Rising from the ashes of recent bank failures, we’re once again hearing discussions of a central bank digital currency (CDBC), also called “Fedcoin” or “digital dollar.”

This is an absurd phrase! Nearly 90% of all dollars are already digital!

Right now there are about $2.3 trillion total paper dollars and pocket change in existence (nobody reports on the total of circulating coinage, but the U.S. Mint made 14.5 billion coins in 2021 and half of them were pennies – so I think it’s safe to assume that all the nickels hiding in sofa cushions nationwide are a rounding error compared to that $2.3 trillion figure.)

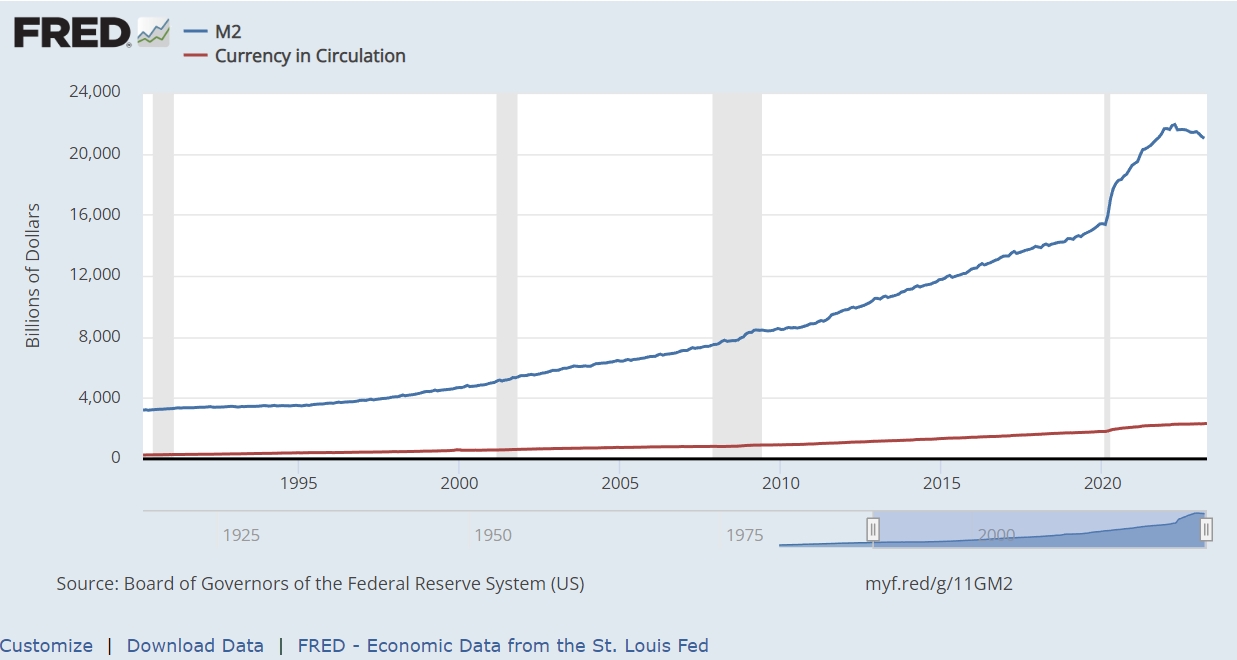

In comparison, there’s over $19 trillion in the “money supply.” Simple math tells that there’s no physical cash basis for $16.7 trillion of our money. It only exists as data on spreadsheets on bank computers.

Look at the difference – blue is “money supply,” while the red line is “actual physical cash.”

If 88% of all dollars are already digital, why do we need a new “digital dollar,” hmm?

This new, digital form of money would be “legal tender.” That’s important, because legal tender status means this form of money must be accepted if offered as a payment.

Legal tender status is what keeps cash alive, despite the federal government’s “war on cash.”

Why does the federal bureaucracy hate cash? It’s private and it’s untraceable. Essentially, cash is one of the few remaining bastions of financial privacy. I say “privacy” rather than “secrecy” on purpose – “privacy” means enforcing your personal boundaries and what you’re comfortable sharing. “Secrecy” means intentionally hidden information.

Now, all manner of illegal and immoral behavior is sheltered by the secrecy of cash transactions. I can’t really speak to that – law enforcement isn’t really my specialty.

On the other hand, when I go out to dinner I tip my server in cash. I do that as a courtesy – the cash tip doesn’t necessarily get reported to the IRS as income, so those hard-working folks get to keep just a little bit of the money they’ve earned.

When we consider the idea of a digital dollar, the very first thing we have to grasp is this idea of privacy. Because, with any electronic payment, especially one designed by the federal government for the federal government, I assert that both financial privacy and secrecy would be swept into the dustbin of history.

Whether or not you’re a Christian, this matters to you. I strongly encourage you to reflect on your financial habits and ask yourself if you’d feel more or less comfortable granting the federal government insight into every single dollar you spend.

If you are a Christian, keep reading – because there are bigger concerns.

Many Christian faithful in my audience believe such a digital form of legal tender was prophesied in the Bible as a sign of the end of days…

The mark of the Beast

The Book of Revelation, chapter 13:16-17 (NRSV) says:

And he causes all, both small and great, rich and poor, free and bond, to receive a mark in their right hand, or in their foreheads: and that no man might buy or sell, save he that had the mark, or the name of the beast, or the number of his name.

John the Revelator warned that the greatest tyranny on earth would take the form of biometrically-enforced, perfectly traceable money.

Sound farfetched? You haven’t been reading the news. Because it already exists:

…biometric authentication is gaining popularity. Biometric tools are thought to be the most secure method of transaction authentication. According to Goode Intelligence, global biometric payments are expected to reach $5.8 trillion by 2026, with up to three billion users.

Until now, this sort of technology just didn’t exist. Today, though? “Users must complete a brief enrollment process in-store before they can pay for their purchases by scanning their palms or face.”

Palm or face… right hand or forehead?

This combination of perfectly-traceable, privacy and secrecy-destroying money is already here.

Combine that with a form of “legal tender” like FedCoin and you have a compulsory system of payments. Everyone has to accept it if offered! That’s the law!

Now, there’s no legal mechanism to force anyone to pay with FedCoin – but there’s no legal mechanism to force anyone to pay with dollars, either. All it would take to make that happen is a simple bureaucratic switch.

And if you think the government is already too involved in your business, just imagine how much worse it would be if they knew every single financial transaction you made. Every dime you earned. Every penny you spent.

Actually, you don’t have to imagine – they already have this form of totally trackable electronic payments system in China. Let me quote Federal Reserve chairman Jerome Powell here, describing China’s e-yuan:

It’s one that really allows the government to see every payment for which it is used in real time.

I thought credit card companies tracking gun sales was bad enough. This is an order of magnitude worse!

There are many, many horror stories about China’s e-yuan and its destruction of financial freedom. Citizens prevented from buying food. Barred from public transportation. Denied medical care. Anyone labeled a “political dissident” can be financially canceled – prevented from spending their own money!

I hope this helps you understand why FedCoin and other central bank digital currencies are often called “Orwellian,” and whistleblower Edward Snowden dismisses them as “cryptofascist currencies.”

So let me ask again, who is this for?

For you? For your convenience? For a healthier, more prosperous economy?

Or is Big Brother’s Digital Dollar simply a final solution to the “problem” of financial privacy?

Only by envisioning potential futures can we actively work to prevent them

I have every hope that every true American patriot in addition to every Christian in the nation would reject a biometric, digital, privacy-destroying form of money like FedCoin.

I pray that there’s still a critical mass of patriots and believers here in the U.S. Enough to prevent this grim future from becoming reality.

The federal government is powerful, though – and insidious. Maybe nobody wants to use FedCoin at first. Until all welfare checks and tax refunds become FedCoin transfers. Social Security and military pensions get deposited into your FedCoin account instead of your bank account.

Friends, ultimately what this all comes down to is control. Who is in control of your financial decisions? Who knows what’s best for you and your family?

If you share my concerns, let me offer you one further piece of information… Physical precious metals are one of the last bastions of financial privacy. When you own gold and silver, they’re portable and accessible at all times. You have absolute control over them.

I’m concerned there’s a time coming, very soon, when “no man might buy or sell” without surrendering the last shreds of privacy to the federal government. When that day comes, you’ll want to make absolutely certain you have untrackable, untraceable and private forms of money at hand.

Better to have it and not need it than need it and not have it.

By Lance Wallnau, for Birch Gold Group