While The Economy Collapsed In 2020, CEO Pay Surged

At the same time the corporate world was suffering from implementing new burdensome Covid restrictions, dealing with shutting down in-person office sites, and generally trying to quell the panic of a government induced recession brought on by its pandemic response, CEO pay was soaring.

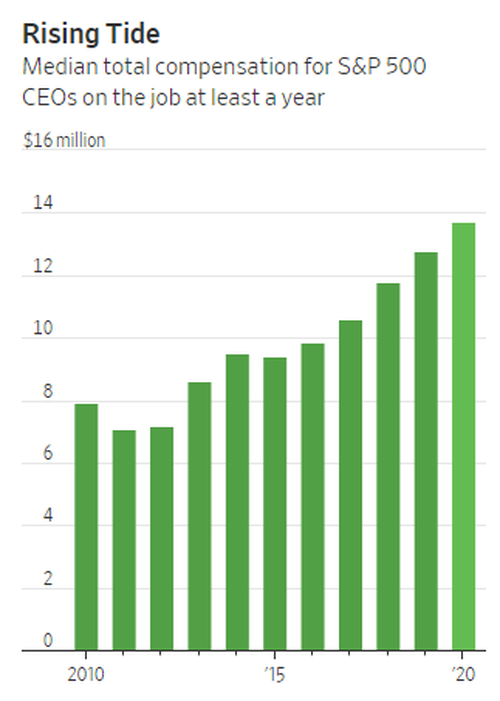

During 2020, as millions lost their jobs, median pay for CEO of more than 300 of the biggest U.S. public companies hit $13.7 million, up from $12.8 million the year prior, according to a new Wall Street Journal report. Of the 322 CEOs that the Journal analyzed, pay rose for 206 of them, with the median raise coming in at about 15%.

The rise was helped along by the bounce in the stock market and modified pay structures for dealing with the response to the pandemic. Shareholders have spoke out at companies like Starbucks and Walgreens Boots Alliance, voting against pay arrangements at the companies’ annual general meetings.

TransDigm also saw 57% of its shares voted against the company’s proposed pay program, which allowed options to vest when they normally otherwise wouldn’t be allowed to be exercised.

“TransDigm’s executive compensation plans, along with the board’s decision to vest certain options in 2020, are designed to incentivize leaders to act like business owners and align their interests with shareholders over the long term,” the company’s IR rep said.

Even companies that felt the brunt of the pandemic the worst saw their CEO pay rise. For example, Norwegian Cruise Lines posted a $4 billion loss last year and its revenue fell 80% – but its CEO’s pay doubled to $36.4 million, thanks to resigning a contract extension with the company.

The company said: “We believe these changes were in the best interests of the company and secured Mr. Del Rio’s continued invaluable expertise. Our management team took quick, decisive action to reduce costs, conserve cash, raise capital.”

At food service company Aramark, CEO John Zillmer saw his 2020 pay come in at $27.1 million versus $11 million in the year prior. The company’s board “bumped executives’ annual incentive payments up to 40% of initial targets instead of the 10% that pay-program formulas would have dictated,” the report notes.

Aramark claims the changes were to retain executives and recognize the “extraordinary circumstances” of the pandemic.

Shaun Bisman, a pay and corporate-governance consultant at Compensation Advisory Partners in New York, told the Journal: “I don’t think we’ve ever seen anything like this before in terms of the number of changes we’ve seen in incentive plans.”

However, not all companies followed suit. CEOs of Exxon, Omnicom Group Inc. and Intel all took less in pay in 2020 than they did in 2019, the report noted. Those companies generated total returns of between -15% and -36% during 2020.

Tyler Durden

Tue, 04/20/2021 – 21:45

While The Economy Collapsed In 2020, CEO Pay Surged

At the same time the corporate world was suffering from implementing new burdensome Covid restrictions, dealing with shutting down in-person office sites, and generally trying to quell the panic of a government induced recession brought on by its pandemic response, CEO pay was soaring.

During 2020, as millions lost their jobs, median pay for CEO of more than 300 of the biggest U.S. public companies hit $13.7 million, up from $12.8 million the year prior, according to a new Wall Street Journal report. Of the 322 CEOs that the Journal analyzed, pay rose for 206 of them, with the median raise coming in at about 15%.

The rise was helped along by the bounce in the stock market and modified pay structures for dealing with the response to the pandemic. Shareholders have spoke out at companies like Starbucks and Walgreens Boots Alliance, voting against pay arrangements at the companies’ annual general meetings.

TransDigm also saw 57% of its shares voted against the company’s proposed pay program, which allowed options to vest when they normally otherwise wouldn’t be allowed to be exercised.

“TransDigm’s executive compensation plans, along with the board’s decision to vest certain options in 2020, are designed to incentivize leaders to act like business owners and align their interests with shareholders over the long term,” the company’s IR rep said.

Even companies that felt the brunt of the pandemic the worst saw their CEO pay rise. For example, Norwegian Cruise Lines posted a $4 billion loss last year and its revenue fell 80% – but its CEO’s pay doubled to $36.4 million, thanks to resigning a contract extension with the company.

The company said: “We believe these changes were in the best interests of the company and secured Mr. Del Rio’s continued invaluable expertise. Our management team took quick, decisive action to reduce costs, conserve cash, raise capital.”

At food service company Aramark, CEO John Zillmer saw his 2020 pay come in at $27.1 million versus $11 million in the year prior. The company’s board “bumped executives’ annual incentive payments up to 40% of initial targets instead of the 10% that pay-program formulas would have dictated,” the report notes.

Aramark claims the changes were to retain executives and recognize the “extraordinary circumstances” of the pandemic.

Shaun Bisman, a pay and corporate-governance consultant at Compensation Advisory Partners in New York, told the Journal: “I don’t think we’ve ever seen anything like this before in terms of the number of changes we’ve seen in incentive plans.”

However, not all companies followed suit. CEOs of Exxon, Omnicom Group Inc. and Intel all took less in pay in 2020 than they did in 2019, the report noted. Those companies generated total returns of between -15% and -36% during 2020.

Tyler Durden

Tue, 04/20/2021 – 21:45

Read More