“World War II Was Transitory” – Putting Inflation In Context

Inflation In Context: A Liquidity Adjusted CPI Index

We had a few requests to write up something about today’s hot U.S consumer price inflation data. So we put together a quick note in honor of our friend from down in the Land of Oz, GMac, one of the most decent human beings on earth. He is one proud father of a super studly 18-year son, who is an incredible surfer and someday wants to surf Mavericks. God. Bless. His. Soul.

Let us preface our inflation note with one of our favorite quotes:

“World War II was transitory”

– GMM

Recall our post in January, Ready For 4 Percent CPI By Mid-Year?, when we speculated the U.S. would be experiencing 4 percent inflation, possibly 5 percent by mid-year. We were beaten down like a red-headed stepchild (I am at liberty to say that as I have been a ginger most of my life).

GMM was also one of the first to point out the base effects (12-month comps) would kick in April and May 2021 due to the deflation that troughed last year from the COVID crash. But don’t be gaslighted; the latest few month-on-month core prints essentially negate the base effect excuse for high inflation as three-month core CPI is now running at 7.9 percent on an annual basis.

We don’t know for certain if inflation will stick and move higher or lower but as betting folk we are taking the over, however.

Liquidity Tsunami

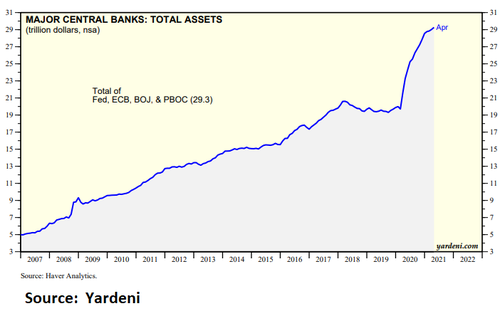

We do know the major global central banks have pumped in a shitload of high-powered money into the global financial system over the past year — as in around $10 trillion, close 50 percent increse of their collective balance sheets. Here’s Dr. Ed’s excellent chart,

Moreover, banks now seem eager to start lending, thus creating more endogenous money on top of the trillions upon trillions of base money central banks have already injected.

Transitory? Yeah, right.

It’s not a question whether the Fed has the tools to reign it in, it’s do they have the ‘nads? Given the multiple asset bubbles that would burst, and bust spectacularly, if the Fed draws it word, we seriously doubt it.

The following chart from Dr. Ed also illustrates not only has the digital printing press been working overtime, the credit system is just fine and dandy as deposits are expanding. Don’t be confused by, yes, the base effect, as the money aggregates have a much large base to grow from they did a year ago before the pandemic.

Tough to beat comps after expanding over 25 percent

Note, these are monetary aggregates, which include cash in circulation, bank deposits among near money and other short-term time deposits, not the expansion of the Fed’s balance sheet, though it does hugely influence the data.

Big spurts from the digital printing press without a credit crisis and an impaired financial system — as was the case after the Great Financial Crisis — will almost always generate inflationary pressures. Stimulating demand without production during a supply shock is not optimal unless carefully targeted to those who need it most.

It’s very amusing to us to see the FinTweets, “peak inflation has arrived.” True, if the financial markets crash. But what do they base their conclusion on? A warm feeling in their tummy?

Show me the money data, Jerry.

Banks Itching To Lend

Banks now seem eager to start lending, thus creating more endogenous money on top of the trillions of base money central banks have injected.

Loans are “starting to pick up,” and there’s plenty of borrowing capacity because companies have unused credit lines, {BofA CEO Brian ]Moynihan said. Loan growth has been a challenge across the banking industry because many consumers and businesses are sitting on cash from savings and stimulus during the pandemic. – Bloomberg, June 6

This should send shivers up the Fed’s spine, but we are not so sure. We are also not so sure they are not flying blind and will again miss the next big one just as they have in the past.

The Chart: Liquidty-Adjusted Inflation

It’s late and we want to present the chart in honor of GMac.

We have taken the non seasonaly adjusted year-on-year change of CPI and subtracted a scaled up version of the Chicago Fed’s National Financial Conditions Index (NFCI), which measures how loose or tight monetary conditions are in the U.S.. It’s has been running at an extreme historical low — i.e., very loose financial conditions.

You can see the 105 indicators it is based upon here.

We are trying to give context to the inflation data of how loose and accomodative finnancial market and monetary conditions are currently. As you can see, today’s year-on-year CPI print less the NFCI is at the highest level since November 1990, which was in the middle of the first Gulf war, Where the Fed was facing spiking inflation due to the run-up in oil and a recession.

Prior to that our adjusted inflation index hasn’t been so high since the high inflation late 197Os and early ‘80s. Gulp.

Clearly, it is a different environment in today’s economy. In fact, just the opposite – the economy is ready to roar for the next several quarters as consumers are flush with cash, the supply chain is still a mess due to the “bullwhip effect” (more on this in a future post), and new businesses should be looking for credit and loans to rebuild and start new ventures.

Most of all, folks, the central banks still have their pedal to the metal and balls to the walls, and as we all know (well some of us),

Inflation is always and everywhere a monetary phenomenon in the sense that it is and can be produced only by a more rapid increase in the quantity of money than in output. – Milton Friendman

The Upshot

Inflation is way too high given exremely easy financial and monetary conditions. There will be blood.

Finally

Life is transitory.

Inflation has eroded my purchasing power in my transitory life. Bring back the $.35 Big Mac, which was only about 20 percent of the minimum wage. Now? About 40-50 percent. Enough to spark a revolution.

Finally, the Democrats should begin to worry.

Biden inflation is real, and it’s happening right now. It’s hurting Tennessee’s poorest families and workers the most, and is a clear and immediate tax on the middle class. pic.twitter.com/tvcStztWah

— Senator Bill Hagerty (@SenatorHagerty) June 10, 2021

Stay tuned.

Tyler Durden

Sun, 06/13/2021 – 14:30

“World War II Was Transitory” – Putting Inflation In Context

Via Global Macro Monitor,

Inflation In Context: A Liquidity Adjusted CPI Index

We had a few requests to write up something about today’s hot U.S consumer price inflation data. So we put together a quick note in honor of our friend from down in the Land of Oz, GMac, one of the most decent human beings on earth. He is one proud father of a super studly 18-year son, who is an incredible surfer and someday wants to surf Mavericks. God. Bless. His. Soul.

Let us preface our inflation note with one of our favorite quotes:

“World War II was transitory”

– GMM

Recall our post in January, Ready For 4 Percent CPI By Mid-Year?, when we speculated the U.S. would be experiencing 4 percent inflation, possibly 5 percent by mid-year. We were beaten down like a red-headed stepchild (I am at liberty to say that as I have been a ginger most of my life).

GMM was also one of the first to point out the base effects (12-month comps) would kick in April and May 2021 due to the deflation that troughed last year from the COVID crash. But don’t be gaslighted; the latest few month-on-month core prints essentially negate the base effect excuse for high inflation as three-month core CPI is now running at 7.9 percent on an annual basis.

We don’t know for certain if inflation will stick and move higher or lower but as betting folk we are taking the over, however.

Liquidity Tsunami

We do know the major global central banks have pumped in a shitload of high-powered money into the global financial system over the past year — as in around $10 trillion, close 50 percent increse of their collective balance sheets. Here’s Dr. Ed’s excellent chart,

Moreover, banks now seem eager to start lending, thus creating more endogenous money on top of the trillions upon trillions of base money central banks have already injected.

Transitory? Yeah, right.

It’s not a question whether the Fed has the tools to reign it in, it’s do they have the ‘nads? Given the multiple asset bubbles that would burst, and bust spectacularly, if the Fed draws it word, we seriously doubt it.

The following chart from Dr. Ed also illustrates not only has the digital printing press been working overtime, the credit system is just fine and dandy as deposits are expanding. Don’t be confused by, yes, the base effect, as the money aggregates have a much large base to grow from they did a year ago before the pandemic.

Tough to beat comps after expanding over 25 percent

Note, these are monetary aggregates, which include cash in circulation, bank deposits among near money and other short-term time deposits, not the expansion of the Fed’s balance sheet, though it does hugely influence the data.

Big spurts from the digital printing press without a credit crisis and an impaired financial system — as was the case after the Great Financial Crisis — will almost always generate inflationary pressures. Stimulating demand without production during a supply shock is not optimal unless carefully targeted to those who need it most.

It’s very amusing to us to see the FinTweets, “peak inflation has arrived.” True, if the financial markets crash. But what do they base their conclusion on? A warm feeling in their tummy?

Show me the money data, Jerry.

Banks Itching To Lend

Banks now seem eager to start lending, thus creating more endogenous money on top of the trillions of base money central banks have injected.

Loans are “starting to pick up,” and there’s plenty of borrowing capacity because companies have unused credit lines, {BofA CEO Brian ]Moynihan said. Loan growth has been a challenge across the banking industry because many consumers and businesses are sitting on cash from savings and stimulus during the pandemic. – Bloomberg, June 6

This should send shivers up the Fed’s spine, but we are not so sure. We are also not so sure they are not flying blind and will again miss the next big one just as they have in the past.

The Chart: Liquidty-Adjusted Inflation

It’s late and we want to present the chart in honor of GMac.

We have taken the non seasonaly adjusted year-on-year change of CPI and subtracted a scaled up version of the Chicago Fed’s National Financial Conditions Index (NFCI), which measures how loose or tight monetary conditions are in the U.S.. It’s has been running at an extreme historical low — i.e., very loose financial conditions.

You can see the 105 indicators it is based upon here.

We are trying to give context to the inflation data of how loose and accomodative finnancial market and monetary conditions are currently. As you can see, today’s year-on-year CPI print less the NFCI is at the highest level since November 1990, which was in the middle of the first Gulf war, Where the Fed was facing spiking inflation due to the run-up in oil and a recession.

Prior to that our adjusted inflation index hasn’t been so high since the high inflation late 197Os and early ‘80s. Gulp.

Clearly, it is a different environment in today’s economy. In fact, just the opposite – the economy is ready to roar for the next several quarters as consumers are flush with cash, the supply chain is still a mess due to the “bullwhip effect” (more on this in a future post), and new businesses should be looking for credit and loans to rebuild and start new ventures.

Most of all, folks, the central banks still have their pedal to the metal and balls to the walls, and as we all know (well some of us),

Inflation is always and everywhere a monetary phenomenon in the sense that it is and can be produced only by a more rapid increase in the quantity of money than in output. – Milton Friendman

The Upshot

Inflation is way too high given exremely easy financial and monetary conditions. There will be blood.

Finally

Life is transitory.

Inflation has eroded my purchasing power in my transitory life. Bring back the $.35 Big Mac, which was only about 20 percent of the minimum wage. Now? About 40-50 percent. Enough to spark a revolution.

Finally, the Democrats should begin to worry.

Biden inflation is real, and it’s happening right now. It’s hurting Tennessee’s poorest families and workers the most, and is a clear and immediate tax on the middle class. pic.twitter.com/tvcStztWah

— Senator Bill Hagerty (@SenatorHagerty) June 10, 2021

Stay tuned.

Tyler Durden

Sun, 06/13/2021 – 14:30

Read More

Najnovije web vijesti u stvarnom vremenu