“What you know you can’t explain, but you feel it. You’ve felt it your entire life, that there’s something wrong with the world. You don’t know what it is, but it’s there, like a splinter in your mind, driving you mad. It is this feeling that has brought you to me. Do you know what I’m talking about?”

-Morpheus, The Matrix

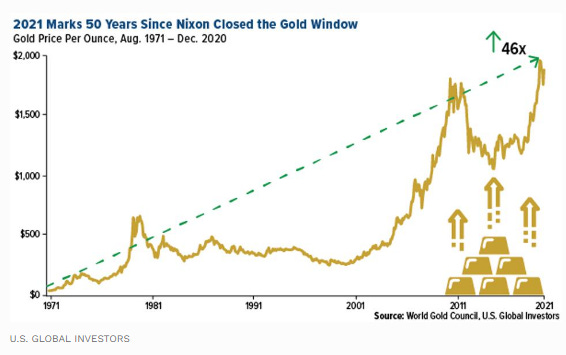

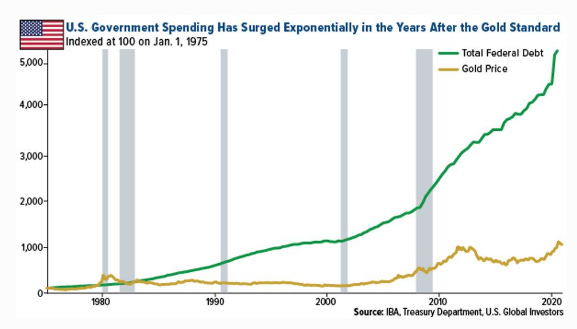

Many of these people, myself included, know deep down that something went horribly askew when we were taken off the gold standard in 1971.

And today, many people witnessing soaring inflation are starting to feel their spider senses tingle even more: something is definitely wrong with “the system”.

But not everybody can put their finger on exactly what is wrong. This is what makes our system so nefarious to begin with: its complexity. It’s also why I try to explain these feelings for people in podcasts like my most recent one discussing why now must be the time we start to discuss inflation seriously.

Left unchecked by gold, it took us less than half a century to destroy our currency, run production out of the U.S., become reliant on importing almost everything we use on a daily basis, turn the country into a third world country and run up a nearly $30 trillion national tab, all while the Fed has stacked almost $10 trillion in subprime crap onto its balance sheet.

Along our merry way we have also pissed on and/or made a mockery of almost every safeguard (like the debt ceiling) we once put in our place for our own future good.

Holy shit.

Make no mistake about it: we have become severely addicted debt and spending junkies, horrifyingly misinformed at best and nefariously negligent to the consequences of our actions at worse.

And now, the train is officially off the tracks.

Tea leaf reading isn’t my specialty and I’m hardly the world’s greatest analyst, but I like to think that I’m not totally numb to common sense and certain signs that pop up during my day-to-day.

For example, I was one of the first to point out that it was just common sense that Covid would be a big deal in the U.S., and I also pointed out that it was just common sense that the lab leak theory was the most likely theory. Other “bold” predictions that I’ve made – like that President Biden won’t finish his first term – to me, fall into the realm of common sense, too. Much of my macro analysis is also simply just common sense.

And so common sense tells me that a Bloomberg headline like this one, from August 17 of this year, shouldn’t be overlooked:

FED’S POWELL: COVID IS STILL WITH US, LIKELY TO BE THE CASE FOR A WHILE. WE’RE NOT SIMPLY GOING BACK TO THE PRE-PANDEMIC ECONOMY

Read it again: “We’re simply not going back to the pre-pandemic economy…”

And here’s AP’s version: “There’s no returning to the pre-pandemic economy”

Read it again: “There’s no returning…”

Now, read this part of the Bloomberg headline again, by itself:

WE’RE NOT SIMPLY GOING BACK TO THE PRE-PANDEMIC ECONOMY

The statement looks so different when you take it out of an hour long mishmash of Powell’s testimony in front of Congress, doesn’t it?

When you parse out this line and write it out, like a lawyer looking at a transcript after a deposition, the words carry a different weight than they did when it was one of 1,000 sentences replete with backtalk and jargon being read in monotonous fashion.

Statements like this and other “tea leaves” have been ubiquitous – surely you’ve heard of the World Economic Forum’s Great Reset already, right? It’s a plan that has been slid right under your nose – a plan to reset the entire global economy while blaming decades of abuse by the powerful and the elite on Covid.

And I have no doubts: a great reset of any sort isn’t going to benefit the average citizen of Earth. Rather, it’s going to bail out and then redistribute power to those in charge.

Think of our various monetary bailouts and how they’ve widened the inequality gap – then multiply the intensity by a factor of the entire globe.

Whether it comes from directly stealing purchasing power from the everyday citizen, like central banking already does without people noticing , or if it comes from an invasion of privacy (digital money tracking what you spend, vaccine passports, etc.) anytime we “progress” and “move forward” according to the government, we wind up surrendering some of our civil liberties.

“You never let a serious crisis go to waste. And what I mean by that it’s an opportunity to do things you think you could not do before.”

– Rahm Emanuel

As a result, our quality of life may move incrementally lower and we may wind up with less civil liberties, but there will still be a large chunk of our country – and the globe – that mindlessly advocates for these policies as part of the belief that everything government does for me is in my best interest.

I think it’s safe to say that most of my readers are not in that group. They’ve either been red-pilled already or I am helping them along the way at this very moment. Most of my readers understand that once you lose civil liberties, you never get them back. Most of my readers understand how precious civil liberties and freedom from government truly are.

Ask Australia how it has felt to lose the right to bear arms while the government essentially keeps the populace in a prison state right now. I’d be willing to bet that one or two people who advocated for giving up their guns wouldn’t think it’s such a bad idea for them to have them back right now.

The point of this article is to remind you that even worse than losing your civil liberties and/or your quality of life right under your nose is why it’s going to be happening. I’m writing to remind us, for as long as this blog stays on the web, to never forget where the blame should go.

I get this feeling that when the “Great Reser” does happen, no matter how it is pitched to us, many people are simply going to move forward with their heads down, do what they’re told and not question why things have happened to begin with. In other words, they will be happy to adopt whatever they are told is best for them without questioning it – you can spot these people nowadays by searching for the people walking outside in the park, hundreds of feet from other human beings, with three masks on.

The point of this article is to offer a stark reminder: when this reset does happen, regardless of whether or not you immediately find the faults in it, just remember what got us here: decades of arrogance from power-hungry politicians and elites that would’ve rather kicked the can down the road like cowards than do the patriotic thing and truly embrace how damaged our monetary system has become.

And this isn’t just a United States issue – it’s a global elite issue – but my focus is on the United States because that’s where I live.

For decades, our government, its officials and career politicians have refused to play it straight and do the honorable thing by informing our citizens about what truly needs to take place in order for our country to rectify its deteriorating financial system.

We spent decades lying to ourselves and imagining that we were still living in a prosperous 1950s and 1960s, where the country was productive and experienced its last true boom before the money printer was turned on and while we still had sound money. Politicians chose to pretend that was still happening for decades even as we went off the gold standard and started to embrace quantitative easing. Back then, it would be easier to make the argument that they just didn’t know what kind of negative consequences their actions would have. Now, in an era of bloated Fed balance sheets and soaring inflation, that argument is clearly ridiculous – even to those without backgrounds in finance.

Make no doubt about it, there have certainly been times where politicians had the chance to level with the American people and tell them that the country needs to address its debt, produce more, spend less, and protect the integrity of our currency.

However, cowardly elected officials almost always arrive at the conclusion that it’s not in their best interest to do so because an unpopular message doesn’t help them get elected.

So instead of somebody – any fucking body – along the way trying to stand in the way of the power-hungry elites that want to assert power and are arrogant enough to think that they can usurp economic laws, we have now broken the system so badly that talk of a great reset is inevitable.

The system, for lack of a better term, is FUBAR.

Given that context, comments like Jerome Powell‘s last summer read in an entirely different light than most people would think.

WE’RE NOT SIMPLY GOING BACK TO THE PRE-PANDEMIC ECONOMY

To the average observer, his words were scattered commentary about economics.

To anybody paying attention, it’s an admission that the road of monetary policy and fiscal policy disaster that we have willingly traveled down has finally come to an end.

Just one government official or elite that chose to speak out against what was an obviously flawed path could’ve changed the course of history in our country. And so when it’s time to place blame decades from now and we look back, these people are a great place to start looking.

In conclusion, the point is this: when the reset happens – whatever it entails – and you go to be vocal about your first gripes or raise your first questions about why this was ever pitched to be a good idea in the first place, just remember how we got here.