Tomorrow may be ugly: according to Axios, the White House – or at least those who are feeding lines to the so-called president – are bracing for a “brutal” inflation report.

- WHITE HOUSE BRACES FOR BRUTAL INFLATION REPORT – AXIOS

While it remains to be seen if tomorrow’s report is brutal, the damage has already been done – here is a snapshot of key price changes in the past year, courtesy of Bank of America:

- price of basic human needs such as food, heat, shelter soaring; global food prices up 27% YoY;

- US heating costs up: 30% for natural gas, 43% for oil, 54% for propane;

- US rents up 12%,

- house prices 18%

- lumber prices up 40% past 4 months

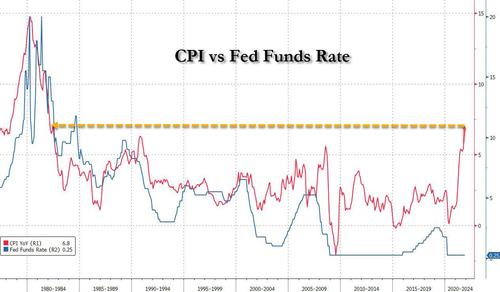

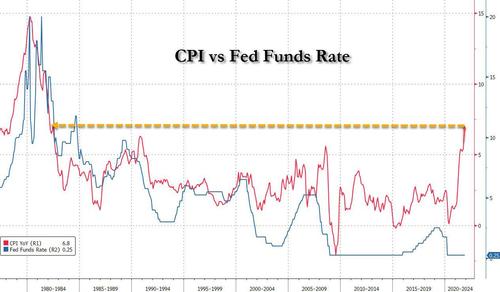

Here is what consensus expects: according to economists, the consumer price index (CPI) increased 0.4% in December, bringing the year-ago inflation rate up from 6.8% to 7.0%, which will be the highest headline print since June 1982 when the Fed Funds rate was in the double digits.

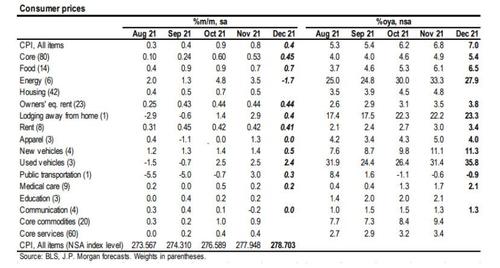

While energy prices had been jumping in earlier months, JPMorgan slook for the energy CPI to fall 1.7% in December based on weakening in a variety of related price measures (that will promptly be reversed in January when energy prices jumped again). But even with energy prices down in December, a 0.7% increase in food prices and a 0.5% increase in core prices (ex. food and energy) should push headline inflation higher in December.

For the core index, consensus looks for a 0.5% increase, which should push year-ago inflation up from 4.9% in November to 5.4% in December. Increases in the rent measures have been especially firm lately (just as we warned they would be) and economists expect December gains close to the increases from earlier months, with tenants rent up 0.41% and owners’ equivalent rent rising 0.44%

Meanwhile, vehicle prices have been surging in the CPI throughout much of 2021 and additional increases are expected in December, albeit with a slight moderation relative to the past few months. As such JPM forecasts that new vehicle prices increased 0.5% in December while used vehicle prices jumped 2.4%.”

In its snap preview, Deutsche Bank writes that with y/y CPI set to touch 7% and core inflation come in near 5.4%, “these are ultimately not the kind of inflation numbers that will gently settle back near target, without both a huge favorable supply side reversal, and a very substantial suppression of demand that includes much tighter financial conditions that will have to include much higher real and nominal US yields.” Of course, much tighter financial conditions will also likely trigger a recession first we and then Jeff Gundlach suggested today. At the end of the day, however, the decision is entirely political: is Biden – and the Democrats – hurt more by soaring prices or by the risk of a market crash. We’ll know soon enough.

* * *

How will FX react to tomorrow’s CPI print? According to DB macro strategist Alan Ruskin, as per Figure 1, the two most recent CPI reports where core came in largely as expected (the release for November and September), saw the USD weaken moderately. This is one indication that going into the recent CPI releases, the market has tended to fear larger than expected core CPI numbers, and shows some relief if it gets “as expected” data.

Note the stock market has also exhibited this behavior of recording gains on as expected data for the September and November data released in October and December respectively. For the coming CPI number, there is again a high likelihood of the market exhibiting “a relief” response if the data comes in as expected at 0.5% for core. Note that in terms of the 0.5% core median, the distribution skews slightly more to 0.4% than 0.6%.

For broader FX context, going into the data, the USD’s performance so far in 2022 has been very disappointing (as discussed earlier today when we framed the latest market conundrum). US yields and spreads have generally moved in favor of the USD. All of EUR-USD 2y nominal, 2y real, 10y nominal and 10y real spreads have moved in favor of the USD year to date by 11bps, 15bps, 9bps, and 7bps respectively. Dec ’22 fed fund futures has moved 12bps in favor of the USD. Some of the spread adjustment in favor of the USD represents an unwind from late 2021 spread moves in favor of the EUR when the ECB briefly came into the spotlight. Either way, the USD performance has been a disappointment, and we ended Tuesday’s session knocking on the DXY technical floor at 95.50. The danger is even on as expected CPI data, the USD breaks to the downside and only finds its footing multi-week, on further evidence that the Fed will still leapfrog these readjusted rate expectations, in the next dance between the market leading the Fed, and the Fed then leapfrogging the market, signaling still higher rates.

* * *

A slightly different perspective comes from Bloomberg’s Vincent Cignarella, who suggests ignoring the (soraing) year-over-year inflation data (we know it will be plus or minus 7%) and to instead focus on month-over-month. According to Cignarella, “what investors need to follow is where is inflation going now, not the trend from a year ago. The forecast for this week is for some good news for bond bulls, but not so much for stocks.”

The problem is that while inflation could roll over in the the next few months, earnings (on a 3-month moving average) appear to not be keeping pace. And while bonds would like see a moderation in inflation, without wages keeping pace, it’s difficult to see equities rallying as lower wages implies lower earnings according to the Bloomberg strategist. .

Finally, if indeed the CPI numbers are truly “brutal” and well above consensus expectations, the BLS has already signaled what the next step will be: as we asked one month ago in “And Just Like That, Inflation Is About To Disappear?”, the BLS is about to make some adjustments to its CPI basket weights…

… and we are 100% confident the adjustments won’t make inflation appear any higher than it already is.