Will The Economy Replace Ten Million Jobs By 2022?

Authored by Patrick Hill via RealInvestmentAdvice.com,

“Employment will bounce back to pre-pandemic levels by December 31st, 2021.” – Bank of America

Popular forecasts call for a return to pre-pandemic levels of employment and economic activity by year-end. Really? We are not so sure. The economy lost over 22M jobs between February 2020 and today. The recovery has gained 12M jobs leaving a deficit of 10.7M jobs to replace. This post evaluates trends in employment, hiring, and worker job concerns to determine if this robust forecast to gain 10.7M jobs in 11 months is likely. We begin with a review of automation and job growth at the corporate level from an executive perspective. Next is a look at the worker perspective, a review of automation in various industries, an examination of small business hiring, and an outline of entrepreneur activity. Finally, we offer an outlook for total employment and ideas for sustainable job growth.

Executives Focus On Cutting Costs and Staff

As the pandemic rages on, executives are laser-focused on increasing productivity, reducing costs, and implementing programs to reduce staff. The pandemic accelerates the trend toward automation and staff reductions. Executive searches for artificial intelligence, automation software, and new business process robotics grew by 5 – 15 % in 2020. Workers in the office or plant require social distancing, desks spaced 6 feet apart, plastic separator sheeting, continuous surface disinfecting, and periodic temperature testing. Implementing these pandemic office changes is expensive.

As one COO at a global manufacturer declared, “bringing workers back during the pandemic is expensive, we have to cut costs, I can get 10x – 20x return on automation investments instead.” An October 2020 World Economic Forum survey global executives and found that 43% planned staff reductions. Executives are busy hiring new leaders for automation deployments. Gartner Group reports that S & P 100 companies will employ 20% more automation architects in 2021 than last year, and 90 % of companies will be hiring automation experts by 2025.

Automation Goes Beyond Repetitive Task Replacement to ‘Digital Assistants’

Manufacturing companies have deployed automation systems for the past 20 years achieving lower cost and productivity improvements. Automation reduced the need for hiring workers as well. A Federal Reserve survey showed that U.S. manufacturers had increased output by 20% in 2018 with the same number of workers employed in 2000.

Now automation of knowledge worker jobs is beginning to take hold in financial and services-based businesses. In the past year, corporations are investing heavily in Robotic Process Automation (RPA) software that supports ‘machine learning,’ artificial intelligence, and business process automation. New RPA software packages enable non-programming workers to build programs that create ‘digital assistants’ for their job. Enabling workers close to the business process to be automated reduces time to implement and takes the programming load off central IT departments. To counter the need for hiring more software and information services professionals, companies install RPA software. Thus, even ‘secure’ information services jobs may be at risk due to smart software.

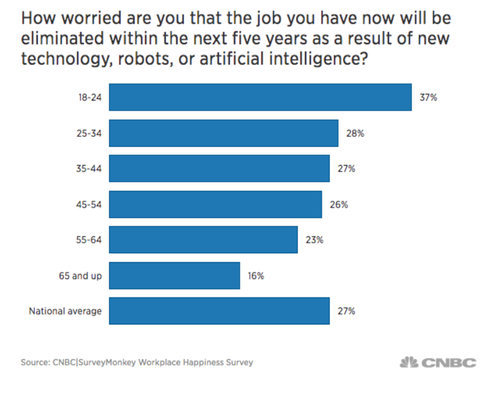

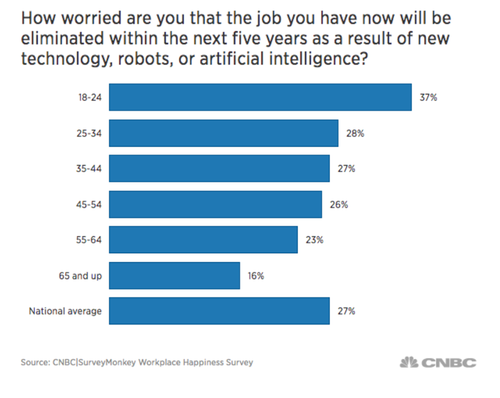

A CNBC survey found 37% of workers, 18- 24 years old, were worried about their job replacement by artificial intelligence systems in the next five years. A national average of 27% of all workers was concerned about losing their jobs due to artificial intelligence.

Source: CNBC – 11/7/19

Most early-career workers are internet fluent and know software systems’ capabilities to replace their jobs, says Dan Schwabel, Director of Research for Future Workplace. As they use systems like Siri and Alexa and begin programming, they realize that a smart software service could do their job in the not too distant future.

Workers Across Many Sectors Are Concerned About Automation Job Elimination

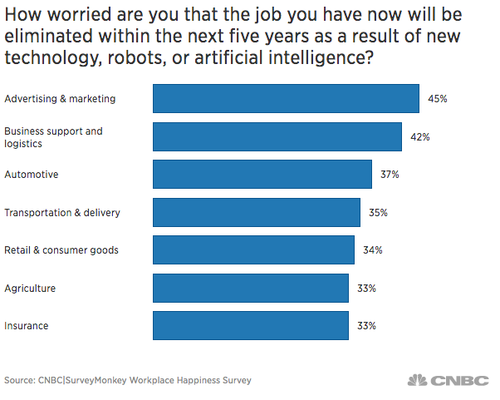

The following chart shows 45% of Advertising and Marketing workers to 33% of staff in Insurance are concerned with robots and AI eliminating their jobs.

Source: CNBC – 11/7/19

The pandemic has caused a pause in hiring with workers furloughed or others working remotely. This pause provides managers with the opportunity to explore new ways to automate labor-intensive tasks. Simultaneously, it offers a chance to deploy AI tests to see how robots can do some knowledge workers’ tasks.

In advertising, creative work producing ad content will be challenging to automate. But, smart software systems can make ad placement, client management, and reporting more efficient and customer responsive. Accounting and back-office repetitive tasks and customer communication can all be managed by intelligent services. In transportation, Tesla and other electric vehicle manufacturers are building autonomous delivery trucks. Farmers use computer-based weather systems synchronized with watering system controls to add intelligence to crop growing and management. The Pennsylvania Turnpike laid off 500 toll booth workers and replaced them with computer automated toll taking machines.

Small Business Hiring Continues To Decline

Small businesses in core cities like San Francisco and New York have seen 33 – 60% declines in revenues as lockdowns in December and January almost completely shut down sales. Restaurants survived by offering takeout food for pickup but still experience sales losses of 50% more.

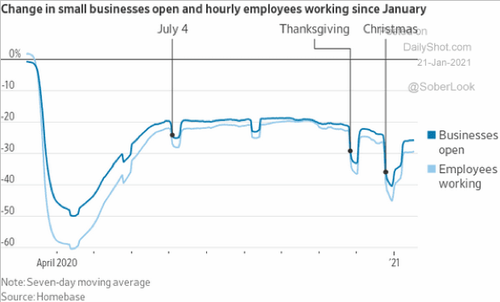

Small businesses nationwide report a drop in employment of 30%. And, a lack of commuters in many major cities of 75 – 80% has caused owners to close and furlough employees until commuter traffic returns. In the following chart from Homebase, hiring increased into the fall but since has fallen off.

Sources: Homebase, The Daily Shot – 1/21/21

Small businesses employed 60.6M workers in 2020. With 30% fewer employees, a possible 18.1M small business workers are permanently or temporarily unemployed. Many restaurants’ closing has caused significant layoffs in the restaurant and bar industry and executives plan on not rehiring 35% of their employees in 2021.

The good news is the pandemic has triggered a new wave of entrepreneurship across the country. Employees and owners of businesses that were closed are the primary founders of many of these new businesses.

Entrepreneurs Are Creating New Jobs

The Census Department reports 4.4M new businesses started in 2020, for a yearly increase of 900k new firms over 2019. Cooks laid off by restaurants are starting their own takeout food businesses. Daycare workers laid off with a talent for pastry making are running dessert take out businesses.

Women owned 47% of all small businesses in 2019, according to a report by American Express. But, the U.S. Chamber of Commerce reports that only 47% of female-owned small businesses owned by women reported business was ‘good’ compared to 62% of male-owned companies. So, when the pandemic forced small businesses to close, women were more likely than men to return home. Women entrepreneurs are pivoting their businesses quickly. A female personal fitness studio owner had just opened a studio last March. When business lockdowns were declared, she shifted her business to virtual sessions and successfully built a customer base. She now has over 100 participants in each virtual session of 4 sessions per day.

Women laid off in many services businesses or who left companies to take care of children at home have started various home-based businesses. One Macy’s store clerk let go last April started a wig business now grossing enough to pay her rent per month in the Bronx. LinkedIn found the number of women who changed their job title to ‘founder’ from a worker role had doubled in the 4th quarter of 2020. However, an analysis by the Women’s National Law Center of Bureau of Labor Statistics shows that 6M women have lost jobs since February of last year. So, it’s not clear that all the new businesses started by women will create enough jobs to make up the female jobs deficit.

Manufacturers Are Hiring Too

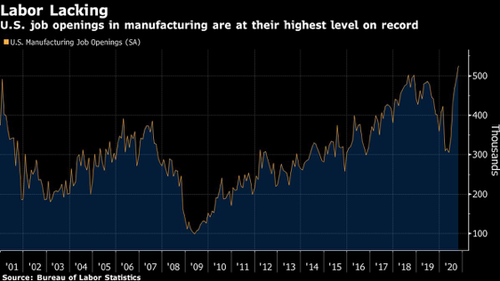

Orders for products were continuing to grow as manufacturers try to keep up with demand. The pandemic has forced some manufacturers to shift managers into factory floor roles. These managers fill in for workers out due to illness, taking care of children, or just anxious about returning to the factory floor. There were over 500k new job openings in manufacturing for last December.

Source: Bureau of Labor Statistics – 1/22/21

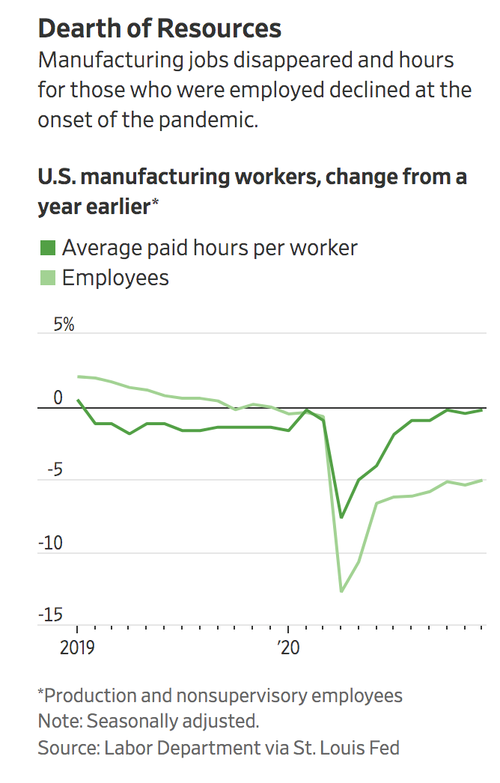

The irony is that with millions on unemployment, these positions should be quickly filled. Yet, manufacturers often compete with fulfillment and warehousing companies for workers. Amazon is hiring 100,000 new workers over the next year to support its surging ecommerce business. Companies are asking employees to work on multiple shifts to handle the additional production volume. The following graph shows hours worked have returned to near pre-pandemic levels while the number of workers has leveled off at – 5%.

Sources: The Wall Street Journal, St. Louis Federal Reserve – 1/9/21

Companies are raising wages as one Wisconsin manufacturer found they could not get workers to come onto the factory floor for $11.00 @hr. So the firm raised entry-level wages to $15.00 @hr. A generator producer in Ohio has added a shift overnight so workers with school-age children. The overnight shift allowed workers to be home during the day to assist their children with online learning.

The Number of Permanently Laid Off Workers Is Increasing

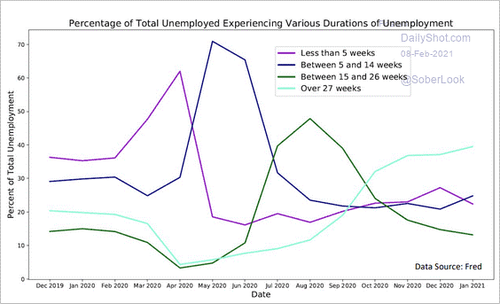

While temporary layoffs have declined significantly, the number of permanent job losers has continued to climb. The number of claimants for continuing unemployment benefits jumped by 2.5M for the week of January 23rd to 20.4M as the extended benefits bill from Congress enabled states to offer longer-term payments. The 20.4M level of continuing claims is 10 times the rate for 1 year ago before lockdowns! Another major concern, workers unemployed for greater than 27 weeks has increased to 39.5% of total jobless workers.

Sources: Federal Reserve of St. Louis, Bureau of Labor Statistics, The Daily Shot – 2/5/21

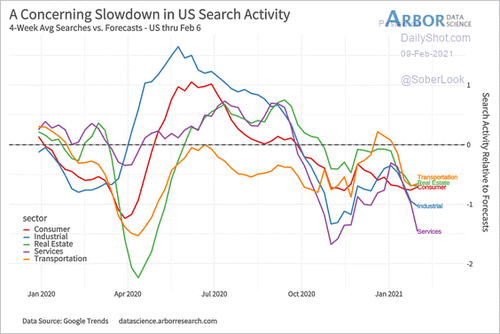

The following chart shows that job searches for new positions have spiraled down as job prospects dimmed in January. Further, searches continue to decline since a peak right at the onset of the pandemic last March. Search activity in all major sectors consumer, industrial, real estate, services and transportation fell in January.

Sources: Google Trends, Arbor Research, The Daily Shot – 2/9/21

Indeed reports that job opening listings are now .7% higher than in February of 2020. The Labor Department announced 6.6M job openings for January holding steady from December of 2020. There is a significant mismatch of skills of millions of unemployed workers and millions of information services and factory job openings.

The continuing growth of permanently laid-off workers is a challenge to build a strong foundation for an economic recovery. If workers are not working, they are saving what money they have and not increasing discretionary spending. There is an urgent need for a significant job development and training program for unemployed workers to fill millions of open jobs. On February 10th, Fed Chairman Jay Powell told the New York Economic Club that a national jobs strategy and program is the top priority for the recovery.

Workers Are Still Worried About Employment & No Raises

The Bloomberg Consumer Comfort index shows consumers’ comfort about the future economy is 20 points below their confidence level at the pre-pandemic level.

Sources: Bloomberg, The Daily Shot – 1/21/21

The future employment component of the Comfort Index has consistently been declining over the past several months.

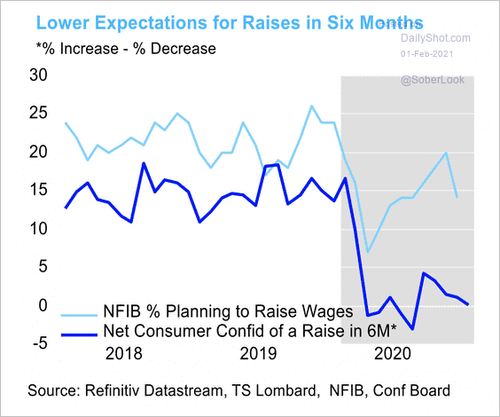

Only 15% of small businesses are planning on offering their workers raises in the next six months. Worse yet, nationally, few consumers have confidence they will receive a raise in the next six months

Sources: Refinitiv Datastream, TS Lombard, NFIB, Conference Board, The Daily Shot – 2/1/21

Employment Growth Is Stalled – Yet There Are Growth Opportunities

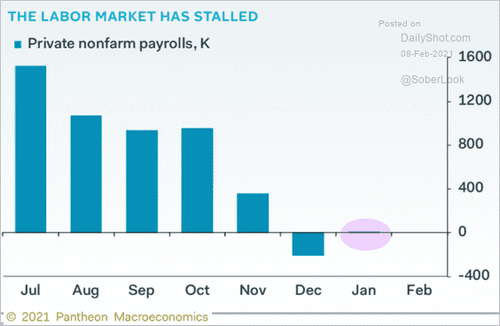

The labor market for January stalled, as this chart shows there were only 49k new jobs and job losses in December, 202 were revised upward to 227k.

Sources: Panetheon Macroeconomics, The Daily Shot – 2/5/21

Countering the loss of jobs in services, hospitality, and small business are the millions of startup companies founded by innovative entrepreneurs.

We have noted the massive mismatch between job openings and the skills of the unemployed. To overcome the skills deficit, the Biden administration has proposed a Clean Air & Jobs Act Proposal for 10M new jobs by investing in climate projects and infrastructure for the economy. The proposal includes Job training, career development, and placement programs. The initiative comes with a $2T price tag. It will be interesting to see if the program will pass a divided Congress. It seems like the most likely bill to pass will be about $1.2T.

Will Job Creation Overcome Permanent Unemployment Drag?

Growth in manufacturing job openings is helpful, yet manufacturing accounts for only 9% of all employment. A major challenge is the mixed picture in services sectors where information systems seems to be the only growth sector.

Plus, with 50% of S & P 500 companies reporting sales of -.54% in the 4th Quarter 2020, executives’ reluctance to hire will harden. As we noted in our post Catch 22 – Employee & Executives, both sides of the employment equation will be monitoring each other. Each side is waiting for the other to make a major move in either hiring or spending. But, executives hold the power to hire and will wait for consistent sales over a quarter or two. The first indication that hiring is improving is growth in temporary employment with full time hiring to follow. In January, there was an increase of 80k temporary jobs. Monitoring hiring of temporary worker over the quarter will tell us more about a possible shift in labor demand.

The ‘Bounce Back’ In Employment Is Likely To Take 2-3 Years

The workplace has experienced a once in 100 years shock. The virus attack shattered traditional worker, and executive assumptions about how and where work is done. Executives are now deploying new work systems, processes, and measures that increase productivity and reduce staffing. Job growth efforts face significant headwinds from virus-driven lockdowns. Lockdowns continue in most states, with corporations extending work from home policies until the end of 2021. Delayed vaccination programs have stalled the phasing out of lockdown programs.

At the earliest, the CDC does not expect ‘herd immunity’ until late summer of 2021. Thus, opening the economy will be a slow process over the summer into the fall. The narrative that employment will ‘bounce back’ by the 2nd half of 2021 to February, 2020 levels is unlikely. Employment back to pre-pandemic levels is more likely to take 2-3 years after worries of virus infection have disappeared. When employment is growing at robust levels consumers will spend again.. Entrepreneurs starting new businesses will fuel job creation but face significant headwinds from a stagnant economy.

We Need Entrepreneurship, Productive Investments & Trade For A Growing Economy

Consumers anxious about their jobs will continue to save, not spend except on essentials. Their lack of spending will delay hiring and economic growth beyond the end of the pandemic. A return to a growth economy will require consumers to spend, executives to hire, and normal mobility patterns to resume. All these factors will take time to build against the overhang of federal debt, corporate debt, and housing debt. A return to solid entrepreneurship, a focus on productive investments, and the renewal of robust international trade are ways to build a growing economy.

Tyler Durden

Sun, 02/21/2021 – 11:15

Will The Economy Replace Ten Million Jobs By 2022?

Authored by Patrick Hill via RealInvestmentAdvice.com,

“Employment will bounce back to pre-pandemic levels by December 31st, 2021.” – Bank of America

Popular forecasts call for a return to pre-pandemic levels of employment and economic activity by year-end. Really? We are not so sure. The economy lost over 22M jobs between February 2020 and today. The recovery has gained 12M jobs leaving a deficit of 10.7M jobs to replace. This post evaluates trends in employment, hiring, and worker job concerns to determine if this robust forecast to gain 10.7M jobs in 11 months is likely. We begin with a review of automation and job growth at the corporate level from an executive perspective. Next is a look at the worker perspective, a review of automation in various industries, an examination of small business hiring, and an outline of entrepreneur activity. Finally, we offer an outlook for total employment and ideas for sustainable job growth.

Executives Focus On Cutting Costs and Staff

As the pandemic rages on, executives are laser-focused on increasing productivity, reducing costs, and implementing programs to reduce staff. The pandemic accelerates the trend toward automation and staff reductions. Executive searches for artificial intelligence, automation software, and new business process robotics grew by 5 – 15 % in 2020. Workers in the office or plant require social distancing, desks spaced 6 feet apart, plastic separator sheeting, continuous surface disinfecting, and periodic temperature testing. Implementing these pandemic office changes is expensive.

As one COO at a global manufacturer declared, “bringing workers back during the pandemic is expensive, we have to cut costs, I can get 10x – 20x return on automation investments instead.” An October 2020 World Economic Forum survey global executives and found that 43% planned staff reductions. Executives are busy hiring new leaders for automation deployments. Gartner Group reports that S & P 100 companies will employ 20% more automation architects in 2021 than last year, and 90 % of companies will be hiring automation experts by 2025.

Automation Goes Beyond Repetitive Task Replacement to ‘Digital Assistants’

Manufacturing companies have deployed automation systems for the past 20 years achieving lower cost and productivity improvements. Automation reduced the need for hiring workers as well. A Federal Reserve survey showed that U.S. manufacturers had increased output by 20% in 2018 with the same number of workers employed in 2000.

Now automation of knowledge worker jobs is beginning to take hold in financial and services-based businesses. In the past year, corporations are investing heavily in Robotic Process Automation (RPA) software that supports ‘machine learning,’ artificial intelligence, and business process automation. New RPA software packages enable non-programming workers to build programs that create ‘digital assistants’ for their job. Enabling workers close to the business process to be automated reduces time to implement and takes the programming load off central IT departments. To counter the need for hiring more software and information services professionals, companies install RPA software. Thus, even ‘secure’ information services jobs may be at risk due to smart software.

A CNBC survey found 37% of workers, 18- 24 years old, were worried about their job replacement by artificial intelligence systems in the next five years. A national average of 27% of all workers was concerned about losing their jobs due to artificial intelligence.

Source: CNBC – 11/7/19

Most early-career workers are internet fluent and know software systems’ capabilities to replace their jobs, says Dan Schwabel, Director of Research for Future Workplace. As they use systems like Siri and Alexa and begin programming, they realize that a smart software service could do their job in the not too distant future.

Workers Across Many Sectors Are Concerned About Automation Job Elimination

The following chart shows 45% of Advertising and Marketing workers to 33% of staff in Insurance are concerned with robots and AI eliminating their jobs.

Source: CNBC – 11/7/19

The pandemic has caused a pause in hiring with workers furloughed or others working remotely. This pause provides managers with the opportunity to explore new ways to automate labor-intensive tasks. Simultaneously, it offers a chance to deploy AI tests to see how robots can do some knowledge workers’ tasks.

In advertising, creative work producing ad content will be challenging to automate. But, smart software systems can make ad placement, client management, and reporting more efficient and customer responsive. Accounting and back-office repetitive tasks and customer communication can all be managed by intelligent services. In transportation, Tesla and other electric vehicle manufacturers are building autonomous delivery trucks. Farmers use computer-based weather systems synchronized with watering system controls to add intelligence to crop growing and management. The Pennsylvania Turnpike laid off 500 toll booth workers and replaced them with computer automated toll taking machines.

Small Business Hiring Continues To Decline

Small businesses in core cities like San Francisco and New York have seen 33 – 60% declines in revenues as lockdowns in December and January almost completely shut down sales. Restaurants survived by offering takeout food for pickup but still experience sales losses of 50% more.

Small businesses nationwide report a drop in employment of 30%. And, a lack of commuters in many major cities of 75 – 80% has caused owners to close and furlough employees until commuter traffic returns. In the following chart from Homebase, hiring increased into the fall but since has fallen off.

Sources: Homebase, The Daily Shot – 1/21/21

Small businesses employed 60.6M workers in 2020. With 30% fewer employees, a possible 18.1M small business workers are permanently or temporarily unemployed. Many restaurants’ closing has caused significant layoffs in the restaurant and bar industry and executives plan on not rehiring 35% of their employees in 2021.

The good news is the pandemic has triggered a new wave of entrepreneurship across the country. Employees and owners of businesses that were closed are the primary founders of many of these new businesses.

Entrepreneurs Are Creating New Jobs

The Census Department reports 4.4M new businesses started in 2020, for a yearly increase of 900k new firms over 2019. Cooks laid off by restaurants are starting their own takeout food businesses. Daycare workers laid off with a talent for pastry making are running dessert take out businesses.

Women owned 47% of all small businesses in 2019, according to a report by American Express. But, the U.S. Chamber of Commerce reports that only 47% of female-owned small businesses owned by women reported business was ‘good’ compared to 62% of male-owned companies. So, when the pandemic forced small businesses to close, women were more likely than men to return home. Women entrepreneurs are pivoting their businesses quickly. A female personal fitness studio owner had just opened a studio last March. When business lockdowns were declared, she shifted her business to virtual sessions and successfully built a customer base. She now has over 100 participants in each virtual session of 4 sessions per day.

Women laid off in many services businesses or who left companies to take care of children at home have started various home-based businesses. One Macy’s store clerk let go last April started a wig business now grossing enough to pay her rent per month in the Bronx. LinkedIn found the number of women who changed their job title to ‘founder’ from a worker role had doubled in the 4th quarter of 2020. However, an analysis by the Women’s National Law Center of Bureau of Labor Statistics shows that 6M women have lost jobs since February of last year. So, it’s not clear that all the new businesses started by women will create enough jobs to make up the female jobs deficit.

Manufacturers Are Hiring Too

Orders for products were continuing to grow as manufacturers try to keep up with demand. The pandemic has forced some manufacturers to shift managers into factory floor roles. These managers fill in for workers out due to illness, taking care of children, or just anxious about returning to the factory floor. There were over 500k new job openings in manufacturing for last December.

Source: Bureau of Labor Statistics – 1/22/21

The irony is that with millions on unemployment, these positions should be quickly filled. Yet, manufacturers often compete with fulfillment and warehousing companies for workers. Amazon is hiring 100,000 new workers over the next year to support its surging ecommerce business. Companies are asking employees to work on multiple shifts to handle the additional production volume. The following graph shows hours worked have returned to near pre-pandemic levels while the number of workers has leveled off at – 5%.

Sources: The Wall Street Journal, St. Louis Federal Reserve – 1/9/21

Companies are raising wages as one Wisconsin manufacturer found they could not get workers to come onto the factory floor for $11.00 @hr. So the firm raised entry-level wages to $15.00 @hr. A generator producer in Ohio has added a shift overnight so workers with school-age children. The overnight shift allowed workers to be home during the day to assist their children with online learning.

The Number of Permanently Laid Off Workers Is Increasing

While temporary layoffs have declined significantly, the number of permanent job losers has continued to climb. The number of claimants for continuing unemployment benefits jumped by 2.5M for the week of January 23rd to 20.4M as the extended benefits bill from Congress enabled states to offer longer-term payments. The 20.4M level of continuing claims is 10 times the rate for 1 year ago before lockdowns! Another major concern, workers unemployed for greater than 27 weeks has increased to 39.5% of total jobless workers.

Sources: Federal Reserve of St. Louis, Bureau of Labor Statistics, The Daily Shot – 2/5/21

The following chart shows that job searches for new positions have spiraled down as job prospects dimmed in January. Further, searches continue to decline since a peak right at the onset of the pandemic last March. Search activity in all major sectors consumer, industrial, real estate, services and transportation fell in January.

Sources: Google Trends, Arbor Research, The Daily Shot – 2/9/21

Indeed reports that job opening listings are now .7% higher than in February of 2020. The Labor Department announced 6.6M job openings for January holding steady from December of 2020. There is a significant mismatch of skills of millions of unemployed workers and millions of information services and factory job openings.

The continuing growth of permanently laid-off workers is a challenge to build a strong foundation for an economic recovery. If workers are not working, they are saving what money they have and not increasing discretionary spending. There is an urgent need for a significant job development and training program for unemployed workers to fill millions of open jobs. On February 10th, Fed Chairman Jay Powell told the New York Economic Club that a national jobs strategy and program is the top priority for the recovery.

Workers Are Still Worried About Employment & No Raises

The Bloomberg Consumer Comfort index shows consumers’ comfort about the future economy is 20 points below their confidence level at the pre-pandemic level.

Sources: Bloomberg, The Daily Shot – 1/21/21

The future employment component of the Comfort Index has consistently been declining over the past several months.

Only 15% of small businesses are planning on offering their workers raises in the next six months. Worse yet, nationally, few consumers have confidence they will receive a raise in the next six months

Sources: Refinitiv Datastream, TS Lombard, NFIB, Conference Board, The Daily Shot – 2/1/21

Employment Growth Is Stalled – Yet There Are Growth Opportunities

The labor market for January stalled, as this chart shows there were only 49k new jobs and job losses in December, 202 were revised upward to 227k.

Sources: Panetheon Macroeconomics, The Daily Shot – 2/5/21

Countering the loss of jobs in services, hospitality, and small business are the millions of startup companies founded by innovative entrepreneurs.

We have noted the massive mismatch between job openings and the skills of the unemployed. To overcome the skills deficit, the Biden administration has proposed a Clean Air & Jobs Act Proposal for 10M new jobs by investing in climate projects and infrastructure for the economy. The proposal includes Job training, career development, and placement programs. The initiative comes with a $2T price tag. It will be interesting to see if the program will pass a divided Congress. It seems like the most likely bill to pass will be about $1.2T.

Will Job Creation Overcome Permanent Unemployment Drag?

Growth in manufacturing job openings is helpful, yet manufacturing accounts for only 9% of all employment. A major challenge is the mixed picture in services sectors where information systems seems to be the only growth sector.

Plus, with 50% of S & P 500 companies reporting sales of -.54% in the 4th Quarter 2020, executives’ reluctance to hire will harden. As we noted in our post Catch 22 – Employee & Executives, both sides of the employment equation will be monitoring each other. Each side is waiting for the other to make a major move in either hiring or spending. But, executives hold the power to hire and will wait for consistent sales over a quarter or two. The first indication that hiring is improving is growth in temporary employment with full time hiring to follow. In January, there was an increase of 80k temporary jobs. Monitoring hiring of temporary worker over the quarter will tell us more about a possible shift in labor demand.

The ‘Bounce Back’ In Employment Is Likely To Take 2-3 Years

The workplace has experienced a once in 100 years shock. The virus attack shattered traditional worker, and executive assumptions about how and where work is done. Executives are now deploying new work systems, processes, and measures that increase productivity and reduce staffing. Job growth efforts face significant headwinds from virus-driven lockdowns. Lockdowns continue in most states, with corporations extending work from home policies until the end of 2021. Delayed vaccination programs have stalled the phasing out of lockdown programs.

At the earliest, the CDC does not expect ‘herd immunity’ until late summer of 2021. Thus, opening the economy will be a slow process over the summer into the fall. The narrative that employment will ‘bounce back’ by the 2nd half of 2021 to February, 2020 levels is unlikely. Employment back to pre-pandemic levels is more likely to take 2-3 years after worries of virus infection have disappeared. When employment is growing at robust levels consumers will spend again.. Entrepreneurs starting new businesses will fuel job creation but face significant headwinds from a stagnant economy.

We Need Entrepreneurship, Productive Investments & Trade For A Growing Economy

Consumers anxious about their jobs will continue to save, not spend except on essentials. Their lack of spending will delay hiring and economic growth beyond the end of the pandemic. A return to a growth economy will require consumers to spend, executives to hire, and normal mobility patterns to resume. All these factors will take time to build against the overhang of federal debt, corporate debt, and housing debt. A return to solid entrepreneurship, a focus on productive investments, and the renewal of robust international trade are ways to build a growing economy.

Tyler Durden

Sun, 02/21/2021 – 11:15

Read More