Eventually policy-makers turn the dials to 11 and nothing happens.

Many others have explained why inflation is part-and-parcel of the status quo. In the simplest terms, where’s why inflation is essential:

1. Our economy and financial system are totally dependent on the expansion of credit/debt. Banks make money by issuing new loans, and financiers make money by buying and selling debt and instruments that leverage debt. Consumers can only buy big-ticket items with credit.

As a thought experiment, let’s consider what would happen to the US economy and financial system if credit was outlawed and the economy was a cash-only marketplace. The government couldn’t run deficits by borrowing money, no one could buy a vehicle except with cash, banks could no longer issue $19 of new loans for every $1 of cash they held.

We all know what would happen: the economy and financial system would both crash. Imagine the horrors of living solely on earnings and having to laboriously save up cash to buy a car or home.

2. the problem with credit/debt is it accrues interest. The more we borrow, the more interest we owe. If our income doesn’t rise, at some point all our discretionary income–what’s left over after paying taxes and essentials–is devoted to debt service, and we can’t borrow more. At that point, the economy slides into recession.

3. There are a few policy ways out of this built-in limit on the expansion of credit/debt:

A. The government can borrow trillions of dollars and give every bottom-80% household cash to spend. The problem here is the government debt also accrues interest, and eventually this crimps government borrowing and spending.

B. The central bank can suppress interest rates to near-zero so consumers can free up income by refinancing old debt at significantly lower rates of interest.

C. The central bank can vastly increase the issuance of currency and credit (a.k.a. “liquidity”) to generate inflation by expanding the amount of currency and credit chasing goods and services.

Inflation slowly reduces the burden of debt by raising wages while keeping the debt unchanged. For example, back when $2,000 a month was a decent salary, a $600/month home mortgage placed a strict limit on the household’s spending.

Fast-forward two decades of “modest” inflation and the average full-time wage has doubled to over $4,000 a month. Voila, the mortgage payment has remained the same (or perhaps been reduced via refinancing) and now the $600 monthly nut isn’t much of a burden. In fact, the monthly nut for the new pick-up truck is larger than the home mortgage.

In a truly steady-state economy, wages would only rise with increases in productivity. With productivity increases dawdling along around 1% per year, that’s a modest and unevenly distributed increase in earnings. Systemic inflation is a much more reliable and broad-based way of reducing the burdens of existing debt.

A back-of-the-envelope calculation based on official inflation is that 2/3 of the wage increases are inflation-driven and perhaps 1/3 or less is the result of increasing productivity.

We now see why inflation is absolutely essential to a credit-dependent economy and financial system. Without inflation, consumers and the state soon max out their income and are unable to borrow and spend more.

What about savers, you ask? They’re sacrificed to support inflation’s erosion of the currency’s value. Once interest rates have been suppressed to enable more borrowing and spending (known as financial repression), savers are unable to stay even with inflation unless they take on the risks of speculating in stocks, housing, collectibles, etc.

Financial repression in service of maintaining inflation inevitably fuels speculation. The constant drip of inflation in a low-interest era forces everyone to take on risks that few are prepared to manage.

Inflation punishes the commoners in two ways: it erodes the value of their labor, the primary source of their income, and it forces them to gamble in speculative bubbles where the super-wealthy hold all the high-value cards.

But without inflation, the economy and financial system collapse. So the slow erosion of the bottom 80% is a systemic cost of maintaining the credit-dependent economy and financial system. The dependence on inflation to keep credit expanding generates winners and losers, but hey, maybe you’ll win big at the stock market roulette wheel.

This dependence on speculation to keep up with inflation has another pernicious consequence: it incentivizes the diversion of capital and talent into speculation rather than into investments that increase productivity. So while capital chases the stock market chimera of AI, the nation’s creaky, outdated electrical grid that is the foundation of whatever fantasy-economy speculators are betting on continues on its path to breakdown.

But nothing in the financial realm is ever permanent, and so eventually global risks rise and capital demands a return above zero. This pushes bond yields and the costs of credit higher, crimping borrowing. The profligate expansion of currency and credit also eventually generate real-world inflation as scarcities meet monetary expansion: too much “money” is chasing a constrained quantity of goods and services.

Once inflation heats up, the system starts breaking down as soaring interest rates stifle borrowing. Central banks and private banks can issue new credit, but if few can afford to borrow more, the economy spirals into recession.

With rates rising, the income pump of refinancing is shut down.

The “Goldilocks” economy of the past 30 years was enabled by the deflationary forces of globalization and the vast expansion of credit, a.k.a. financialization. Both of these have topped out and are reversing. Globalization is no longer lowering costs and everything under the sun has already been commoditized and financialized. There’s no more pools of “free money” (or free anything) waiting to be exploited.

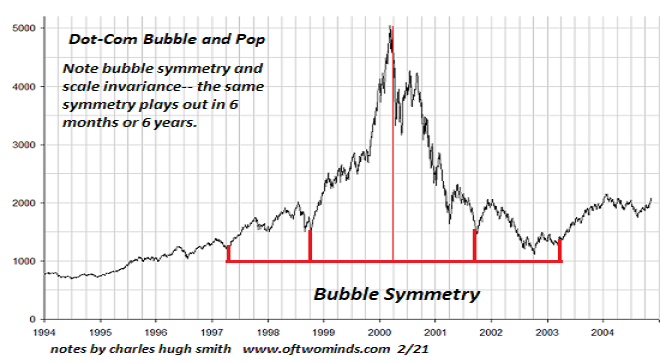

Real-world inflation is crimping discretionary spending, leaving less to service additional borrowing. Post-pandemic “revenge” splurging has depleted savings, and since all speculative bubbles eventually pop, the inevitable collapse of the Everything Bubble will kick the reverse wealth effect into high gear.

In summary, here’s the problem: the system only functions with Goldilocks moderate inflation but that is no longer possible given the changing tides of globalization, financialization, real-world inflation and rising global risks. This leaves those in charge of the status quo system that benefits the few at the expense of the many with no sustainable option other than doing more of what’s failed until it fails spectacularly.

Put another way, distorting the entire economy and financial system with financial repression has generated decades of false signals: the system is permanent and sustainable, policies remain effective forever, we can “grow our way out of any problem,” and so on.

Eventually policy-makers turn the dials to 11 and nothing happens. Their supposedly god-like powers are revealed as mere trickery once the real-world intrudes. What were taken as strong signals turn out to be noise.