble collapse. [went from $0.907T at Sept. 2008 to $8.766T today]

- In the same time frame (2008-2021) the US CPI gauge of inflation went from 211.4 to 278.9 or an increase of 31.9% (annual average 2.2%). If inflation is a monetary phenomenon (we believe it is) there is a lot of catching up to be done as CPI increases to reflect money supply growth.

- During the same time frame (2008-2021) M2 (Money supply) went from $8.2T to $21.4T, growth of 161%, or annualized growth of over 7.7%.

o Notably, M2 growth since March 2020 has been 38.6%, a sharp acceleration above trend.∙ The monthly U.S. Goods Trade Deficit ballooned to a record $98 billion in November vs. a two decade average $56bn.

Larry echoed the sentiments of Doug Noland when opining on inflation in 2021:

Books will be written chronicling 2021. I’ll boil an extraordinary year’s developments down to a few simple words: “Things Ran Wild”. COVID ran wild. Monetary inflation ran wild. Inflation, in general, ran completely wild. Speculation and asset inflation ran really wild. More insidiously, mal-investment and inequality turned wilder. Bucking the trend, confidence in Washington policymaking ran – into a wall.

M2 “money” supply inflated another $2.478 TN (12 months through November) to a record $21.437 TN – with egregious two-year growth of $6.185 TN, or 40.6%. Bank Deposits surged $1.957 TN over the past year (12.1%), with two-year growth of $4.812 TN (36%). Money Fund Assets rose another $408 billion y-o-y, or 9.5%, to $4.70 TN. The myth that QE effects remain well contained within Treasury and securities markets has been debunked.

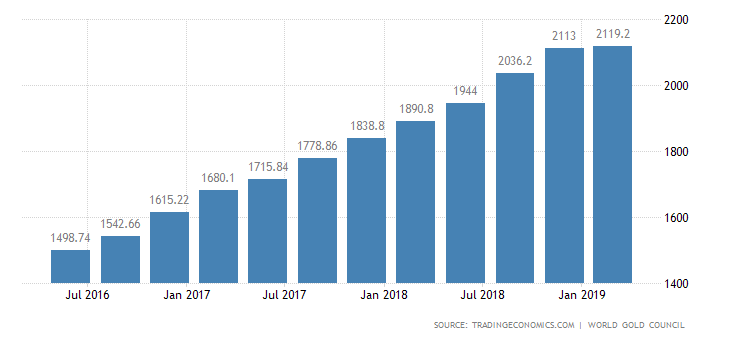

And took to pointing out analysis by Trey Reik on gold:

Between 3/31/20 and 12/31/21, the Fed grew its balance sheet $3.503 trillion (66.67%). During this time span, the S&P 500 appreciated 84.41% while spot gold increased just 15.98%.

We find it bewildering that even though gold has been maligned for “not doing better” while stocks soared during 2021’s QE and inflation, now that the Fed is telegraphing tightening, consensus is equally confident that equity markets are well prepared and will power-through on the back of strong earnings, but gold will surely suffer.

Watching The Fed

In March 2020, COVID erupted and the US Stock and Bond markets began to plunge. In a period of just 23 days, the S&P 500 Index plunged 35% from its high in late February to a low on March 23rd.

At the same time, something very unusual happened in the US Treasury bond market. In the early part of the stock sell off, government bond prices rallied and yields declined as selling stock investors sought safety in US Treasuries. This was normal. But then suddenly, 10 year US Treasury bonds sold off hard too and the treasury yield went from 39 bps to 126 bps in a period of just 7 days! The Fed meeting minutes from that period discussed that for a brief period the US Treasury bond market went “no bid”. This led to Fed Chairman Jay Powell’s announcement on March 15, 2020 to cut the discount rate to effectively zero, resume quantitative easing and expand swap lines.

This was the Fed’s worst nightmare. If the market for US Treasury securities fails, the entire world financial system collapses. What transpired from there was another chapter of the long standing “Fed Put” that was initially written by Greenspan and then enthusiastically renewed by Bernanke, Yellen and now Powell. Originally the put only protected equities but at the base of the entire financial system is the so called “risk free” US Treasury bond.

The put now clearly includes the US Treasury bond. Additionally, we have seen the Fed and financial commentators discuss an additional mandate: “maintaining orderly markets”. Powell has explicitly said that the Fed will take “whatever action is necessary” to maintain orderly markets which we believe is now a Third Fed Mandate, behind stable prices and full employment. In extremis, the Fed will print as much money as is necessary, perhaps a nearly infinite amount.

The stock and bond markets have taken the recent Fed “hawkish” policy shift in stride. Yes, there is still tons of liquidity in the system, but also, we believe investors realize that Powell will execute another “pivot” when the market stumbles. Perhaps investors are willing to front run the next episode of money printing. Thus the market behavior which looks like a “crack up boom” is actually rational if you know that the Fed can never stop printing.

Recently, to the Fed’s credit (and to preserve their credibility), Chairman Powell admitted that it is turning out that inflation is not transitory. Thus, they have announced that they will accelerate the tapering of QE which began slowly a few months ago.

Today’s blog post has been published without a paywall because I believe the content to be far too important. However, if you have the means and would like to support my work by subscribing, I’d be happy to offer you 22% off to become a subscriber in 2022: Get 22% off forever

At the current proposed rate they will not be purchasing any bonds in April of 2022. Furthermore, they have also indicated that taking interest rates off the zero bound in 2022 and the consensus dot plot is that the Fed Funds rate will go to 0.75% via three quarter point hikes this year. Now, whether the markets can handle this withdrawal of monetary stimulus appears to be an open question. [QTR: In the past few weeks, since this letter, inflation has continued, most recently at a 7.5% clip and investment banks are predicting up to 9 or 10 rate hikes for 2022].

In a system that is dependent upon the supply of new money and credit growing at an ever accelerating rate, it is merely a matter of time until the next crisis erupts and the Fed is forced to reverse course again. Hopefully for them, by that time inflation will have abated a bit and so we will start the next inflationary episode off a lower base.

We fear that, as Luke Gromen said, that in trying to control the economy the Fed thinks they have a thermostat when it may be more akin to an on/off switch on a nuclear reactor!

Interestingly, given the Repo markets enhancements by the Fed, it’s possible the Taper of QE is irrelevant. As a former Federal Reserve Open Markets Senior Trader Joseph Wang points out:

There is still $1 trillion in Fed liquidity that will gradually flow into the private sector after QE stops. A large chunk of liquidity created by QE over the past two years never entered the banking system, but instead sat first in the Treasury’s Fed account and later in the RRP Facility. In the coming months Treasury will restart bill issuance and draw those funds out of the RRP into the TGA, and then spend those funds into the banking sector. Over time that will leave the banking sector with about $1T more in reserves, and the non-banks with a $1T more in deposits. If the past is any guide, that suggests more portfolio rebalancing where banks will purchase more Treasuries and non-banks more risk assets.

Why Soft Gold And Bitcoin Prices?

Gold and Bitcoin, analog and digital sound money, respectively, are the two monetary fire alarms in our system.

Gold began 2020 at $1,550. It is at $1,830 at year end 2021, appreciation of 18%. Bitcoin began 2020 at $8,000 per coin. It closed 2021 at $47,000, appreciation of 487%.

As we have discussed in the past, we believe the price of gold is heavily suppressed through the futures markets and the issuance of paper claims on gold. Bitcoin does not suffer from this problem yet, although there is a $20B futures market in Bitcoin.

Bitcoin’s total market value is $966B and it trades approximately $25B of value per day in on chain transactions. We do not believe the futures market is a big factor in Bitcoin price discovery….yet. But there is no doubt that the leveraged Bitcoin exchanges and their growth have had an impact on prices. Still, Bitcoin is the monetary debasement fire alarm which is working.

Both the Bitcoin and gold prices are somewhat soft at present. Gold is 11% below its recent all-time high. Bitcoin is 40% below its recent all-time high. We believe this is occurring because the market is reacting to the threat of less monetary accommodation.

And while we concede that the Fed is trying to slow down the printing (sort of), as stated above we do not believe that in the intermediate term they can stop in any sort of meaningful way.

The prescient words of Richard Russell apply here: INFLATE OR DIE.

Our friend and Austrian based investor Ronnie Stoeferle recently posted this missive on Twitter which serves as a good reminder of how history often rhymes:

“Two years ago gold bugs ran wild as the price of gold rose nearly six times. But since cresting two years ago it has steadily declined, almost by half, putting the gold bugs in flight. The most recent advisory from a leading Wall Street firm suggests .that the price will continue to drift downward, and may ultimately settle 40% below current levels. The sharply reduced rates of inflation combined with resurgence of other, more economically productive investments, such as stocks, real estate and bank savings have combined to eliminate gold’s allure. Although the American economy has reduced its rate of recovery, it is on a firm expansionary course.”

– New York Times, August 1976

And as our friend Brien Lundin, CEO of the New Orleans Investment Conference points out:

“Gold bottomed in early September 1976, but really took off when the Treasury began gold auctions in ’78. This overt manipulation for covert reasons was a desperation move that ironically fueled another 8x rise in the gold price!”

History often rhymes indeed, in this case in terms of an inflationary decade like the 1970s and the reaction of hard money assets.

About Larry Lepard

Larry manages the EMA GARP Fund, a Boston based investment management firm. Their strategy is focused on providing “Monetary Debasement Insurance”. He has 38 years experience and an MBA from Harvard Business School. On Twitter he is @LawrenceLepard Managing Partner and, via email, he is llepard@ema2.com