What Sort Of Inflation Is “Troubling” To The Fed?

The Fed seems to be raising the bar for what constitutes ‘troubling’ inflation, and as Standard Chartered’s Steve Englander notes, many expect the Fed to characterize inflation as ‘transient’ in many cases.

In the discussion below, Englander and his team explain why the big fears are that inflation accelerates sharply near 2%, forcing a rapid move to neutral and that markets see a 1970s-like willingness to explain away all surges…

Who you gonna believe, me or your lying eyes?

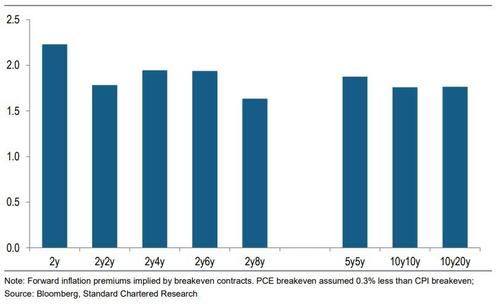

Inflation breakevens suggest that PCE inflation will not trigger the Fed to hike policy rates any time soon (Figure 1). The Fed’s reaction to inflation outcomes under their new framework does not have an approximative formula such as the Taylor rule, so it is useful to look at recent Fed comments to tease out how quick off the mark the Fed may be in the case of higher inflation.

We see recent comments as having raised the bar significantly to reacting to higher inflation. At the press conference following the 27 January FOMC meeting, Fed Chair Powell said: “we think it’s very unlikely that anything we see now would result in troubling inflation”. He categorised inflation resulting from base effects or from a spending burst after reopening as transient rather than troubling. Inflation resulting from higher food and energy prices or from a weaker USD is already excluded.

We see four issues:

(1) the Fed’s ‘show me’ view on inflation means the reaction to fiscal stimulus will likely be muted initially;

(2) the low inflation history of the past few decades probably makes the Fed more willing to risk higher inflation;

(3) if inflation does hit 2%, the policy response will largely depend on how fast inflation is accelerating;

(4) slow-moving unit labour cost (ULC) trend will likely be one of the guides the Fed uses to determine how troublesome unit labour costs are, perhaps slowing its response.

Figure 1: Calm inflation breakevens (PCE basis)

Fed will likely wait for overheating to be visible

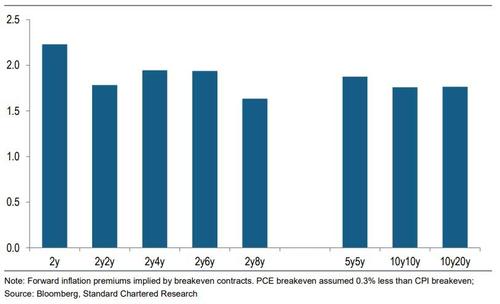

So what kind of inflation troubles the Fed? The Fed has set a very high bar for taking policy rates off zero. It does not seem enough for y/y inflation to be at 2% for a year, but the Fed also must be convinced that the US is at full employment. This is a high bar given that core PCE inflation has barely nudged 2% over the past twenty years; plus, some of the 2% nudges only appear in revised data (Figure 2).

Further, inflation hitting 2% durably may not be enough to get policy rates off zero if the unemployment rate exceeds estimates of the long-term maximum inflation level. Some Fed speakers have suggested that the FOMC would initially treat such inflation as transient. It may take some convincing for the FOMC to be accept that its lower long-term unemployment estimates were wrong, given the inflation and unemployment experience of recent decades.

The tolerance of fiscal stimulus is striking.

Powell was invited several times to express concern on overdoing fiscal stimulus and each time he refused the invitation: “the judgment on how much to spend, and in what way is really one for Congress and the administration and not for the Fed”.

But in leaving the fiscal decisions to Congress, he stressed the need for ongoing support and the difficulties in getting those whose jobs have disappeared new jobs in other sectors. There was no implication that added fiscal support removes the need for monetary easing.

By contrast, in the June 2018 press conference he said in response to a question on the Trump tax cuts: “You asked, is the … neutral rate moving up because of fiscal policy? Yes. … there should be an effect if you have increased deficits that should put upward pressure.”

Underlying economic conditions are very different now but his comments at the January 2021 press conference avoided any implication that fiscal stimulus would put upward pressure on yields.

This is important because the sustainability of the fiscal plans advocated by Treasury Secretary Yellen depend on debt servicing remaining ultra-low. Powell’s agnosticism on the appropriate level of fiscal stimulus can be seen as the Fed abandoning a forward-looking approach to policy. The new monetary policy framework enables the Fed largely to make policy based on realised rather than expected inflation.

Figure 2: First print of core PCE is sometimes an underestimate

Assuming inflation is a slow and steady process

We think slow and steady is what Powell has in mind when he characterises the Phillips curve as flat. The Fed does not need to forecast inflation’s rise in that world. It can wait until above-target inflation is visible, and take its time to move to neutral, as inflation gradually makes up its prior shortfall. There is little risk that inflation will get out of control and little reason to step heavily on the brakes.

If the above sketch of the inflation process is correct, then the risks of ‘thinking big’ on fiscal stimulus are not so high either, at least at first glance. Low yields and debt servicing costs allow debt to be used to achieve economic and social goals, without significant redistribution through taxation. The Fed need not act in anticipation of hitting maximum employment or of hitting troubling inflation, because it will likely have ample warning from incoming inflation data of the need to move to neutral.

The risk, as raised by former Treasury Secretary Larry Summers among others, is that fiscal stimulus of an additional 5.0-8.5% of GDP (see US – Getting better), when the underlying recovery already looks firm, runs the risk of blasting through maximum employment rather than nudging past it. Ideally the risk analysis on stimulus is to be 90% sure of full employment with a very low chance of troubling inflation. If 90% certainty of full employment means a 50% chance of troubling inflation, the better policy may be to start with more incremental stimulus and have additional stimulus at the ready should it be needed.

The sentiment expressed by Fed policy makers that they have the tools to deal with high inflation reflects confidence that tighter policy can predictably push unemployment higher and inflation down. That is not the same as saying disinflation will be costless. There is also risk that more generous safety nets and political pressure to ease quickly could slow the disinflation response to unemployment. Moreover, historically higher unemployment in recession affects less educated and minority workers heavily. If the Fed (and Treasury) miscalculate, the burden of the error will fall on the workers they are most trying to help.

Complicated Fed reaction function near 2%

Several Fed speakers have been careful to damp expectations of a formulaic statement of how it will react to inflation durably going above 2%. The speed at which inflation is picking up seems to be a key determinant of how policy rates will behave.

If the annual sequence of inflation numbers looks like 1.9%, 1.9%, 2.0%, 2.0%, 2.1%, the lift-off speed is likely to be much slower than if the sequence is 1.8%, 2.1% 2.4%. In the second example, the pace at which inflation accelerates is a good indication that maximum employment was breached even before the 2% inflation level was hit. In the second case, the move to neutral would be much stronger.

Unit labour costs as core core inflation (but not now)

One signal that the Fed may rely on is a sustained increase in ULC, the difference between compensation growth and productivity. On a quarterly basis, ULC has a strong transient component. Averaged over a few years it captures the trends in hourly compensation and valued-added per worker, the major domestic cost factors, especially in the middle and mature phases of the cycle when policy decisions are likely to be discussed. Both compensation growth and trend productivity growth are relatively slow-moving processes, so when ULC registers a pick-up in costs, inflation is likely to be deeply embedded in domestic costs.

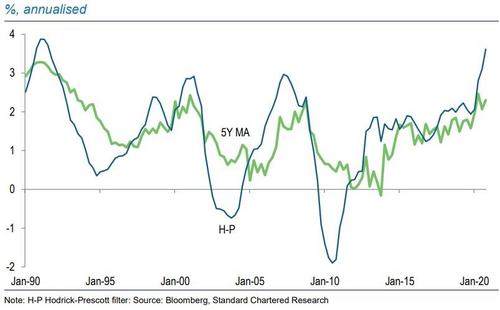

Unit labour costs have been very erratic since COVID-19 struck because the compensation measure used in calculating ULC is sensitive to disproportionate layoffs among low-wage workers. This shows up as a sharp uptick in labour costs even when smoothed over five years or using a Hodrick-Prescott filter (Figure 3).

Figure 3: Alternative estimates of trend unit labour cost growth

In normal times, productivity growth would reflect the distribution of unit capital among workers, but the layoffs among low-wage workers are so pronounced that compensation measures are heavily distorted. More likely the Fed would look at the fixed-composition employment cost index and independently estimate productivity trends to arrive at an estimate of unit labour cost until standard labour cost measures settle down

What could go wrong?

One possibility is that the Phillips curve is indeed flat for many levels of unemployment but gets steeper near the maximum employment level. The cost of a small overshoot is low, but going well beyond would generate a significant inflation response and significantly raise the costs of restabilising the economy.

A second risk is that the Fed is overestimating how easy it is to move strongly if inflation becomes a problem. As noted above, rapid disinflation in the past has come at the cost of much higher unemployment; in the 1960s and 70s, the political costs of economic slumps encouraged policy makers to risk higher inflation.

A third risk is that Fed scepticism on the strength of inflationary forces makes it likely that the Fed may explain away or look through inflationary shocks that initially look transient, but ultimately become persistent and troubling. The characteristic of disinflation since the 1990s is that macro stimulus has mostly relied on monetary policy, except in the depths of recession. Applying large, steady doses of fiscal stimulus to an economy already rebounding may be more effective in reviving activity and inflation than monetary policy.

Tyler Durden

Sun, 02/14/2021 – 16:10

What Sort Of Inflation Is “Troubling” To The Fed?

The Fed seems to be raising the bar for what constitutes ‘troubling’ inflation, and as Standard Chartered’s Steve Englander notes, many expect the Fed to characterize inflation as ‘transient’ in many cases.

In the discussion below, Englander and his team explain why the big fears are that inflation accelerates sharply near 2%, forcing a rapid move to neutral and that markets see a 1970s-like willingness to explain away all surges…

Who you gonna believe, me or your lying eyes?

Inflation breakevens suggest that PCE inflation will not trigger the Fed to hike policy rates any time soon (Figure 1). The Fed’s reaction to inflation outcomes under their new framework does not have an approximative formula such as the Taylor rule, so it is useful to look at recent Fed comments to tease out how quick off the mark the Fed may be in the case of higher inflation.

We see recent comments as having raised the bar significantly to reacting to higher inflation. At the press conference following the 27 January FOMC meeting, Fed Chair Powell said: “we think it’s very unlikely that anything we see now would result in troubling inflation”. He categorised inflation resulting from base effects or from a spending burst after reopening as transient rather than troubling. Inflation resulting from higher food and energy prices or from a weaker USD is already excluded.

We see four issues:

(1) the Fed’s ‘show me’ view on inflation means the reaction to fiscal stimulus will likely be muted initially;

(2) the low inflation history of the past few decades probably makes the Fed more willing to risk higher inflation;

(3) if inflation does hit 2%, the policy response will largely depend on how fast inflation is accelerating;

(4) slow-moving unit labour cost (ULC) trend will likely be one of the guides the Fed uses to determine how troublesome unit labour costs are, perhaps slowing its response.

Figure 1: Calm inflation breakevens (PCE basis)

Fed will likely wait for overheating to be visible

So what kind of inflation troubles the Fed? The Fed has set a very high bar for taking policy rates off zero. It does not seem enough for y/y inflation to be at 2% for a year, but the Fed also must be convinced that the US is at full employment. This is a high bar given that core PCE inflation has barely nudged 2% over the past twenty years; plus, some of the 2% nudges only appear in revised data (Figure 2).

Further, inflation hitting 2% durably may not be enough to get policy rates off zero if the unemployment rate exceeds estimates of the long-term maximum inflation level. Some Fed speakers have suggested that the FOMC would initially treat such inflation as transient. It may take some convincing for the FOMC to be accept that its lower long-term unemployment estimates were wrong, given the inflation and unemployment experience of recent decades.

The tolerance of fiscal stimulus is striking.

Powell was invited several times to express concern on overdoing fiscal stimulus and each time he refused the invitation: “the judgment on how much to spend, and in what way is really one for Congress and the administration and not for the Fed”.

But in leaving the fiscal decisions to Congress, he stressed the need for ongoing support and the difficulties in getting those whose jobs have disappeared new jobs in other sectors. There was no implication that added fiscal support removes the need for monetary easing.

By contrast, in the June 2018 press conference he said in response to a question on the Trump tax cuts: “You asked, is the … neutral rate moving up because of fiscal policy? Yes. … there should be an effect if you have increased deficits that should put upward pressure.”

Underlying economic conditions are very different now but his comments at the January 2021 press conference avoided any implication that fiscal stimulus would put upward pressure on yields.

This is important because the sustainability of the fiscal plans advocated by Treasury Secretary Yellen depend on debt servicing remaining ultra-low. Powell’s agnosticism on the appropriate level of fiscal stimulus can be seen as the Fed abandoning a forward-looking approach to policy. The new monetary policy framework enables the Fed largely to make policy based on realised rather than expected inflation.

Figure 2: First print of core PCE is sometimes an underestimate

Assuming inflation is a slow and steady process

We think slow and steady is what Powell has in mind when he characterises the Phillips curve as flat. The Fed does not need to forecast inflation’s rise in that world. It can wait until above-target inflation is visible, and take its time to move to neutral, as inflation gradually makes up its prior shortfall. There is little risk that inflation will get out of control and little reason to step heavily on the brakes.

If the above sketch of the inflation process is correct, then the risks of ‘thinking big’ on fiscal stimulus are not so high either, at least at first glance. Low yields and debt servicing costs allow debt to be used to achieve economic and social goals, without significant redistribution through taxation. The Fed need not act in anticipation of hitting maximum employment or of hitting troubling inflation, because it will likely have ample warning from incoming inflation data of the need to move to neutral.

The risk, as raised by former Treasury Secretary Larry Summers among others, is that fiscal stimulus of an additional 5.0-8.5% of GDP (see US – Getting better), when the underlying recovery already looks firm, runs the risk of blasting through maximum employment rather than nudging past it. Ideally the risk analysis on stimulus is to be 90% sure of full employment with a very low chance of troubling inflation. If 90% certainty of full employment means a 50% chance of troubling inflation, the better policy may be to start with more incremental stimulus and have additional stimulus at the ready should it be needed.

The sentiment expressed by Fed policy makers that they have the tools to deal with high inflation reflects confidence that tighter policy can predictably push unemployment higher and inflation down. That is not the same as saying disinflation will be costless. There is also risk that more generous safety nets and political pressure to ease quickly could slow the disinflation response to unemployment. Moreover, historically higher unemployment in recession affects less educated and minority workers heavily. If the Fed (and Treasury) miscalculate, the burden of the error will fall on the workers they are most trying to help.

Complicated Fed reaction function near 2%

Several Fed speakers have been careful to damp expectations of a formulaic statement of how it will react to inflation durably going above 2%. The speed at which inflation is picking up seems to be a key determinant of how policy rates will behave.

If the annual sequence of inflation numbers looks like 1.9%, 1.9%, 2.0%, 2.0%, 2.1%, the lift-off speed is likely to be much slower than if the sequence is 1.8%, 2.1% 2.4%. In the second example, the pace at which inflation accelerates is a good indication that maximum employment was breached even before the 2% inflation level was hit. In the second case, the move to neutral would be much stronger.

Unit labour costs as core core inflation (but not now)

One signal that the Fed may rely on is a sustained increase in ULC, the difference between compensation growth and productivity. On a quarterly basis, ULC has a strong transient component. Averaged over a few years it captures the trends in hourly compensation and valued-added per worker, the major domestic cost factors, especially in the middle and mature phases of the cycle when policy decisions are likely to be discussed. Both compensation growth and trend productivity growth are relatively slow-moving processes, so when ULC registers a pick-up in costs, inflation is likely to be deeply embedded in domestic costs.

Unit labour costs have been very erratic since COVID-19 struck because the compensation measure used in calculating ULC is sensitive to disproportionate layoffs among low-wage workers. This shows up as a sharp uptick in labour costs even when smoothed over five years or using a Hodrick-Prescott filter (Figure 3).

Figure 3: Alternative estimates of trend unit labour cost growth

In normal times, productivity growth would reflect the distribution of unit capital among workers, but the layoffs among low-wage workers are so pronounced that compensation measures are heavily distorted. More likely the Fed would look at the fixed-composition employment cost index and independently estimate productivity trends to arrive at an estimate of unit labour cost until standard labour cost measures settle down

What could go wrong?

One possibility is that the Phillips curve is indeed flat for many levels of unemployment but gets steeper near the maximum employment level. The cost of a small overshoot is low, but going well beyond would generate a significant inflation response and significantly raise the costs of restabilising the economy.

A second risk is that the Fed is overestimating how easy it is to move strongly if inflation becomes a problem. As noted above, rapid disinflation in the past has come at the cost of much higher unemployment; in the 1960s and 70s, the political costs of economic slumps encouraged policy makers to risk higher inflation.

A third risk is that Fed scepticism on the strength of inflationary forces makes it likely that the Fed may explain away or look through inflationary shocks that initially look transient, but ultimately become persistent and troubling. The characteristic of disinflation since the 1990s is that macro stimulus has mostly relied on monetary policy, except in the depths of recession. Applying large, steady doses of fiscal stimulus to an economy already rebounding may be more effective in reviving activity and inflation than monetary policy.

Tyler Durden

Sun, 02/14/2021 – 16:10

Read More